So perhaps you want to start investing and want to make sure your money is working as hard for you as it can. Or maybe you’re looking to shake up your existing portfolio by adding some higher performing investments.

Either way, is it possible for your money to be put into actual 12% compound interest accounts?

While past performance is no guarantee of future performance, it’s absolutely true that there are investments out there that have had average annual returns of at least 12% – or even more, in some cases!

And we’re going to show you some of the best performing options, as well as how you can jump on board with them too.

Are there really 12% compound interest accounts?

As this article will show, there are a number of investments that have had average returns over the last 10 years of at least 12%.

While they’re not strictly accounts in the literal sense of the word, they do allow your investments to take advantage of the power of compound interest at a massive rate.

They’re also mostly the best index funds in the market, in line with the fact that index funds are certainly our investment vehicle of choice – as well as of many other investors.

And why wouldn’t they be when they’re both low-cost and outperform actively managed funds 92% of the time?

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

2020 update

You’ll notice that the graphs in this article show the performance of these compound interest accounts for the period from 2010 to 2019.

This also coincides with one of the longest bull runs in investment history – followed by a crash that, at the time of writing, is still ongoing. Time will tell where the bottom ends up being.

Clearly, then, returns in the near future will not be anywhere near as high as those seen over the previous 10 years.

This is definitely a good lesson in what we said earlier: past performance is no guarantee of future performance.

At the same time, the results in this article came straight after the 2008 crisis.

So consider these graphs as showing what has been in the past – and what the future may also hold once we wait out the instability we’re seeing now.

(And for some tips on just what that may entail, take a look at this article.)

8 compound interest accounts earning 12% (or more)

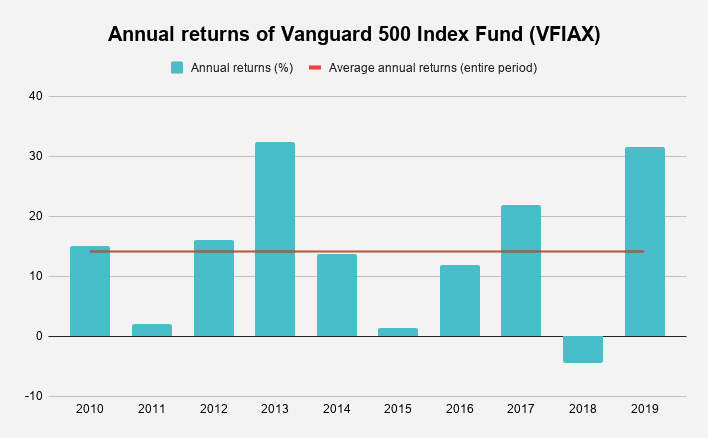

1. Vanguard 500 Index Fund (VFIAX)

This fund tracks the performance of the S&P 500, or the 500 largest publicly traded companies in the US.

This makes it equivalent to owning stocks in some of the biggest companies in the world such as Microsoft, Apple, Amazon, Facebook and more – without having to directly buy their shares yourself.

There’s no doubt that investing in any S&P 500 index fund is a solid choice for any investor.

In fact, in his 2016 Berkshire Hathaway annual shareholder letter, Warren Buffet wrote: “My regular recommendation has been a low-cost S&P 500 index fund”.

After all, it not only carries the low fees that are the hallmark of any index fund, but it also provides for a significant amount of diversification.

Related: VOO vs SPY: Which S&P 500 ETF is Best?

What is the compound interest rate on this?

The average annual returns of VFIAX for the period from 2010 to the end of 2019 were 14.12%.

The graph clearly shows there was some volatility with some very strong years counter-balanced by some where investments barely broke even – or, in one case, lost money.

Overall, however, this fund far exceeded the 12% limit during this decade.

