When it comes to finding the best reloadable debit card for teenagers (or even younger kids!), the discussion often comes down to the products offered by two companies: FamZoo vs Greenlight.

Both of them ultimately have the same goal: to teach kids how to manage their money and to responsibly use a debit card.

And given the ongoing shift we’re seeing towards a cashless society, there’s no question that both of them are great for showing your kids that swiping a piece of plastic has actual financial implications.

But depending on what you – and your kids – need, the question of what’s the absolute best debit card for kids out of these two products will likely come down to a few key points, as you’ll see below.

You can also see our pick for which one is the best product at the end of this article – because, yes, we do have a favorite.

What is FamZoo?

FamZoo is essentially a virtual bank where you, the parents, act as the bank manager with your kids as the customers.

There are two products here: the IOU account and the prepaid card account. The prepaid card account allows kids to have a Mastercard to use how they want, with you controlling how much money goes on to the card.

The IOU account, on the other hand, is more like a digital way of recording the money that goes in and out of your child’s piggy bank, with no actual money being transferred to your kid.

For example, if your child wants to buy something, you can check in their account to see if they have enough money. If they do, you would then buy the item with your money and then deduct the amount from their account.

You can find out more in our FamZoo review here.

What is Greenlight?

Greenlight works similarly to FamZoo’s prepaid card account through offering a debit card for kids.

It works just like a normal Mastercard except that you, as the parent, have full oversight over how, when and where your child uses their card.

In addition, Greenlight also offers a way for kids to start investing their money. Kids are given all the information they need to decide where they want to invest – although you’ll have the final say.

See our Greenlight review for more on how this works.

FamZoo vs Greenlight – which one has the best debit card for kids?

From a broad review of both FamZoo and Greenlight, both cards are fairly similar, which isn’t really surprising given their shared objective.

In particular, they both have very similar features on offer and similar parental oversight aspects, so you really wouldn’t be making a bad decision in choosing to go with one over the other.

That said, there are some key differences that are worth highlighting to help you decide which is the best debit card for your kids.

When using a prepaid debit card, you can only spend up to the amount of money that’s on it. This means that your kids can’t spend more than you’ve provided. They also can’t incur any fees that are typical of credit cards, like late payment fees or interest charges.

FamZoo vs Greenlight features

Products

FamZoo offers both a prepaid debit card account or an IOU account. On the other hand, Greenlight only offers a prepaid debit card, as well as the option of having access to a kid-oriented investing platform

Automatic, recurring transfers

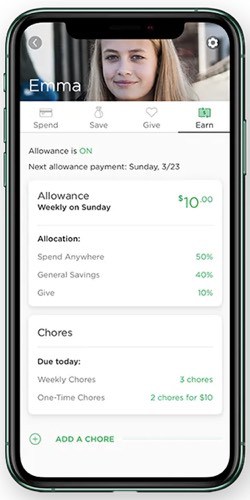

Both FamZoo and Greenlight have the option of allowing you to set up automatic, recurring transfers. This is particularly good if you don’t like the hassle of remembering to pay allowances, as both apps will do the work for you.

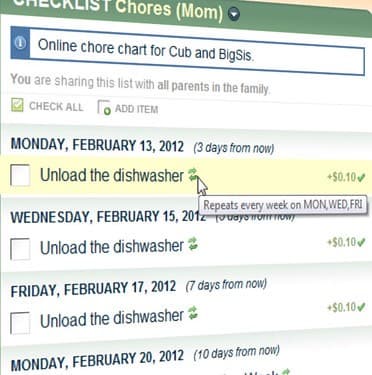

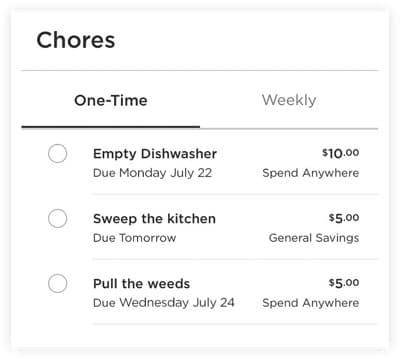

Chore management

Both FamZoo and Greenlight offer a chore management feature, which allows for payments to be made based on completed chores. In addition, FamZoo has an option where you can actually penalize kids for not doing certain chores.

