You suddenly need to use a check after who-knows-how-long. You pull out your dusty old checkbook from a drawer somewhere, open it up to fill it out and…the check’s address is wrong.

So can you use a check with an old address – or are you in trouble?

Well, as you’ll see, this isn’t actually as big a problem as it may first seem. In fact, in the vast majority of cases, the address on your check doesn’t even matter at all.

That said, there are some situations where it could be an issue – but there’s also a very simple solution, as we’ll run through below.

Not only are they amazing value, but they also have a huge range of designs.

Can you use a check with an old address?

Yes, you can use a check with an old address as long as the account number and routing number are correct, so that the receiving bank can process the check and withdraw funds from your checking account.

This means that your checks’ address actually isn’t the most important part, especially when compared to the numbers needed for the check to be valid. In fact, you can even order checks now without any address at all!

And if you do need to order new checks, take a look at our article on whether it’s safe to order checks online… (spoiler alert: it’s actually better).

Does it matter if my address is wrong on a check?

No, it doesn’t matter if your address is wrong on a check, provided that your account and routing numbers on the checks are still accurate. Otherwise, the receiving bank will not be able to access the necessary funds in your checking account.

This means that if you’ve simply moved houses but all your account details are unchanged, it’s fine to continue using your checkbook, even if your checks’ address is from your old house.

Of course, while you can deposit a check with your old address, you’d ideally make sure everything on your checks is up to date. At the same time, there’s no point in wasting a perfectly good checkbook – although don’t be tempted to use white out on a check as a way to correct the address.

How long can you use checks with an old address?

The address on a check doesn’t really matter so you can use a check with an old address for as long as you want. Of course, it’s better for all the details on a check to be accurate, but this won’t prevent the bank from processing it.

For that reason, feel free to use an old checkbook for as long as your account is still open at that bank!

Can I put an address label on a check?

Yes, you can put an address label on a check to cover an old address, as long as it does not also cover the account and routing numbers. While it’s not strictly necessary, some people like to do this for peace of mind.

These are incredibly easy to order, with these customizable address labels on Amazon being an absolute steal, given how many you get.

Just make sure that you measure the size of the area of the check that shows your address, to make sure that the label you end up buying isn’t too big and accidentally covers other parts of the check that you need to leave unaffected.

You could also go the more traditional route and just buy blank white label stickers, like these ones which are less than $5. That way, you can simply cover the check’s address and write your new address over it by pen.

It may take slightly more work on your part, but at least it means that you won’t be stuck with labels with the wrong address if you think that you’ll move before you use the pre-printed ones up.

You may also be interested in: If a Deposit is Pending Can I Use the Money?

Does the address on your check matter?

No, the address on your check doesn’t really matter, although it’s good if it’s accurate. The more important details are your account and routing numbers, which have to be accurate for the check to be processed.

The fact that your checks’ address can be fairly unimportant is shown by the fact that you can order checks without any address at all.

This could actually be the best strategy if you don’t use checks very often, so you think that your checkbook could last you for a few years – including, possibly, a move to a new address.

What address should be on checks?

The address that should ideally be on your checks is your current address, although it doesn’t matter if your check has an old address on it. However, you can actually order checks now without any address at all, which are completely valid.

This is much better for reducing waste, as it means that you won’t have to worry about your checks’ address if you move houses and realize that the address in your checkbook is no longer up to date.

It’s also great from a privacy perspective, as it ensures that you’re only sharing the information that you absolutely have to for the transaction at hand. That is, while your account and routing number are needed in order to process a check and allow the receiving bank to withdraw the funds from your checking account, they don’t need your address for this.

Do checks have to have an address?

No, checks don’t need to have an address on them. However, what they do need is to have your account and routing numbers so the check can be processed, allowing the bank to withdraw the necessary funds from your account.

This means that having checks with your address on them really isn’t necessary any more. In fact, it’s arguably the best practice now to order checks without an address.

On the odd occasion where you’re asked for your address to verify the check, you can simply give it to them verbally. Alternatively, if someone really won’t accept a check that doesn’t have an address on it, you can have a cashier’s check issued as a one-off, which has that information.

You may also be interested in: When You Get a New Debit Card Does the Card Number Change?

Can I use a check without a name and address?

There is no rule against using a check without a name and address, as the only strict requirement is that a check has your account and routing number. However, some recipients will not be able to accept checks that do not have a name and address included.

This is rare, but can happen if, say, you need to send a check to a government department. This forum comment, for example, mentions how the Department of State required a check with the person’s full name and address.

You can always choose to have your check issued with only your first initial. For example, Tom Jones could have his check issued under “T. Jones”, which you may wish to do for added privacy.

That said, you could still run into the problem mentioned above on occasion. It’s also worth mentioning that someone receiving a check from you would usually have a pretty good idea of your full name already.

At the same time, it’s very rare for this to be a requirement, so you may wish to buy checks that don’t have your full name and address and then simply have a cashier’s checks issued when those requirements pop up.

You may also be interested in: 17 Reasons Why Your Debit Card Isn’t Working – and How to Fix It

Where do you write your address on a check?

If you feel you need to write your address on a check, add it to the top left corner. That said, you don’t generally need to do this as it’s usually printed in the top left corner. In most cases, you’re also able to issue a check without your address on it.

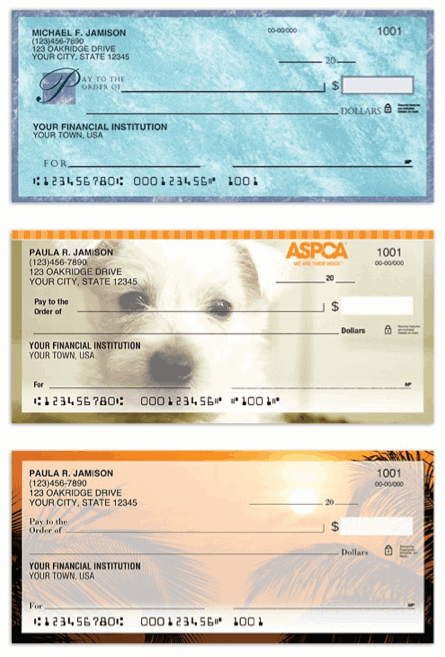

You can see an example of this here on the checks below, which come with the checks’ address printed on them already:

(If you like these designs, they’re from Checks In The Mail, which let you order checks online – and you can choose to have your address and phone number left off. Click here to get 20% off when you order from them.)

At the same time, it’s not completely unheard of for check recipients, like retailers, to ask for specific details about you in order for them to accept a check. In some cases, if it’s not printed on there already like on the ones above, they may ask for your phone number to help them (or their bank) verify the check as a fraud prevention strategy, which they’ll write on the check with a pen.

This doesn’t invalidate the check – far from it, actually, as it’s more common than you may expect. So, similarly, if your check’s address isn’t printed on there, it’s theoretically possible for someone who requires that information to handwrite it, much like a phone number.

To be clear, I’m not aware of any examples of that specific situation happening. But given that writing a phone number on the check still makes sure that it’s valid, it seems like handwriting an address on it, if needed, could do the same.

Can I cash a check if the address is different?

Yes, you can generally cash a check if the address is different from the one on your ID, as it’s more important that the name on the check is accurate. However, this won’t always be accepted by everywhere that cashes checks.

This is because some places do require that both the name and address on the check match yours if you’re the one cashing it.

It’s hard to give a general rule as to when you can’t cash a check with the wrong address, as it will largely depend on each place’s own rules. But to avoid any issues, try to make sure that your details as the recipient match all of the relevant details on the check itself.

Related: Can Someone Else Deposit a Check For Me?

Does a check have to have the correct address?

No, a check does not need to have the correct address, as the more important features for the check to be valid and for the bank to process it are that the account and routing numbers as well as the name of the recipient are accurate.

However, as mentioned above, having an incorrect address can cause problems in some places that may have specific requirements. That is, they may need the correct address to be included so that they can check this against the relevant person’s ID as a fraud prevention strategy.

If you’re the payee, the check’s address is incorrect and you can’t find anyone that will cash the check despite this, it’s perfectly fine to ask for the check to be reissued.

One situation where this comes up is if your employer pays you by check and you’ve moved houses but payroll hasn’t been updated yet. In that situation, there will be internal processes to resolve this problem as you can pretty much guarantee that this isn’t the first time this has happened.

You may also be interested in: How to Get Rich From Nothing: The One Strategy That’s Proven to Work

Required information on personal checks

The only required information that must be on a check is the payee’s name, the value of the check, the payer’s account and routing number, their signature and the date of the check. Having these details will allow the bank to process the check.

There’s a bunch of other information you can include if you want to (and is sometimes required by the recipient based on their own policies) but you don’t strictly need to have it on there. This includes:

- Personal details about the person who issued the check, such as their name, address and phone number

- Notes about what the check is for in the “memo” section

- Your bank’s contact information is often printed on there automatically, although this is less common now that you can buy checks online much more cheaply (and just as safely!)

Final thoughts on whether using a check with an old address matters

As should be pretty clear by now, it’s absolutely not necessary to have your checks’ address printed on there.

In fact, common practice now is the exact opposite. Whether it’s for security or privacy concerns or a desire to reduce waste by not having to throw out old checkbooks that no longer have the correct address (even though you can use a check with an old address), it’s often seen as better now to order checks with no address on them at all.

That said, it may not be your choice if you tend to order certified checks, in which case it may ultimately end up being up to your bank.

There are also very easy solutions if you do come across someone that will only accept a check with your address on it, specifically getting a cashier’s check with all of the information on it that the recipient needs.

Otherwise, calling your bank for advice on these kinds of things is always a good strategy. That way, you’ll be confident that you know exactly where your money is going.