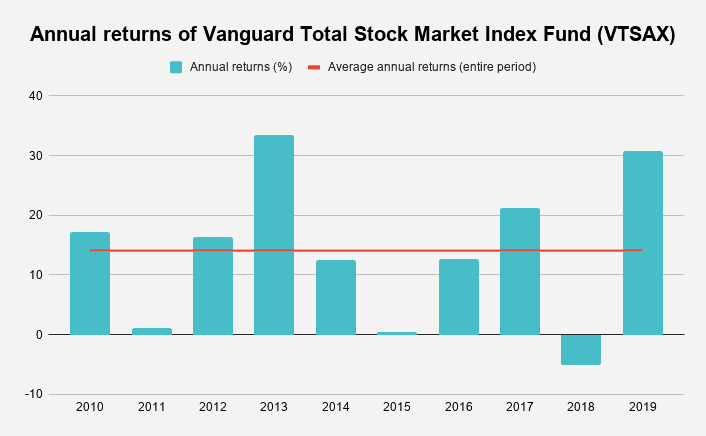

2. Vanguard Total Stock Market Index Fund (VTSAX)

Another strong option for potential investors in the US is to invest in a total stock market index fund, like VTSAX.

This means that the fund tracks the performance of every publicly traded stock in the US, which amounts to more than 3,500 individual shares.

This, in turn, will certainly maximize your diversification while maintaining the low costs that accompany most index funds.

Related: VTSAX vs VTI: What’s the Difference (and Which One Should You Pick)?

What is the compound interest rate on this?

VTSAX was slightly outperformed by its S&P 500 equivalent, in that its average annual returns from 2010 to 2019 were 14.07%.

While there were some years where performance was less impressive, this shows that investing in a total stock market index fund, including when just emerging from a recession, can produce strong results.

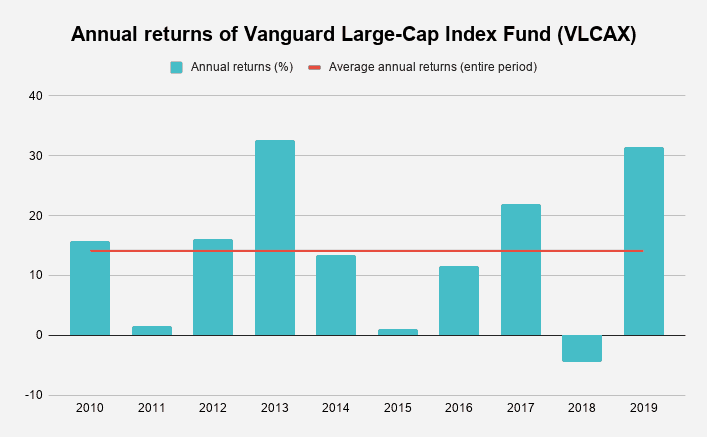

3. Vanguard Large-Cap Index Fund (VLCAX)

This index fund provides broad, low-cost exposure to large US companies representing the top 85% of market capitalization.

This means its biggest holdings are similar to those seen in the last two funds on this list, such as Microsoft, Apple and Amazon, with almost 600 stocks held.

The downside of this is that its returns may be less impressive when other areas of the market outside of the large companies perform better.

What is the compound interest rate on this?

Perhaps unsurprisingly given their similar portfolios, the average annual return of VLCAX at 14.12% over the ten-year period is almost identical to VFIAX.

The graphs are also almost identical, showing that even the so-called “safe” large companies aren’t immune from volatility.

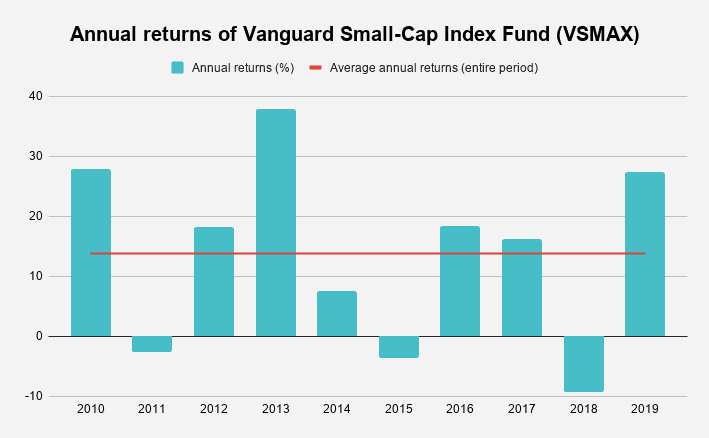

4. Vanguard Small-Cap Index Fund (VSMAX)

This fund tracks an index of small-sized companies, equal to holding almost 1,350 stocks.

