Most of us start investing in order to make sure we can afford to retire at some point in the future. But perhaps you’re looking to go further than that by finding out how to invest and make money daily, to really ramp up the benefits that investing can offer.

It does sound pretty good to think that you’re putting your money somewhere that continues to generate income every single day. And really, the ultimate aim of most investments is for them to continue to grow in value until the day comes where we need to cash out.

Of course, at the same time, the more you expect to make each day, the riskier the investment can become. And that means the chance of also losing money every day, not only earning it.

So for any investment, even small investments that make money, it’s important to make sure you’re aware of the risks and comfortable to accept them – and that you’re not pouring your life savings into an investment where there’s a chance that you could lose everything tomorrow.

That doesn’t mean that it’s not possible to invest and make money daily. In fact, some of the recommendations below in order to do this are also great ones to follow for your longer term retirement strategy.

But it’s also good to keep in mind that you should be in this for the long haul. This means that focusing only on investments that pay daily profits should perhaps not be your primary goal.

Instead, your main aim should be to grow your wealth over the long term to make sure you’re fully securing your financial future. And these strategies can offer some great ways to get started with that!

How to invest and make money daily

While your overall objective with investing should be to set yourself up for retirement, there still could be room in your portfolio for some other investments that have a slightly different focus.

And if that focus happens to be looking how to get a guaranteed daily return on your investment, then finding out how to invest and make money daily could be a great way to achieve that as a secondary goal.

1. Stocks

Buying and selling stocks is probably what first comes to mind when you’re wondering how to invest and make money daily.

Most wannabe investors have probably had dreams at some point of putting a small amount of money into one company’s shares and the value of that company just skyrocketing overnight. And there are certainly stories of when someone invests $100 and makes $1,000 a day from it after selling for a massive profit a short time later.

Want to get two free stocks? Simply sign up with Webull and open a brokerage account (it’s free!) and two free stocks will be yours! (Some people even got Google and Apple stocks from this, just saying…)

And what about two more free stocks? All you have to do is deposit $100 in your new brokerage account and two bonus stocks will be on their way.

The act of buying and selling shares over a short period of time is known as “day trading”. As opposed to, say, those who buy and hold for years, with the aim of only selling when they need to fund their retirement, day traders most look for what they can invest in to make money fast. Overall, their aim is to make small (or large) amounts of money over a few days or weeks.

Making something like a 10% daily profit sounds pretty nice, although this presents a pretty obvious risk. That is, the fact that stocks can rapidly go up in price means they can also rapidly drop in price too.

This is why you should always be wary about something like day trading and make sure you take the time to do your research into what exactly you’re investing in. In this case, it’s generally best if you’d be fine with losing the money you invest.

Can you make a lot of money in stocks?

It’s safe to say that you can definitely make a lot of money in stocks, with this historically being one of the most lucrative income generating assets you can own. Some individual investors have built a net worth of literally billions of dollars from their stock investments, largely thanks to the consistently upwards trend of the market.

That said, it takes time, experience and, in some cases, more than a little luck.

But just to highlight how much money you can make on the stock market, some of the world’s most successful investors include:

- Stephen Schwarzman, with a net worth of $18.5 billion. The former managing director of Lehman Brothers then went on to found Blackstone Group, which now manages over $470 billion in assets.

- George Soros, who’s worth $24.9 billion, originally worked as a waiter before starting a highly successful career in finance. This has led up to his current role of being the chairman of Soros Fund Management which, among other things, manages the Quantum Fund. Since its inception in 1973, this has generated $40 billion, making it the most successful hedge fund in history.

- Warren Buffet, who has a current estimated net worth of $64.3 billion. As the face of Berkshire Hathaway, Buffet is easily the most famous investor in the world, having also made billions of dollars for his followers. Funnily enough, he’s a renowned advocate of the index fund rather than something like day trading.

How can I make $500 a day in the stock market?

Being able to make $500 a day in the stock market will depend on how much you’re investing in the first place. That is, the more you build up your portfolio over time, the more likely it is that you’ll be able to see these kinds of returns. Some luck will also come into play here.

For example, if you only invest $5,000, that would equate to a 10% daily profit, which is not only rare but likely going to be very risky. It’s also very unlikely to be the consistent returns you’ll get over time.

