There’s no question that investing in real estate is one of the most popular choices for building wealth. And something that a lot of people turn to, especially in areas where houses may be overly expensive, is apartment investing.

After all, it can often offer a much cheaper way to start building your real estate empire, especially if you’re looking to start enjoying all the tax benefits involved in renting out property.

At the same time, there are definitely some things to consider before diving into this – including some other ways that you can start investing in apartments that don’t simply involve buying one yourself.

Keep reading for some different options for you to get into apartment investing, as well as some points that you may want to take a second look at before getting started.

How do I start investing in an apartment?

There are a bunch of ways that you can see how to get started in apartment investing, not all of which are as obvious as you may think.

Here’s our crash apartment investing course for you.

1. Buy an apartment yourself

This may sound a bit “apartment investing for dummies” but it has to be the first one on the list – if you want to get into apartment investing, buying one should be your first option.

The main reason people skip over this one is because they can’t afford it. If that’s you, you could consider purchasing an apartment with someone else, whether that’s a partner, family member or someone else.

That does come with its own complications though, so make sure you know what you’re getting into and that you’re both on the same page in terms of how you see each of you managing the apartment going forward.

But if the cost puts this out of the question, don’t worry: there are other options too.

2. Invest in a real estate investment trust (REIT)

A real estate investment trust (or REIT) is a company that owns and invests in properties that produce income. It then allows investors to buy shares in the REIT, so that any money earned by the REIT is then distributed to investors.

Of course, it means that you won’t own the property yourself. But you will get many of the benefits of owning a property, without all the expense and hassle involved. This is why, for those asking themselves how to invest in apartments with no money (or at least not enough money to own an apartment themselves), the answer is often to invest in a REIT.

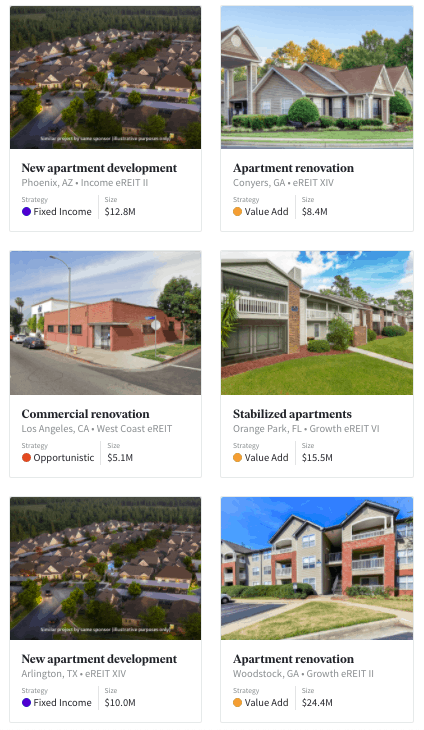

And one of the biggest names in the area of REITs is Fundrise. With over 150,000 investors, they have literally hundreds of properties into which you can invest without the hassle (and cost) of doing it yourself.

You can even see some examples of these properties in the picture below.

How it works is that you pick from various portfolios that offer a mix of properties that fit your risk profile – and you only need $500 to start.

Find out more about investing with Fundrise here.

3. Contribute to a syndication

A syndication is when a group of investors (referred to as “limited partners”) pool their funds to purchase an investment property. The person leading the syndication is the “general partner” and they’re responsible for deciding how to manage the property according to the business plan that all partners agree to before signing on.

Limited partners aren’t involved in those decisions, although they do agree to the business plan when adding their money to the pot. Instead, their role is to collect any distributions and their share of the profits if the property is ultimately sold.

As you can see, this has some similarities to a REIT and can also come with many of the benefits that owning a property involves.

Related: How to Invest $25k: 13 Strategies to Grow Your Wealth

4. Lead a syndication

While you probably shouldn’t do this without a lot of research, you could always consider becoming the general partner in a syndication.

That is, instead of simply contributing money and waiting for the returns to start rolling in, you’d be the active leader, making decisions on behalf of the other investors in how to deal with and, eventually, sell the property.

It’s a lot more work – but you also get a lot more money out of it than you would otherwise.

5. Invest in a real estate fund

When investing in things like REITs and syndications, you know which properties you’re investing in.

A real estate fund is different in that you’re adding your funds to a pool of money that you know will be invested in real estate, but you don’t know exactly which properties. Instead, it’s the fund manager who decides how the money will be invested, including how the properties they end up buying are managed.

