When your goal is to increase your net worth, you might think that the question of being rich vs wealthy basically has the same answer. After all, they’re both something to aim for, right?

But in practice, there are some major differences between the two. In particular, when it comes to setting your goals of where you want to be in future financially, one of them is definitely more attractive than the other.

This is why we’ll go through just how the two are distinct from one another – and what you can do to get to that point too.

Is wealthy and rich the same?

The main difference between being wealthy and being rich comes down to whether your wealth is sustainable. Both types of people may currently have a high net worth, but someone who is wealthy is far more likely to be able to maintain this wealth into the future.

Generational wealth is definitely part of it, although that suggests that only families with famous last names can be wealthy – and doesn’t really help those of us who aspire to be wealthy.

Instead, one of the key differences in being rich vs wealthy is based on mindset. With all this money that you have when you reach this point, it’s going to come down to how you view this money – and, in turn, how you choose to manage it.

Just look at the fact that 60% of NBA players go broke within five years of retirement and 78% of NFL players experience “financial distress” just two years after finishing up. This is despite the fact that these players earn millions every season – more than enough to live off for the rest of their lives and definitely putting them in the “rich” category.

But they can only claim to be wealthy if they manage their money properly so that it lasts. And with so many of them apparently not making the cut, despite their astronomical earnings while playing, it’s clear that just having a high income isn’t enough.

Rich vs wealthy: Key differences

Looking at the differences between being rich vs wealthy, it should be pretty clear that there’s more to it than simply how much you have in your bank account. Those NBA players we just mentioned had more in their accounts than most of us could ever dream of having in a lifetime – and yet they still ended up right back at the beginning.

This is why considering the difference between being rich and wealthy can help the rest of us see how managing our own money the right way can also lead us down the path to wealth.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

Rich vs wealthy mindset

We just mentioned it earlier but it’s worth saying again: the difference between being rich vs wealthy largely comes down to mindset.

Sure, you can have a massive paycheck and blow it on houses or jewelry or at the casino. You could even spend it on things that aren’t that extravagant, as a straightforward case of “keeping up with the Joneses” can easily destroy your path to wealth.

For example, this survey found that 18% of people making more than $100,000 per year live paycheck to paycheck. Given that your earnings shouldn’t really be a problem at that point, it shows just how much of an impact uncontrolled spending can have on your overall financial situation.

This is why focusing on your long term wealth rather than your short term riches is key to maintaining that wealth. That is, as fun as you may find it to have those cars/jewelry/nights out at the casino, thinking about tomorrow instead of today by investing this money means those riches you may have now will be well on track to turn into solid wealth in the years to come.

Earnings vs asset accumulation

The other main difference in being rich vs wealthy is related to the concept of mindset. That is, thinking about the way you manage your money is one thing – but what you actually do with it is another.

We’ve seen that those who are both rich and wealthy generally have high earnings, with the possible exception of those who inherit their wealth. But we’ve also seen that earning a lot of money isn’t a one way ticket to holding on to it.

Instead, saving and investing are going to be critical to welcoming you into the Wealthy Club.

Just take a look at some of the main findings of what is, I think, one of the best personal finance books of all time: The Millionaire Next Door.

After profiling almost 300 millionaires in the US, the authors found that most millionaires actually live in middle class, blue-collar neighborhoods, rather than the more affluent communities you’d expect to find them in.

In particular, the book finds that more millionaires achieved their seven-figure net worth by earning an average salary. This is largely based on the fact that high income professionals are often more likely to spend their money on luxury goods rather than saving and investing.

And it’s this very straightforward realization that can set out your own roadmap to wealth.

How to become wealthy

Becoming rich is simply about finding enough money to reach the threshold of what you consider “rich”. Becoming wealthy, however, involves a few more steps – and as you should have seen by now, the size of your paycheck really isn’t the main factor.

Instead, with some simple planning and careful management of your own money, there’s no reason why you can’t get there too.

1. Spend less than you earn

Living within your means sounds like an easy thing to do – but it’s easier said than done for many of us. In fact, it was found that almost two-in-five US employees live paycheck to paycheck.

Spending less than you earn, allowing you to save and invest what’s leftover, comes down to just two things:

- Spending less

- Earning more

…or, ideally, a combination of both!

This is why, for anyone planning to build their wealth (even if you’re aiming to get rich from nothing), your very first step should be to get your spending under control. By tracking your spending and seeing where your money is going, you’ll be much better placed to see where you may be spending more than you realize – and to start taking steps to address this.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

From there, you could try to combine this with earning more money, such as by starting a side hustle.

2. Start investing as soon as possible with as much as you can afford

Compound interest is really an amazing thing. With just a bit of time, that money you’ve carefully saved can quickly balloon to an amount that you never could have dreamed of having.

But the more time it has to work, the better off you’ll be. This is why if you’re not investing already, you should absolutely make it a priority to set aside some of your paycheck every month just for this, whether it’s to add to your 401(k) or by investing another way, such as in index funds.

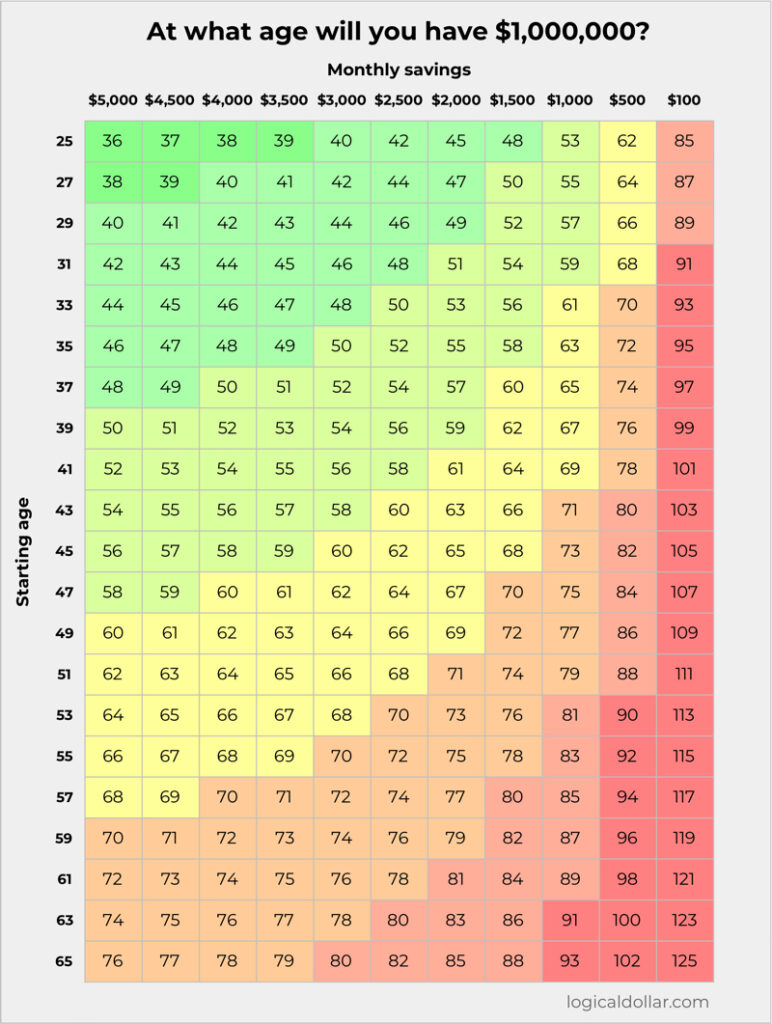

You can see just how critical this is to reaching financial freedom in the table below:

These figures are based on average annual returns of 8% (the historical returns of the stock market) and let you see just how big of an impact you can have on your net worth simply by starting earlier and investing more.

If the thought of starting to invest is a bit overwhelming or if you’re not sure how you’ll find enough money to do this, why not start simple with an app like Acorns? It automatically “rounds up” your purchases to the nearest dollar and invests the difference, meaning you’ll barely notice when this happens, allowing your investments to build in the background.

This makes it a great starting point for showing you just how possible it is to start investing, no matter your income.

Acorns

Ideal for beginner investors

Want to start investing but always think that you don’t have enough money left over each month? Then Acorns is for you.

It automatically rounds up and invests your spare change, making it a great choice for starting to save and build wealth – without even noticing!

3. Avoid high interest debt

High interest debt is a killer to anyone’s personal financial plan. That is, just like compound interest can make you very wealthy over time, it can also absolutely destroy your wealth when it works the other way on any debt you carry.

This ties very closely into the fact that you have to live within your means if you have any plans to build your wealth. If you start to spend more than you can afford and find yourself putting your expenses on your credit card or taking out something like a payday loan to cover your spending, it’s critical that you do everything you can to rein in your spending ASAP.

After all, the high amounts of interest that apply to these kinds of debts can quickly cause the amount you owe to grow to be well over the amount you initially borrowed. This means you’ll be paying double, if not much more, what you actually paid.

(Not to mention that it’s going to be pretty hard to get a good credit score or maintain an adequate liquid net worth if you spend like this.)

All this means that it’s going to be essentially impossible to build your wealth if what you owe is spiralling out of control like this. This is why avoiding high interest debt is going to be key if you’re looking for how to become wealthy.

Related: 10 Best Personal Finance Podcasts for Beginners

4. Have clear financial goals

Having clear financial goals links very closely to the importance of mindset when it comes to the distinction of rich vs wealthy.

By setting goals for your finances and making sure all your money-related decisions are made with those goals in mind, you’re putting yourself in the right mindset to build your wealth over time.

Ideally, your goals should be SMART, meaning they’re going to be Specific, Measurable, Achievable, Realistic and Timely. That way, you’re making sure that your objectives are actually feasible for you to reach.

You may also be interested in: Is Being Debt-Free the New Rich? (13 Pros and Cons)

An example of this is having the goal of “getting rid of your credit card debt”. While that’s definitely something great to aim for, a far better way to frame it is to think of it as “You want to pay off your entire credit card balance of $5,000 in one year”. That way, your goal is:

- Specific: You want to pay off your credit card debt in full.

- Measurable: You have $5,000 in credit card debt to pay off.