But if you invest $15,000, making $500 from the stock market in one day is only about a 3% daily profit from your investment. Again, this is very good and far from guaranteed over time, especially when you consider that the average annual returns from the stock market are 7% per year.

That said, 3% growth in one day isn’t unheard of, meaning it’s certainly possible to make $500 a day in the stock market. However, if you’re investing in individual companies with the aim to try to make this kind of money every day, make sure you’re giving yourself the time to do your research before committing your money to this.

Even more importantly, make sure you’re doing this with money that you can afford to lose. As this article explains, many day traders risk less than 1% to 2% of their account per trade. If you apply that same rule to your overall portfolio value, you’ll be making sure that you’re protecting as much of it as possible while “playing the market”.

2. REIT

A real estate investment trust (REIT) allows you to invest in real estate without the hassle and cost of buying and managing property yourself.

How it works is that you pool your money with other investors into a trust consisting of various real estate investments. As these properties earn money, whether it be from rent or from the properties being sold, you then share in the earnings with the other investors.

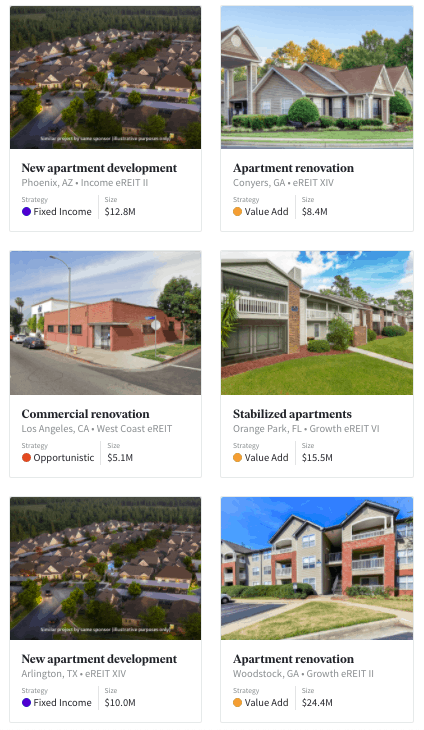

One way to do this is through a company like Fundrise. They have over 130,000 investors on their books, each of whom pick from a range of portfolios that offer various commercial properties that align with your risk appetite.

In fact, you can see some actual examples of their properties in the picture below:

Find out more about Fundrise here or check out our article on apartment investing to see how to get started with this.

3. Micro-investing

Micro-investing is generally done through platforms that help you to regularly save and invest small amounts of money. You’ve probably heard of it in the context of apps that round up your change and invest the rest.

And while you probably won’t earn thousands of dollars with this method, it is a way for almost anyone to invest and make money daily.

In particular, micro-investing can be a good way for someone to start investing who knows they should be, but aren’t really sure where to start.

So the fact they can, say, invest $10 and earn daily interest on that can lay the foundations for building up to investing more significant amounts.

How to manage small investments that make money

Our top pick for getting started with micro-investing is definitely Acorns.

How it works is that every time you buy something on your card or through PayPal, the app will round up the change to the nearest dollar. The rounded up amount is then transferred to a different account and, once it reaches $5, is invested for you.

So if you buy a sandwich for $3.20, Acorns takes the extra $0.80 for you. It means you end up saving and investing every day without even noticing.

(And you can even use Acorns to invest for retirement in a Roth IRA, to really set you on the right path for your financial future.)

Find out more from our Acorns review.

Acorns

Ideal for beginner investors

Want to start investing but always think that you don’t have enough money left over each month? Then Acorns is for you.

It automatically rounds up and invests your spare change, making it a great choice for starting to save and build wealth – without even noticing!

4. High-interest savings account

While you may not immediately think that keeping money in a savings account can be considered “investing”, this should actually be part of everyone’s investing strategy.

In particular, keeping at least three to six months worth of living expenses in a savings account as an emergency fund should be the first thing you do before starting to invest. That way, you know you’re protected should an unwelcome financial surprise appear one day.

And when trying to find a high-interest savings account, it’s important to check not only the interest rate, but also the fees. There are plenty of great fee-free products out there now, meaning there’s no reason you should be paying to keep your money somewhere safe.