This has the benefit of giving you more diversification, as you’re likely investing in more properties here than you would with some of the other options.

At the same time, you’re putting a lot of trust in the fund managers, so it’s good to do your research. You’ll also likely have a higher minimum deposit here than with a REIT or syndication.

Related: How to Invest and Make Money Daily: 7 Proven Strategies

Are apartments good investments?

Apartments can be good investments for many of the same reasons that standalone properties can be good investments too. At the same time, there are some particular advantages to focusing on adding apartments to your property portfolio, as you’ll see below.

1. Can provide a consistent income stream

One of the main reasons investors often consider property over other types of income generating assets is due to the consistent income stream that can be provided from rent.

It’s hardly surprising to say that having multiple streams of income is definitely a good thing for many reasons, with rental income being one of the most popular of these.

Related: The 11 Best Compound Interest Investments To Grow Your Wealth

2. Income produced can pay off debt related to the property

Unlike other forms of debt, a mortgage over an investment property is a good example of where the asset itself can, in time, pay off the debt.

This is especially the case if the rent you receive exceeds any mortgage payments and other expenses for the property, as it means the apartment will basically be sustaining itself while it (ideally) goes up in value.

(That said, it’s worth mentioning that there are some cases where people prefer that the rent received is actually less than these expenses, primarily for tax purposes.)

And as the amount of debt over the property reduces, your equity in the property will build. Depending on your overall investment strategy, this can be a great way for apartment investing to almost be self-sustainable, as the equity that builds in your first investment property can be used to buy your next one.

3. Tax benefits

While you should always speak to a professional to get tax advice that’s specific to your circumstances, as a general rule, property investors have a number of tax advantages available to them. This includes benefits that aren’t available to homeowners.

For example, you can deduct any mortgage interest, various insurance premiums, repairs made to a property for your tenants and utilities that aren’t paid by your tenants.

You can find out more directly from the IRS.

4. You can often build your property portfolio faster

If you’re looking to own multiple properties for investment purposes (and you’re not already a real estate baron), it’s often easier to do this through apartment investing rather than standalone properties.

This isn’t necessarily because apartments are cheaper than houses, although that’s sometimes the case depending on where you are.

Instead, you can find yourself in a position where you can buy a building or a block of land with several apartments already on it – or where you plan to build this, if you’re at that point financially.

This means that any steps needed relating to the purchasing process – like inspections, contract negotiations and discussions with the bank – will result in you owning several properties, not just one. Not only does this mean that it’s quicker on a per property basis, but it can also be cheaper overall when compared to doing it for individual properties.

Depending on your overall strategy, this could be a clear advantage for you.

5. Increases in value over time

This isn’t specific to apartment investing, but it’s still important to mention that the overall goal of most property investors is for their properties to increase in value.

After all, earning rental income is great and all, but the real gains come from when you can sell later at a profit.

But if 2008 taught us anything, it’s that this isn’t guaranteed, which is why apartment investing shouldn’t be seen as a one-way ticket to wealth. But with some careful research, this can be a great advantage of investing in this way.

6. Can be cheaper to maintain

Another benefit of apartment investing over standalone properties is that, in many cases, they can be cheaper to maintain.

With a house or building, you’ll often have to deal with all sorts of outside maintenance that doesn’t apply to an apartment. And that’s not even to mention the fact that, generally speaking, apartments are smaller than standalone properties, meaning there’s simply less to maintain.

Of course, it’s not always as black and white as that. But it’s definitely a point to consider when deciding which way you want your real estate portfolio to go.

7. Benefits of consolidating the management of the property

For most people, hiring out your property management is going to be the easier choice. While it obviously costs more than doing it yourself, outsourcing this can save you a lot of time and headaches, and is especially needed if you’re looking to get into passive apartment investing.

And the fee for a firm to manage your apartment is often less than for a house or commercial property. Because, on average, it can involve less work by the property manager, many of them will charge a lower fee for apartments.

It’s also worth mentioning the advantage here of owning multiple properties which, as mentioned, can sometimes be easier to do with apartments. But one way for this to cost less is if you can engage a property management firm to manage several properties on your behalf. In those cases, you’ll almost always get a better deal on a per property basis

Why apartments are a bad investment

When it comes to investing in apartments, the pros and cons should both be considered before signing on the dotted line. We’ve listed some of them below.

