Being on the same page financially is critical to any relationship. So it’s a great idea to use an app to help you and your partner have the same money mindset.

Different apps do different things, though. Which is why we’ve done the hard work and found the best budgeting app for couples – depending on what the couple actually needs.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

Whether you share finances or not, whether you’re trying to invest or pay off debt or simply split your expenses, one of these apps will have just what you’re looking for.

Which is the best budgeting app for couples?

- Personal Capital: Best overall. Simple to use with everything you need to manage your entire financial situation, including your budget.

- Goodbudget: Best for dealing with shared household expenses

- YNAB: Best for couples that want a budget app with all the details

- PocketGuard: Best for couples that want to keep things simple

- Mint: Best for couples that want an easy budget tracker

- Honeydue: Best for those that want a dedicated couples budgeting app

- Zeta: Silver medal

- Honeyfi: Best for couples that don’t want to make their own budget

- Twine: Best for couples with a shared financial goal

- Betterment: Best for couples that want to start investing

- Splitwise: Best for couples that don’t share accounts

- EveryDollar: Best for couples looking to get out of debt

- Mvelopes: Best for couples that budget with the envelope method

Best app for couples who like to see an overview of their entire financial position: Personal Capital

- Cost: Free

- Summary: A solid combination of budgeting and investing features, giving you a great overview of your overall financial position

Personal Capital is our clear pick for the best budgeting app for couples who really want to get their finances in order.

What’s great about it is that in addition to letting you work on your budgeting, it’s also really good for sorting out your entire financial situation. We particularly love it for how well it can help you with your investments, offering free, automatic analysis of your portfolio, including recommendations on the next steps you could take.

You simply connect all of your bank accounts and investing accounts to it and it will give you the information you need.

Personal Capital

Our pick: Best budgeting app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

You can even create hypothetical scenarios (such as buying a house or one of you stopping work for a while) and it will tell you how that will impact your financial position going forward.

While its budgeting aspects may not be quite as detailed as some of the other apps on this list, it has everything you need in terms of tracking purchases. Similarly, its recommendations about your investments – including letting you know if your fees may be too high – are excellent for setting up your shared financial future.

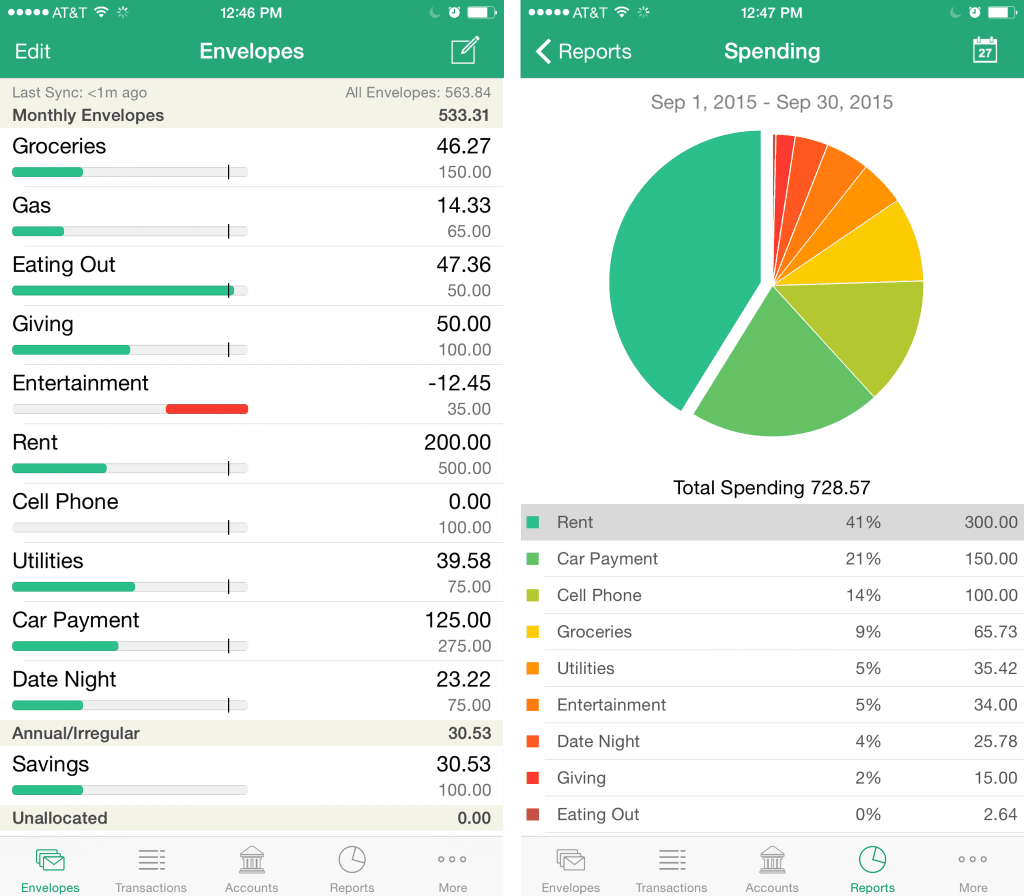

Best for dealing with shared household expenses: Goodbudget

- Cost: Free for a basic account and $6 per month or $50 annually for a Plus account

- Summary: For couples looking to make sure that they only spend a certain amount on different areas of their lives and who don’t need the automation of other budgeting apps

Goodbudget involves assigning different amounts to different spending categories – similar to the envelope budgeting method (although keep reading for another app which we think does this slightly better).

It works well for couples as you can have multiple devices (on either iPhone or Android, as well as desktops) logged into an account at once and will automatically sync across all of them. This means either of you can know immediately just how much you have left to spend on, say, groceries for the month.

You do have to manually enter transactions as it can’t extract that information from your bank accounts automatically.

That said, this can actually be a benefit for your budget as it will help make sure your spending remains under control.

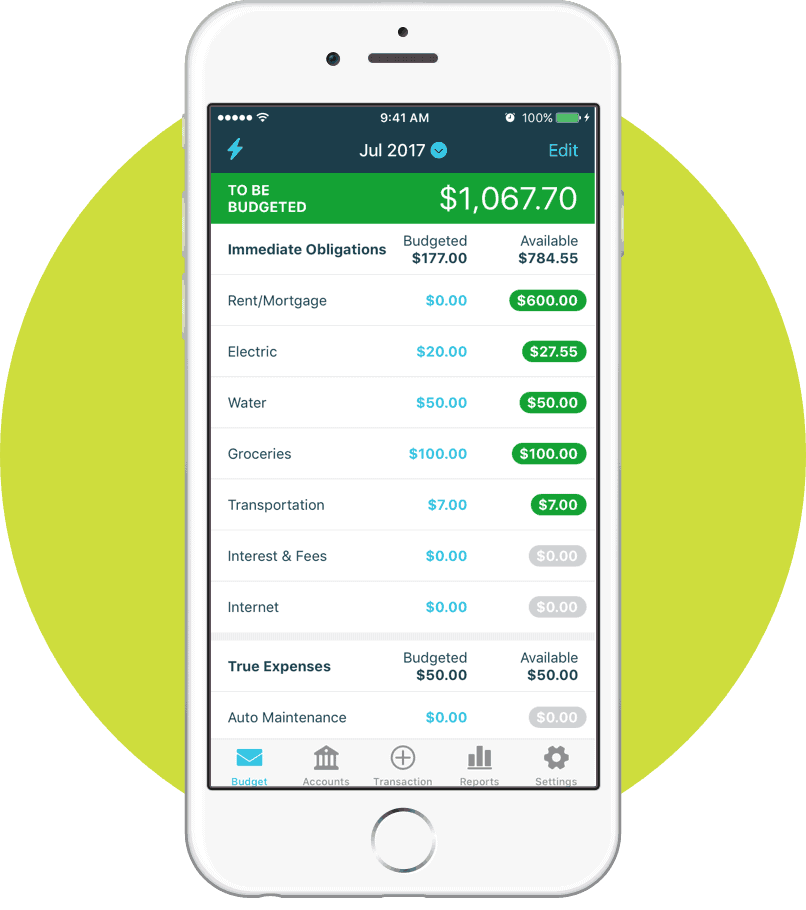

Best for couples that want a budget app with all the details: YNAB

- Cost: Trial period for 34 days. After that, it’s $11.99 per month of $84 annually.

- Summary: Has all the bells and whistles you could want in a budgeting app. There’s a reason YNAB is one of the best in the business.

YNAB (or You Need a Budget) works based on the concept of giving every dollar a job.

Whether it be paying off debt, adding to your savings or just your usual living expenses, YNAB will make sure that your money is put to its best use possible – and forces you to think what that best use just might be.

YNAB is one of the most popular budgeting apps out there for a reason, as it really has everything you could possibly need.

Manual and automatic entry of expenses? Check. