Getting cashback at Walmart doesn’t involve you having to wait for coupons to land in your inbox. Instead, you can actually use a bunch of different apps to get Walmart cashback every single time you shop.

And as an added bonus, you can even double up on some of these options to get extra money back from your Walmart purchases.

Keep reading to find out just how you can do this!

How can you get cashback at Walmart?

1. Swagbucks

Swagbucks is one of the best apps for earning money for everyday activities, and this includes that the app pays you cashback at Walmart when you shop there – along with many other stores. That is, for each purchase you make, you’ll earn a percentage back of what you spend, whether that’s in store or online.

And this works at Swagbucks’ 300,000+ partner retailers, meaning there are plenty of opportunities here to get money back on your shopping. As a great starting point, you’ll get a free $5 welcome bonus just for signing up.

Your cashback comes when you redeem your earnings for gift certificates at places like Amazon, Starbucks, Walmart itself or even at PayPal, which is basically the same as getting straight up cash.

Swagbucks

Free sign-up bonus: $10

A great app for making extra money, including with cash back from online shopping, watching videos, playing games and more.

And given it’s paid out over $550 million through Amazon, Paypal and other gift cards, it’s 100% legit.

2. Survey Junkie

With Survey Junkie, you earn points for a bunch of things. It’s primarily for taking surveys but you can also earn money from sharing your online activity with them – and this includes shopping activity. To participate, simply download Survey Junkie and follow the prompts.

It’s worth keeping in mind that you don’t receive a percentage of Walmart cashback here. Instead, you’ll get credit for shopping at Walmart (and dozens of other stores) from Survey Junkie, with these points able to be converted to cash. This means you can easily combine this with one of the cashback apps to double up on your bonuses.

Sign up with Survey Junkie here to get started.

FYI: Another super easy way to make money based on your online activity is with Nielsen. You’ll get $50 just for downloading their app, with the aim being for them to anonymously track how you use your phone or computer.

(And don’t worry – it’s completely anonymous with no way for the data to be traced back to you.)

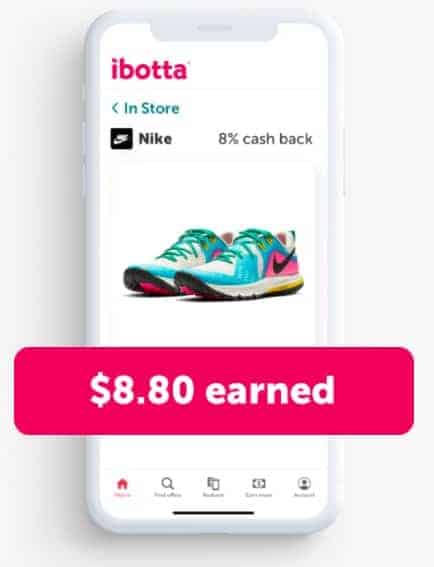

3. Ibotta

Ibotta is our pick for the best app around when it comes to cashback at Walmart – not to mention the (literally) thousands of other retailers that let you get money back for shopping there through Ibotta. This includes whether you shop online or in person.

And Ibotta is definitely a legit way to earn cash on your purchases. All you have to do is either download the Ibotta app or add the browser extension. From there, simply follow the prompts depending on how you plan to do your shopping.

Ibotta makes savings simpler and more straightforward, since you see your savings as cash rather than points you convert to cash like in other apps. And to get you started, you’ll receive a free $20 welcome bonus just for signing up.

Ibotta

Free sign-up bonus: $20

Ibotta’s a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

In fact, users make $150 per year on average – not including your free $20 welcome bonus – with over $682 million having been paid out, so you know Ibotta is definitely legit.

4. Rakuten

Rakuten provides three ways to earn cashback at Walmart: between 1% and 6% cash back on eligible purchases, grocery coupons, and a Walmart e-books program. You can even combine the coupons and cashback to earn more on each shopping trip.

Rakuten also lets you rack up the cashback at more than 2,000 retailers, so you can shop online to earn cash back at many locations. The percentage of returns does vary by store, with certain stores providing a flat amount per purchase. The best way to check this is to simply sign in to Rakuten and check the deals at the stores you plan to visit (either online or in person) to find the store that gives the most cash back.

And don’t forget that you’ll get $10 for free just for signing up!

5. MyPoints

With MyPoints, you’ve got two options to get cashback at Walmart. Sometimes, there are offers where you can get points per purchase at Walmart. However, the more common one is that you need to use the site’s coupons section to earn money back.

All you have to do is register with MyPoints and begin each shopping trip on the site. From there, just click a link to the retailer before shopping there to receive credit.

One point to note is that the site doesn’t yet use digital coupons. You activate a coupon on MyPoints, then print it to use it in-store.

FYI: You’ll get a free $10 Amazon gift card if you use MyPoints to make essentially any online purchase in the first 30 days after signing up!

6. Honey

Honey is a great way to automatically save money on any online purchase. It’s a browser extension that will notify you if there’s a better deal somewhere else on the internet for an item you’re looking at.

Simply install the Honey browser extension and wait for it to light up to let you know where you can save money. This includes alerting you to any coupons or a Walmart promo code, allowing you to save up to 2% at Walmart as well as plenty of other retailers.

7. Drop

Drop is an app that lets you earn points back when you make purchases at a huge range of retailers, including Uber, Expedia, Amazon and, yes, Walmart.

All you do is link your card to the app and it will automatically recognize when you make a purchase that’s eligible for points. You can then cash out these points for gift certificates that spend just like cash at places like Amazon, Netflix and Starbucks – and even at Walmart, meaning you can use the money you just earned back to fund your next Walmart purchase.

8. Capital One Reward Card

The Capital One Reward Card essentially acts as a Walmart cashback credit card, in that it gives you 5% on each Walmart purchase you make with it.

Simply apply for it in the same way as you would any credit card. Then, at the end of each month, the credit card company tallies the purchases you made and pays you a credit on your card of 1%.

Note: Make sure you pay your bill at or before the due date, as the fees you’ll accrue if you carry over a credit card balance will wipe out any Walmart cashback rewards you’ll earn.

You can use it anywhere to shop and you earn cashback at many other locations besides Walmart, so you can rack up the savings. Plus there’s no reason why you couldn’t use one of the other cashback apps to get even more advantages!

9. Dosh

Another great way to get Walmart cash back rewards is by downloading the Dosh app and linking your credit cards or debit cards to it. That way, it will automatically detect when you shop at one of its partner retailers, which includes when you shop at Walmart as well as other locations.

You earn money back which accrues in a Dosh account. When you hit a $25 deposit in your Dosh, you get to cash out to your PayPal or Venmo, making it a solid option for getting free PayPal money.

Dosh tries to simplify what other apps complicate. You have no points to tally. It keeps your card data safe since Braintree saves the data, not the app. Local businesses and hotels can sign up to offer cashback, too, so you can shop at far more than Walmart with this app and earn more money back.

10. Paribus

Paribus does the work for you once you link your accounts to it. It watches for price drops and offers you rebates on items you buy. This includes that the app handles contacting the store for the rebate or difference between your purchase price and the sale price.

With Paribus, you can quickly rack up cash which the retailer transfers back to your original form of payment. You don’t even have to cash out because the money goes directly back to you as a credit on your credit card or a deposit to your bank via your debit card.

11. Fetch

Receipt scanning programs like Fetch have become the latest entry into cashback programs. Given that many consumers still shop in-store, this makes it tougher for them to earn money back since they do not shop online. Fetch solves that problem by letting consumers photograph their in-store receipts with their cell phone and submit them via the Fetch app.

However, online shoppers don’t miss out. That is, when you install the Fetch app and link your email address, it also checks for online purchases. You can also do this by manually clicking the eReceipts button to gain credit for all purchases at specific retailers, including at Walmart.

In addition, you can earn extra points by purchasing specific products such as a brand of toilet paper or multiple issues of a specified magazine, meaning it’s basically like having coupons without all the effort of clipping them and remembering to bring them to the store. The app also offers periodic bonuses that let you amass extra points for regular shopping, plus your earnings can grow even more if you wait a bit longer before cashing them out.

12. Citi Double Cash Credit Card

The cashback credit card from Capital One isn’t the only game in town when it comes to getting Walmart cash back via credit card. That is, you can also get cashback using the Citi Double Cash Credit Card.

You’ll earn 1% cash back on every purchase when you make the transaction through your card. And when you pay off your credit card bill, you’ll earn another percent back for a total of 2% back on each purchase.

Of course, it pays you back on more than just Walmart, so you can rack up the savings. You also do need to qualify for the credit card – and don’t forget to pay off the balance each month to avoid interest accruing. Otherwise, this will essentially become a Walmart cash back fee, which isn’t necessary.

13. PayPal Business Debit Card

Never fear if you have no credit or bad credit, as you can also earn cashback on Walmart purchases using many debit cards.

This includes the business debit card from PayPal which pays you back 1% of your purchases each month. That said, you can also check with your bank or credit union to learn if they offer a cashback debit card if you’d rather not go with PayPal.

14. BeFrugal

A rebate program similar to the well-known Rakuten, BeFrugal, lets you simply log into the rebate program site, click the Walmart link, then make your purchases. At the end of each month, the rebate program tallies your savings and adds them to your account.

If you meet their payout minimums, you can request a payout. Here, you have a range of choices, with BeFrugal paying out via check, PayPal, direct deposit to your bank account, Venmo, Zeller, or a gift card. You can also use this rebate program in conjunction with your Walmart cashback credit or debit cards, which increases your earnings on your purchases.