- Achievable: By only allowing yourself to get food delivered once every two weeks, taking your lunch to work and only going out for dinner once a month, you’ve calculated that you’ll free up just over $400 every month.

- Realistic: Based on the amount of debt and the timeline you’ve set, this goal is realistic to achieve.

- Timely: You’ve given yourself one year to pay this off.

What is considered being wealthy?

According to the Schwab Modern Wealth Survey, Americans believe you need to have $2 million to be considered wealthy.

(And as those same survey results also show, your net worth should be $655,000 to be “financially comfortable”.)

This means that, when it comes to the question of what is the definition of being wealthy, a high net worth is definitely part of it. However, it’s also important to consider the ability of those assets to continue to sustain themselves. That is, investing that money rather than, say, buying a fleet of fancy cars is going to go a lot further to helping you be (and stay) wealthy compared to “only” being rich.

Sure, if you ask why being rich is awesome, having access to those fancy cars could be your answer. But I’d argue that foregoing the cars and maintaining your high net worth going forward is an even better feeling. In fact, this is often the deciding factor between those considered as having new money vs old money.

Just ask Warren Buffet, who still lives in the house he bought in 1957 for $31,500 – despite now being worth over $85 billion.

This suggests that when it comes to the question of how to know you’re wealthy, a combination of your high net worth and your ability to sustain this over time are going to be the main factors.

Are millionaires considered rich?

While having a net worth of over $1 million is a good goal to have, you may no longer be considered rich if you reach this point. This is because the data now shows that to be in the top 1% of household net worth, you need to have $11,099,166.

In fact, as you can see in the Federal Reserve’s Survey of Consumer Finances, having $1 million wouldn’t even put you in the top 10% of households based on net worth – although you’d be close, given that just under 12% of all households in the US (or around 15.3 million households) are considered “millionaire households”.

Of course, this isn’t a bad problem to have. But it tracks with the fact that the survey we mentioned a bit earlier says that people tend to consider having $2 million as being wealthy.

What does this mean for you? Well, aiming for a net worth of $1 million would put you firmly in the range of “financially comfortable” which is absolutely nothing to sniff at. But having the ultimate goal of growing your wealth beyond that point could certainly be possible, especially when you see how many “millionaire households” are out there already.

After all: if they did it, why can’t you? This is especially when you consider that, as found in The Millionaire Next Door, around 80% to 85% of millionaires in the US are entirely self-made.

Does being rich make you happy?

Research has shown that your happiness increases alongside levels of income until your basic needs are met. This means that the benefits of being richer reduce once you start earning more. In other words, being rich doesn’t make you any happier compared to being middle class.

It’s often said that the magic figure is about $75,000. That is, once your income hits this amount, meaning that you’re probably able to live fairly comfortably, your happiness doesn’t continue to go up as much once you start earning more.

This is supported in the research, with the authors of this study suggesting that this is likely because any increase to your income beyond that point doesn’t have as big of an impact on your ability to live comfortably.

Put another way: increasing your income from $50,000 to $75,000 is probably going to have a huge impact on your day to day life compared to if you go from $75,000 to $100,000.

Related:

Is money important for happiness?

Don’t interpret this as saying that being rich will make you miserable. Just think of the saying: “Money can’t buy happiness, but I’ve never seen someone cry on a jet ski.”

There’s no question that being rich can make you much more comfortable. And there’s even been research into whether money can buy happiness – and, if so, how to do it.

According to the professors who wrote Happy Money: The Science of Happier Spending, when it comes to the question of how important is wealth when it comes to happiness, they found that it’s far more significant how you use that money. In particular:

- Buy experiences, rather than things – Their research shows that your happiness from material items is generally less than experiences.

- Make it a treat – Paying to do fun or “special” things all the time means you won’t enjoy them as much. Spacing out these kinds of purchases helps you appreciate them more.

- Buy free time – We all only have 24 hours in the day so spending money so you can use this time as effectively as possible can be one of the most valuable expenses you’ll incur. This could include paying someone to clean your house, iron your clothes or even to outsource the more mundane, admin-related tasks in your side hustle.

- Pay in advance – The book finds that paying for something now and then being able to anticipate your enjoyment of it – like booking a vacation several months before you leave – makes you much happier than having to pay-as-you-go or, worse, coming home to a massive bill.

- Use your money to help others – The research shows that you get a boost of happiness when you spend money on others. This could be anything from a big charitable donation to being generous with your tips.

Final thoughts on being rich vs wealthy

If all that isn’t clear enough in terms of the difference between rich and wealthy, quotes usually do the trick. While there are always the more inspirational financial planning quotes to help you out, there’s a slightly different one that should make this distinction very clear:

Wealth is empowering. Wealth can uplift communities from poverty. You can’t get rid of wealth.

Rich is something you can lose during a crazy summer with a drug habit. Rick James was rich.

Chris Rock

So take your pick as to whether you want to make decisions with your money that allow you to be empowering…or that lead you to lose your money during a crazy summer.

While one of these options are much more likely to let you park a bunch of amazing cars in your garage for at least some time, the memory of those cars in a few years when you can no longer afford them might not be quite as amazing.