Our recommendation for this is definitely CIT Bank. Their Money Market account has some of the highest interest rates in the business. There are also no fees and interest is calculated daily, meaning that this is definitely one way to invest and make money daily.

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

5. Your own side hustle

Investing doesn’t always have to refer to things like the stock market. In fact, putting money into your own earning potential is a great way to invest and make money daily.

And the saying that “you have to spend money to make money” is definitely true when it comes to any income streams you may have outside of your main job.

This is why the best way for you to make more money every day could very well be to put more money into your side hustle to help it grow.

Exactly how that could be done will depend on just what your side hustle is. Maybe you can scale up the amount of stock you have for the product you’re selling or perhaps you could improve the technology that you need to actually make this money, letting you improve the quality or speed of the product or service you’re providing.

In fact, I’d argue that this could be the best way to invest $100 and make $1,000 a day. After all, that $100 added to your business is going directly towards boosting your earning potential in future – which, if you play your cards right could easily be scaled up to $1,000 a day (if not more).

Thinking about starting a blog to make extra money?

Great choice! After all, it’s one of the cheapest online businesses to start at under $3 per month – less than a cup of coffee! In fact, that’s the price you’ll get if you launch your site with Bluehost, which is easily my top pick for the best website host for beginners to use.

Not only will you get a free domain name, but you definitely don’t need any tech experience to get started.

To find out more, check out my simple step-by-step guide on how to start a blog as I show you the exact steps I took to start on the path to earning thousands of dollars every month – on the side of my full-time job!

6. Index funds

Investing in index funds is widely considered the gold standard of retirement strategies. In fact, they’re almost unrivalled in terms of offering a low-fee way to invest in a large portion of the market.

They also offer returns that have beaten managed funds in over 90% of cases. This means that history has shown that choosing to invest in index funds is one of the best investments to compound your returns over time.

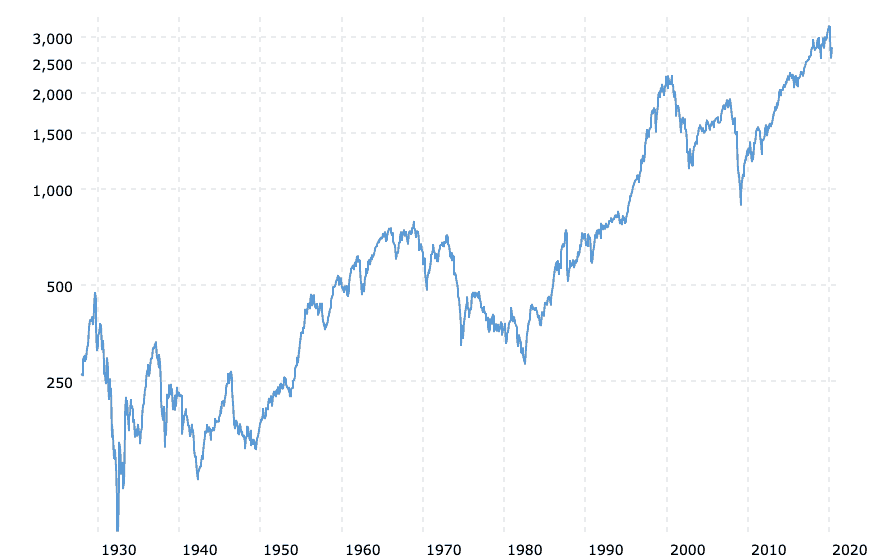

And while you may not consider index funds as a way to invest and make money daily, they work by tracking the performance of a section of the market, such as index funds that follow the S&P 500. As you can see, this has very clearly had an upward trend over time:

With the market naturally moving up and down every day, this also means that index funds can make you money on a daily basis. Of course, this also means you can lose money with them every day – which is why the best strategy is to leave your money in there for the long term, to help you ride out any dips.

It’s also worth noting that you’ll only actually make this money when you sell your investments. However, buying index funds is a great way for the value of your investment to grow over time as those daily gains add up.

Related: VTSAX vs VTI: What’s the Difference (and Which One Should You Pick)?

7. Invest in websites

Flipping websites is becoming increasingly popular these days. It essentially involves buying an existing website, making a few tweaks to it, watching your traffic and income increase and then reselling it at a profit.

And given that the standard at the moment is for websites to sell for about 45x their monthly income, you can probably see just how easy it is to make money here. That is, let’s say you buy a site that makes $100 a month – not too shabby, but definitely room for improvement – meaning you pay $4,500.

By fixing up the content and adding a few different ways to make money, which is really easy to do, you can very simply increase this to earning $500 a month in a short amount of time. And that then leads to you being able to sell it for $22,500 – a huge $18,000 worth of profit with very little effort.

You’ll have to invest some of your time here, with a bit of work on this every day being one of the simpler side hustles out there. (hence why it counts as an option to invest and make money daily). I’d also suggest considering this only after you’ve built your own site from the ground up, so you know what goes into making this tick. See how to start your own site here.

8. Peer-to-peer lending

Peer-to-peer lending, or P2P, is when you pool your money with other investors so that potential borrowers can get loans from this money. You as the investor makes money when the borrower pays back their loan, including taking some of the interest they pay.

It’s not risk-free, as there is a chance that the borrower won’t pay their money back. But when it works out, it can be quite lucrative, as the interest rates are often higher than what traditional lenders offer.

The fact that interest continues to accrue on an ongoing basis while your funds have been borrowed means that this is one way that you can invest and make money daily.

And it has the added bonus of almost being passive income, as once your money’s in the pool of borrowed funds, you don’t have to do anything else to keep earning!

9. Invest in yourself

It may sound cheesy, but this is one of the very few investments where you basically have guaranteed returns.

Whether you want to work on establishing new partnerships for your side hustle, that new website you launched recently or basically any skill on the planet, putting in a bit of work each day is often the best way to get there. You can then easily turn that into a money making strategy in some form.

Sure, you won’t be running marathons in one day. But that short jog you go for today lays the foundations for you to run just that little bit further or little bit faster next month. And then if you keep at it, you may find yourself going for an even longer. And then comes the marathons.

I like to use a habit tracker app for this (a free one is more than enough). That way, I can see just how well – or, ahem, not – I’ve been doing at my chosen goal, which serves as great motivation to keep going. Even on those days I don’t want to do it, using an app like that soon means that maintaining the streak becomes a goal in itself.

Is it possible to invest and make money every day?

It’s absolutely possible to invest and make money every day, although the better question is whether this actually aligns with your investment goals.

That is, if you simply want to buy and sell quite quickly with the aim of making a small amount of money over the short term, then that’s fine as long as you’re aware of the risks.

But if you want to secure your financial future by setting yourself up for retirement, it’s best to keep a long term view of your investments.

Investing consistently is definitely important for doing this, but this also means that it’s also key to continue investing even if you’re not making money every single day.

That is, the market will go up and down – that’s simply reality. And those investors who end up the best are those who continue to invest their money even if there’s a dip. This is because history has shown that those short term drops will, over time, eventually balance out to some very strong returns.

So while investing to make money every day is good, this probably shouldn’t be the main focus of your investment strategy.

At the same time, it’s perfectly fine to keep a small amount of money to the side as “play money”, as long as you can afford to lose it. Whether you want to try a bit of day trading to see what happens or buy some cryptocurrency in case there’s another boom, this isn’t necessarily bad for your overall financial objectives – as long as you’re realistic about the possible (negative) outcomes.

How do investors make money daily?

While investors may choose to put their money to work in different ways, they generally make money daily in the same, broad ways. That is:

- They have clear financial goals

- They invest consistently

- They do their research

- They have a well-balanced portfolio in line with their risk appetite

- They rebalance at regular intervals

There’s a reason that the saying is that “the best time to start investing was 20 years ago and the second best time is today”. This is because one of the main points that will lead to someone being a successful investor is the fact that they started doing so early.

But the other points are also important. After all, pumping all of your money into a company about to go bankrupt is never going to end well, no matter how many years ago you did this.

So set your goals, do your research and stay committed to reaching your desired outcome – which should be in line with the amount of risk you think you can handle.

In doing this, it will make it much easier for you to choose the specific investments where your money ends up.

How do I invest my money to make profit?