Small-cap stocks can be subject to even more volatility than their large-cap cousins, and thus are generally recommended to be included as part of an already diversified portfolio.

At the same time, they offer a good opportunity for investors to diversify further away from the more traditional options seen above – subject to care being exercised, though.

What is the compound interest rate on this?

While the volatility in this fund can be seen below, given the many ups and downs on the graph, the average annual return of 13.77% makes this one of the strongest 12% compound interest accounts.

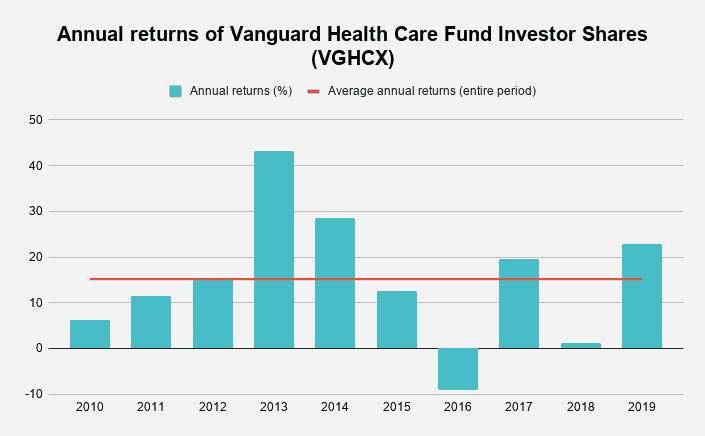

5. Vanguard Health Care Fund Investor Shares (VGHCX)

VGHCX is a good example of an industry-specific index fund. It consists of around 90 stocks in US and international companies involved in various areas of the healthcare industry.

This means you’d be buying into a pool of companies that include medical supply forms, pharmaceutical companies and research entities.

Just keep in mind that broad or total market index funds also include companies from these industries.

At the same time, this means that bad years can have a particularly negative effect on funds with a limited scope like this. As such, it’s generally recommended that this be combined with some broader-based funds.

What is the compound interest rate on this?

VGHCX is one of the top performing funds on this list, with an average annual return of 15.18%.

This makes it far exceed the criteria to be considered one of the 12% compound interest accounts included here.

While it’s one bad year was particularly bad, it will be very interesting to see the performance of this specific index fund over the coming years of volatility, given the cause of the current recession.

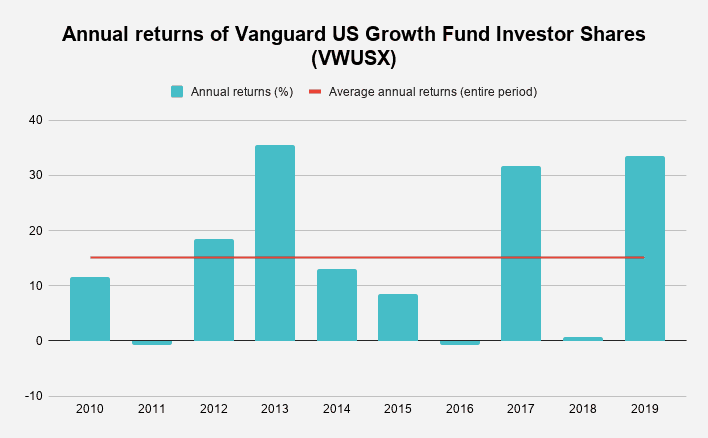

6. Vanguard US Growth Fund Investor Shares (VWUSX)

VWUSX focuses on well-known blue-chip companies, meaning they tend to hold strong positions in their areas of expertise with corresponding steady performance.

With just over 250 stocks in this fund, it’s largest holdings are much like some of the others you’ll find on this list, including Microsoft, Amazon, Alphabet (i.e. Google), Visa, Tesla and so on.

What is the compound interest rate on this?

With average annual returns over the relevant period of 15.12%, performance has definitely been strong for VWUSX

That said, the high-performing years have been punctuated by years of essentially no performance at all – or even negative performance, in two cases.

These fluctuations would be concerning for many investors, so it would be entirely reasonable to balance your investment in this fund with some more stable options, such as bonds.