Interest on savings

Both FamZoo and Greenlight allow parents to pay interest on savings, which is great for encouraging kids to save more (especially as you’ll probably set a higher percentage than any bank pays these days). It’s worth noting that, in both apps, any interest will only come from the parents.

Spending, saving and giving “buckets”

Both companies allow you to set percentages in terms of how much of your contributions you want to go into your child’s spending, saving and giving “buckets”. That way, they can only spend from the spending account and will only earn interest on their savings.

However, only FamZoo allows you to branch out further from this if you want. For example, instead of one savings account, you could have one for high interest savings and another as an emergency fund.

It’s also worth noting that only parents can shift funds from one account type to another.

Savings goals

Both companies offer trackable savings goals that kids can monitor and work towards.

Round-ups

Only Greenlight offers the option to “round up” your purchases to the nearest dollar, similar to what Acorns offers for adults.

How this works is if they, say, buy a drink for $1.25, the additional $0.75 will automatically be taken from their “spending” account and put into their savings.

Shared expenses

FamZoo offers the option for kids to be involved in paying for shared family expenses, which is then able to be automatically deducted from their account. For example, they may be expected to contribute to a family’s cell phone plan, helping to show them that these kinds of things aren’t free.

Loans

FamZoo also allows parents to loan money to kids – and to charge interest for this (at a rate that you set). This helps demonstrate to kids that spending more than they have costs more money in the end.

Investing

Greenlight has an extra feature (for an additional fee) where kids have access to its investing platform.

This provides them with information about the different companies in which they can invest, allowing them to choose where their money goes – although you’ll always have the final say.

Referral

You can earn money with both Greenlight and FamZoo when you refer someone to each app using your unique referral link. Greenlight will pay you $10 for this while FamZoo will pay you $15.

Fees

FamZoo offers a free two-month trial with its IOU account and a free one-month trial for its prepaid card account. After the trial, the fees are the same for each type of account but vary depending on whether you’re willing to pay in advance:

- $5.99 if you pay month-to-month, allowing you to cancel at any time

- $25.99 for six months, equal to $4.33 per month (a saving of 27%)

- $39.99 for 12 months, equal to $3.33 per month (a saving of 44%)

- $59.99 for 24 months, equal to $2.50 per month (a saving of 58%)

The fees cover a family of up to four kids, so you don’t pay per child. You can also choose to have some kids on one type of account and some on the other, at no extra cost.

Greenlight also offers a one-month free trial for its prepaid debit card. After that, the fees are as follows for up to five kids, with the option to cancel at any time:

- Greenlight’s standard plan: $4.99 per month

- Greenlight + Invest: $7.98 per month

- Greenlight Max: $9.98 per month

You can see the difference between each of these on Greenlight’s website.

When it comes to other aspects, the fees are as follows:

- ATM withdrawals are free for both Greenlight and FamZoo (although ATM providers may add their own charges)

- With Greenlight, the first card replacement is free and, after that, it costs $3.50 per card. For FamZoo, you get two free card replacements, with additional replacements after that costing $3 per card.

- Both FamZoo and Greenlight have no foreign transaction fees if you use the card overseas.

Parental oversight settings

Both FamZoo and Greenlight allow parents to see everything that their child does with their debit card, including when, where and how much they spend. This includes checking their account usage in each app and, if you prefer, receiving alerts when the account is used.

However, Greenlight also gives the option for parents to set store-specific spend controls and ATM withdrawal limits (or even preventing ATM withdrawals altogether). This means that if you don’t want your kids spending some or all of their money at certain retailers, you can put that restriction in place.

It’s also worth noting that these are in addition to Greenlight’s own built-in restrictions, which prevents the card from being used in places such as those offering wire transfers, adult entertainment, gambling and more. You also can’t get cash back on your Greenlight card.

FamZoo vs Greenlight apps and online platforms

This is one of the major aspects where the two companies differ.

That is, while you can do everything and access all of the features we’ve mentioned in both companies’ apps, the Greenlight app is simply a lot better.

It’s actually one of the only complaints you ever see about FamZoo, in that the online platform does take some time to figure out where things are. It also just doesn’t look quite as slick as Greenlight.

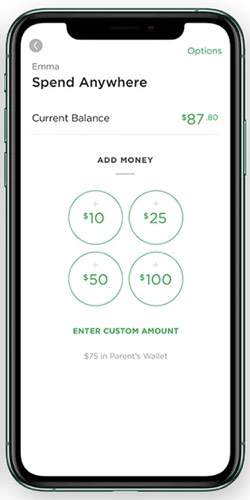

For example, you can see a few different screenshots below of the Parent’s Wallet in Greenlight’s app:

As you can see, it’s clean and clear with all of the information you need easily able to be found.