15. QuickRewards

QuickRewards is similar to other sites and apps where you can earn money for doing certain tasks, including for your shopping. In fact, it’s one of the oldest sites offering these kinds of options, having been around since the early days of the internet in 2002.

But this means that it’s options are also similar to the others, in that it offers things like paid surveys for money to your PayPal and lets you get free gift cards online without completing offers. That is, just buy what you’d normally buy and accrue points in the app which can eventually be exchanged for gift cards.

And that includes that you can get cashback at Walmart with QuickRewards. It’s not the highest paying site on this list when it comes to those kinds of earnings, but it’s still an option, especially if you combine it with some of the other higher paying cash back apps.

How much cashback can you get from Walmart?

You can earn an unlimited amount of cashback on Walmart purchases given that you’re able to combine multiple cashback options. Realistically, by combining several options, whether it’s your cashback credit or debit card, rebate program, loyalty program or coupons, you could earn between 5% and 10% cashback at Walmart on your purchases.

This means that the $1,000 you spend each month at Walmart could become just $900 once you earn your cashback the following month. That’s some serious savings.

Can you get $50 cash back at Walmart?

You can certainly get $50 cash back at Walmart if you spend enough money and if you combine some of the cashback options. For example, if you spend $500 on a major purchase, using your cashback app, some coupons and your debit card could easily allow you to reach 10% back on your purchase, which would equate to $50.

Just keep in mind that you shouldn’t be making major purchases for the sole purpose of getting this much money back. Instead, see the cash back at Walmart option as an extra bonus on things you’d be buying anyway. That way, you’re not spending more than you otherwise would.

Can I get $10 cash back at Walmart?

You can easily get $10 cash back at Walmart by taking advantage of coupons or cashback apps that offer these kinds of returns. In particular, combining some of these options allows you to get up to 10% of your spending as cash back, meaning you would only have to spend $100 to receive $10 cash back.

In particular, keep an eye out for any bonus coupons that are only available for a short time on any of the Walmart cash back apps. These regularly offer higher percentages or more than $10 back off certain purchases.

Related: 23 Simple Ways to Make $10 an Hour Online

How does cashback work at Walmart?

Cashback works at Walmart by letting you use various options to earn money back on any purchases you make in store at Walmart or online through their website. You can rely on a cashback credit card, apps that offer percentages back on your spending or websites providing coupons where you can save money – or a combination to maximize your earnings.

Each of the programs discussed above has vastly different methods of getting Walmart cashback. Some will credit your account immediately, others credit it a week or more later.

Similarly, you must wait for a cash-out minimum in some programs, while others let you cash out as soon as you earn any money back. On the other hand, the credit cards and debit cards tally your savings for one month and then credit your account with that amount.

How do I get cashback from self-checkout at Walmart?

You can also use the self-checkout registers to earn cashback at Walmart. One way is to pay with your cashback credit or debit card. Alternatively, keep your receipt and use one of the apps that let you earn points when you take a photo of your receipt and upload it.

That is, there’s no real difference in how you can get this cash back compared to if you go to a cashier or shop online. The main point is to be able to prove you bought something at Walmart, no matter how you did that, to then be able to earn points for this. That’s why, to get Walmart cash back, save your receipt in this case.

What’s the most cashback you can get at Walmart?

The most cashback you can get at Walmart is going to depend on how much you buy from the retailer, given that cashback is generally a percentage of your spending. This means that, theoretically, the maximum amount is unlimited. However, it’s more likely to expect around $50 per month back if you combine some of the options.

Just make sure you’re consistently using your cashback debit or credit card and combining this with some of the apps that offer cashback or coupons for savings. And this isn’t something that you should limit to only your Walmart shopping, with plenty of other major retailers having similar benefits through these same apps.

As mentioned earlier though, the key is to not spend more money with the goal of getting more cash back. While, say, it’s fun to earn points in these apps, you’re going to come out with less money overall if you don’t follow that strategy, which isn’t really great for your overall finances. Instead, by only using these options on things you’d be buying anyway, you’re essentially able to get cash back for free!

Final thoughts on Walmart cashback

There are plenty of ways to warn Walmart cash back rewards, whether it’s using an app like Ibotta to get Walmart cash back or using a credit card or debit card to earn money on your purchases.

What’s great about these is that there are so many options, with the best one for you being largely dependent on your shopping habits. For example, do you prefer to stick to online shopping? Download the Honey app and set up Swagbucks and, with no extra effort, you can start to save money on your purchases.

On the other hand, do you like to go to stores more? Then you can simply link your bank card to one app and hold on to the receipt to claim back your earnings through another app.

And either way, check that you’re getting the best deal on your debit or credit card to ensure that you’re not ignoring some of the cash back options through them too.

It takes so little time to set up a system these days where you’re getting money back on almost everything you buy that there’s really no reason not to take advantage of these to save some extra cash.