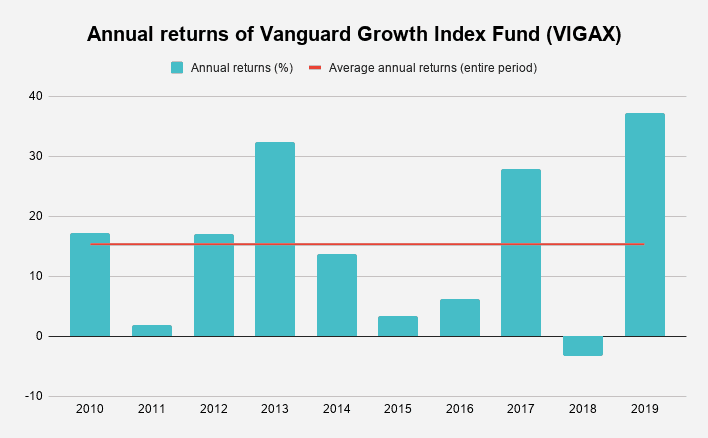

7. Vanguard Growth Index Fund (VIGAX)

This fund holds stocks in large US companies in market sectors that Vanguard perceives as growing quicker than the market as a whole.

This tends to mean that its main holdings are similar to other funds on this list that also invest in major companies on the US stock market with the top three, once again, being Microsoft, Apple and Amazon.

What is the compound interest rate on this?

Over the previous ten-year period, the average annual returns for VIGAX were 15.31%.

This makes it the top performing fund on this list of 12% compound interest accounts. Interestingly, this means that it also outperformed the total market as well as historically reliable broad market funds, like those that track the S&P 500.

Vanguard warns on its site that the focus of this fund on large companies in areas of growth means that it may underperform the broader stock market. For the last decade, though, this doesn’t appear to have been the case.

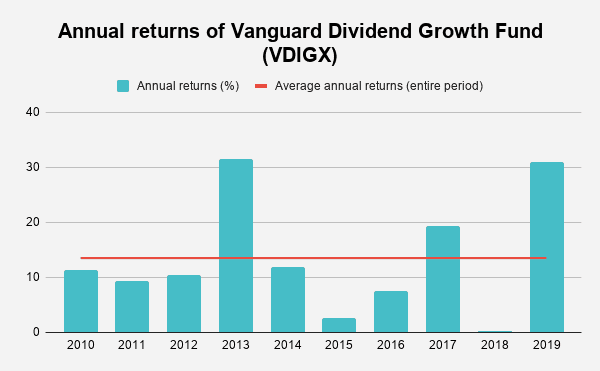

8. Vanguard Dividend Growth Fund (VDIGX)

Rather than focusing on a specific industry or type of company, this fund is designed to provide exposure to companies that pay out strong dividends over time.

This is certainly one option to pursue for your investment strategy to grow your wealth, as the payment of dividends is similar to the concept of banks calculating and adding compound interest to an account.

That said, the fund is smaller than many on this list, with the largest holdings consisting of companies such as McDonald’s, Coca-Cola and Johnson & Johnson. It also only consists of a pool of 42 stocks, potentially opening it up to more volatility than some of the larger funds discussed above.

What is the compound interest rate on this?

The average annual returns of VDIGX over the relevant period were 13.52%.

This is certainly nothing to sniff at. It also saw far more positive performing years during the ten-year period than the other funds on this list, with only one year where returns were barely about 0%.

How to invest in 12% compound interest accounts?

The way to invest in these 12% compound interest accounts (or more, as we’ve seen from the average returns in this article) depends on the type of investment.

Specifically, for index funds, these are divided as follows.

ETFs

ETFs are purchased through a brokerage account and are traded like stocks.

You buy them from other market participants, which may be an individual investor or, more likely, a firm that specializes in buying and selling ETFs.

Related: Acorns vs Robinhood: Which Micro-Investing App is Better?

Mutual funds

Mutual funds, including those that track an index, are bought directly from a fund company, like Vanguard as seen from the options on this list.

Other companies, like Charles Schwab, also have similar index funds on offer.

What is the best compound interest account?

What is the best compound interest account for you will depend on a variety of factors based on your personal circumstances and financial goals.

However, you may want to consider some of the following points:

- Your risk tolerance – better returns over time often mean more volatility. You’ll need to determine whether you’re willing to cope with some white-knuckled drops.