1. Oversupply issues often apply more to apartments than houses

Oversupply is a very real concern for property investors due to the impact this can have on the value of their properties and the amount of rent they can ask for.

And in many major cities that have previously seen property booms, there are repeated reports of oversupply of apartments in particular. This includes cities in the US, Canada and Australia, among many others.

It’s a good lesson why doing your research into apartment investing is a must to make sure it actually is a good investment.

2. Be aware of ongoing fees

Many apartments come with monthly or quarterly fees which should be factored into any decision to get into apartment investing. These are charged for maintenance of the building, common areas and the grounds.

While some houses also have similar fees, like those charged by homeowners associations, it’s much more common to see this for apartments.

3. Limited opportunities to renovate for capital appreciation

One of the main ways that people increase the values of any houses or buildings they own is by renovating them. For houses in particular, this can be a good strategy to increase the value of your asset.

For apartments though, this isn’t quite as possible. Sure, you may be able to do some interior renovations. But there are often restrictions on this and you can’t, say, extend an apartment or even update the outside in most cases.

This means doing the math to see what’s feasible when it comes to capital appreciation will be key.

4. Apartments can be less liquid than houses

As a general rule, houses tend to sell faster than apartments.

It won’t be true everywhere and of course there are other factors involved. But it does mean that you should at least plan for your apartment to be less liquid and have some contingency plans for this.

5. Owning land often sees higher increases in value

Broadly speaking, land tends to appreciate in value over time faster than buildings – including much faster than the apartments in those buildings.

This is often why an apartment can be cheaper to buy than a house. While that will put you on the property ladder, your growth options may be more limited.

Is owning apartments profitable?

Owning apartments can be profitable if the property increases in value as well as if the rent you are receiving allows you to contribute to your mortgage and pay for other expenses relating to the investment. This can be the case when investing in apartments, although it’s important to do your research before purchasing.

That is, much like owning houses or commercial buildings, apartments can still very well increase in value and provide you with a steady stream of rent.

It will be important though to have a good understanding of the approximate amount of capital appreciation you may be able to expect alongside the expenses involved in owning an apartment.

Similarly, determining the rent you may be able to ask for, calculating in periods where no rent may be coming in, will be critical when determining if an apartment is actually a good investment.

You may also be interested in: VOO vs SPY: Which S&P 500 ETF is best?

Do apartments increase in value?

Apartments can increase in value, although it is often the case that this will not be at the same rate as any houses in the area. Nevertheless, factors like the size of the apartment, its location, available parking, build quality and the rate of supply in the local area will all impact this.

This article expands upon these points more to give at least some general rules of when an apartment is more likely to gain in value.

How can I make money with an apartment?

There are several ways to make money with an apartment, some of which can actually be done at the same time.

- Rent your apartment out – Bringing rent in is probably the most obvious way to make money from apartment investing, but there’s no doubt that it works.

- Renovate the apartment – You’re going to be more limited on renovation options compared to a house but, where possible, even minor updates can continue to make it attractive to potential buyers and drive its value up.

- Live in the apartment and rent out your former house – If you live in a house that’s bigger than you need or that otherwise doesn’t meet your needs anymore, one option can be to buy a smaller apartment and then make more money from renting out the house. This can be particularly good for empty nesters who may have things like bedrooms that are no longer in use.

- Rent out unused parking space – If you live in an apartment in a major city where parking is scarce, that unused parking space you have downstairs can be turned into a real money maker.

- Offer it for short term rental on Airbnb – This is different from the first option in that you’re not going to have someone in consistently for a long time. Instead, especially if you live near a major tourist area, it can actually be more profitable to rent on Airbnb. Just be aware of movements in some cities against this kind of thing.

Final thoughts on apartment investing

The question of investing in apartments vs houses or if you even should get into apartment investing at all can be a big one. This means, like any investment, it’s important to do your research.

It’s obvious that investing in property is one of the most popular ways out there for people to build wealth, so it’s clear that it can definitely work.

But in terms of whether it’s better to invest in apartments or houses, that’s going to depend on a number of factors, including the situation in the area you’re apartment hunting.

This means, when it comes to apartment investing for beginners, it’s worth taking your time to weigh up your options, see how much money you have available and do the math to see what the best way forward is for you.