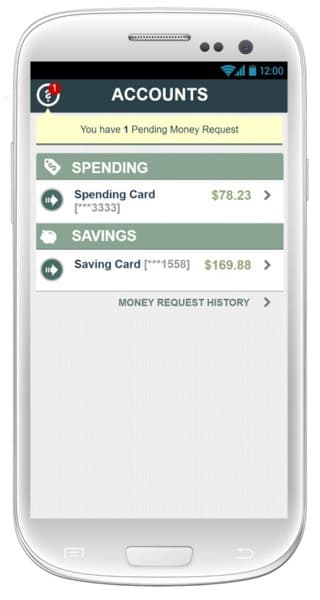

In comparison, here’s what you’ll see as a parent in FamZoo’s app:

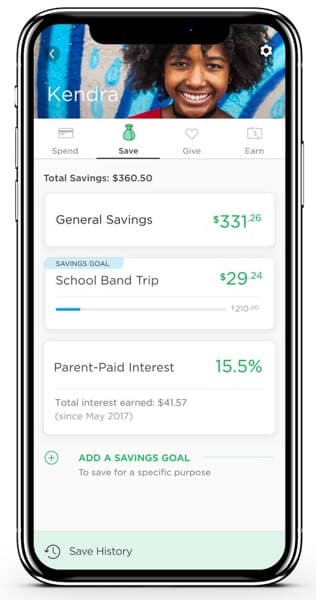

The same design carries over into what kids can see in each app.

In the case of Greenlight, if your child has their own device, they can download the Greenlight app to have access to the “kid view”. And don’t worry, if they don’t have their own phone or tablet yet, they can see the same thing on the app on your phone.

Here’s what it looks like for them:

Alternatively, here’s FamZoo’s app when child view is activated:

Reloading FamZoo and Greenlight cards

Both Greenlight and FamZoo have a wide range of options when it comes to reloading your kids’ cards. In both cases, it works with parents having their own “parent’s card’ which you put money on. Cash can then be pushed to your kids’ accounts from there, with the result that your kids can’t access more money than you provide them.

Direct deposits are free for both cards, with Greenlight offering instant transfers. FamZoo says theirs will take one to three business days.

Both also allow for one key exception to the rule that only parents can load their kids’ cards, in that you can set up direct deposits from your child’s employer or, in the case of FamZoo, with government agencies. There are limits in place for this, such as funds can only come from your child’s own employer, but it’s a good feature if you’re planning on using this card for teens with their first jobs.

You can also transfer cash from an online digital wallet, like Apple Pay. Again, this is free for both apps except for Venmo which will charge you for this.

There’s also the option with Famzoo to load cash on to your card at participating retailers, although this will cost up to $6 per transaction.

Security

Any funds on FamZoo and Greenlight cards are stored in a FDIC-insured account and cards can be locked at any time if they’re lost or stolen.

Keep in mind that Greenlight connects directly to your bank account, which is why they can do instant transfers to your kids, while FamZoo requires you to actually transfer the money to your parent’s card. That said, there are a number of strict security protocols in place to protect your banking information.

FamZoo vs Greenlight: Our pick

Greenlight is our choice for the best debit card for kids. The parental controls are excellent and highly customizable, the app is very easy to use both for kids and parents and the fact it has instant transfers makes it much more user friendly.

It’s true that FamZoo does have certain features that Greenlight lacks (although the opposite is true too), such as loans and shared expenses. This means that, for anyone looking to teach their kids about money without the use of a debit card, I have no hesitation in recommending FamZoo.

In fact, if you’re not sure if your child is old enough to manage a debit card yet, FamZoo’s IOU account is actually the better product.

(And you can sign up with FamZoo here to get a free two-month trial of the IOU account).

But if you’re trying to figure out what is the best reloadable debit card for teenagers, or even for younger kids who are ready to use a prepaid card, Greenlight is our pick.

That said, when getting started, I’d recommend sticking with Greenlight’s most basic plan at first. Not only is it cheaper at $4.99 per month, but it gives your child the chance to get comfortable with both the app and the overall concept of using a debit card.

You can then always introduce the investing option later if they want to give it a try.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.