- How close you are to retirement – the closer you are, the more risk-averse you should generally be

- When you need to access your money – if you will need your funds in the next few years for a certain goal, like buying a house, it’s best to put them somewhere with less volatility

- Your goals for the money you plan to invest – if you’re investing for your kids’ college funds and your kids are still in diapers, you may be able to consider more volatile investments as you’ll have the time to recover from any drops. Alternatively, if they’re in their teens, perhaps consider more conservative investments to make sure your money isn’t at risk before they hit their college years.

- Any tax considerations – this is especially the case for retirement accounts, like a traditional or Roth IRA, which tend to be more tax advantageous depending on the type of account you choose. These do have some limits though, so it’s a good idea to do your research.

Related: How to Invest and Make Money Daily: 7 Proven Strategies

What kind of accounts have compound interest?

Generally, compound interest is applied to things like bank accounts, where the bank calculates the amount of interest you’ve earned on your balance and adds the interest on top of that.

This means that the investments on this list don’t actually generate compound interest in the literal sense of the term. They do, however, work in a similar way.

For example, when an index fund pays out dividends and you choose to reinvest them, the value of the dividends is added to the value of your existing investments. Over time, this can have a huge effect on your overall wealth.

What is the highest compound interest rate at a bank?

CIT Bank’s Money Market account has one of the highest compound interest rates of any bank. And as an added bonus, there are no fees and you only need $100 to open an account with them.

Clearly this is far less than a 12% compound interest account. But if you need to keep your money somewhere safe or for a shorter term, this is a great option.

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

What about a high interest savings account?

The Savings Builder account from CIT Bank is also a solid choice for keeping your savings somewhere secure.

This high interest savings account also offer a great interest rate as well as being entirely fee-free.

If you’re looking for an account to keep your emergency fund or something like a house deposit if you plan to buy within the next three years, you can’t go wrong with either of these.

Can I earn 12% compound interest on a money market account?

Unfortunately not – at least not in the US or other western countries.

However, this article shows that there are banks that offer compound interest at 12% or more in countries like Ukraine, Mongolia, Bangladesh and Argentina.

It’s up to you though to determine the security of your money if you choose one of these options.

FAQs about compound interest?

Does compound interest really work?

Compound interest is the key to any strategy to grow your wealth.

With some time, it can turn a relatively low initial investment into an amount that can ensure your financial security for the years to come.

After all, even a few extra years in a low-cost index fund can have a massive effect on the value of your portfolio in future.

How much interest does $10,000 earn a year?

If you invest $10,000 in a 12% compound interest account, it will be worth $11,200 at the end of that year.

However, the real power comes in the years after that. This is because, in every subsequent year, you’ll then be earning 12% compound interest on the new amount.

After five years, this means your initial investment will be worth $17,623.42. After 30 years, you’ll hold $299,599.22 – all from just a starting amount of $10,000.

Not too bad. But what if you add $10,000 every year?

After five years, your $50,000 investment will be worth $71,151.89.

And in 30 years, you’ll have a massive $2,702,926 – from investing a total of $300,000 during that time.

If anything should show the power of compound interest, it’s results like that.

Related: How to Invest $25k: 13 Strategies to Grow Your Wealth

How much will $100k be worth in 20 years?

If you don’t make any other contributions and keep your money in an account that earns 12% compound interest on average, your initial investment of $100,000 will be worth a cool $964,629.31 in 20 years.

How can I earn compound interest daily?

Some banks do offer interest that is compounded daily, which can result in the account owner earning even more than if interest was compounded on a monthly basis.

That said, the effect is usually fairly minimal. What’s far more important to your overall returns is the actual interest rate.

Where can I try using a compound interest calculator?

We like to use this one from Moneychimp, but there are plenty of others available online for free.

So is earning 12% compound interest actually feasible?

Earning 12% in annual returns on your investments is certainly feasible. As this list should show, over time, there have been plenty of funds where the average annual returns have far exceeded this amount.

You won’t, however, find any 12% compound interest accounts in a bank or other financial institution – at least not in a country with a reliable regulatory framework.

It’s also worth remembering that past financial performance is no guarantee of future performance.

Instead, you should do your research and plan your long-term investment strategy accordingly. While years with 12%+ returns will not always be possible, the market average of 8% will almost certainly let your wealth grow over time.