Investing in something that’s low-cost and diversified, like index funds, has historically proven to be one of the most effective ways to invest your money and make a profit. While no investment has guaranteed returns, this strategy when done over the long term has shown itself to be a reliable way to prepare for retirement.

In particular, index funds provide for basically as much diversification as you could ever need, with returns that, over time, have outperformed over 92% of managed funds.

If you’d like to protect your portfolio from any major swings, you may also want to look into investing in some bonds. But for many people, that’s essentially the end of where you need to look.

So, sure, you could always dabble in some of the investments listed in this article. As mentioned, micro-investing with a company like Acorns is a good place to start for someone who doesn’t really know how to start investing or thinks they don’t have the money to invest more.

And options like peer-to-peer lending or even day trading can be somewhere to use your “fun money” which you’re ok with losing if things don’t quite go to plan.

But for someone looking to achieve solid returns and pay minimal fees over the long term, having a balance between low-cost index funds and bonds in your portfolio is one of the easiest ways to achieve this.

Related: 12% Compound Interest Accounts? 8 Investments To Earn You Massive Returns

What should I do with 20k?

If you’ve suddenly ended up with $20k – or you managed to save it up over time – you may be wondering what to do with it now.

In response, we always recommend a clear order of how to use this to make sure you’re maximizing the gains you can earn from this. This includes:

- Pay off all high-interest debt. There’s no point investing your money if your returns are going to be eaten away by debt. This means that your first goal always has to be to get rid of this.

- Open an emergency fund. We mentioned earlier that you should be keeping at least three to six months of living expenses in a high-interest savings account, ready to save you in the event of a financially rainy day. Our recommendation for a fee-free version of this with great returns is CIT Bank.

- Contribute to tax-advantageous accounts. This includes things like your 401(k) or Roth IRA retirement accounts, as these not only allow you to invest your money, but you can save a ton of money on tax as well.

- Consider other investment types. This is where options like index funds and the other suggestions on this list come in. That is, while we’re big fans of a well-balanced portfolio consisting of index funds and bonds, there are other steps to do first to make sure you’re getting as much out of your money as possible.

For more information on each of these, check out this article on how to invest $25k. The same strategies can also apply when working out what you should do with $20k.

What are the best investments right now?

The best investment right now is going to depend on your current investment strategy. If you have longer to wait until retirement, you can generally choose some slightly higher risk options. Those closer to retirement, however, often prefer to add bonds and other safer choices into the mix.

This could even mean, if you’re in, say, your 30s and have a relatively high risk tolerance, that you could have a portfolio consisting entirely of index funds.

Sure, this may be quite aggressive and could see you experiencing some pretty major drops during a downturn. However, you’re also at the stage where you have the time to ride these out and the more of your portfolio is made up of index funds compared to bonds, the higher your returns will generally be.

It’s only once you start to approach retirement, when you’ll actually need to begin cashing out your investments, that you should probably start to swing your investment strategy in a more conservative direction. That said, you may prefer to do this earlier or later, which is why having a good idea of your risk tolerance is important.

But all this means that the best investments “right now” is hard to determine. Instead, keep your eye on the prize that’s awaiting in the coming years or decades, and you’ll be much better placed to figure out what works for you.

How can I invest small amounts of money and get rich?

While it’s clear that the more you invest, the more likely it is you’ll earn more over time, every investor starts somewhere. If this means that you’re only able to invest small amounts of money now, that’s still a great stepping stone to building your wealth. Try investing in index funds or using an app like Acorns for this.

In fact, what’s often more important than the amount you invest if how early you start investing. That is, if you’re only able to invest a small amount but can invest that same small amount every single month for the next 30 years, you’re going to be far better placed than someone who chose not to invest that amount.

That said, just make sure that any transaction fees involved in your chosen investment make it worthwhile to invest that small amount each month. In some cases, depending on the amounts we’re talking about here, it can be better to wait to invest this every three months or so to save on fees.

Final thoughts on how to invest and make money daily

There are plenty of ways to invest and make money daily, although many of them do have varying levels of risk involved.

This is why a better way to look at this is how to consistently invest so that your investments can consistently grow over time.

By following this path, it doesn’t necessarily mean that they’ll make money every single day. But if you have a clear investment strategy and stick with it over time, history has shown that you’ll almost certainly see the value of your investments increase.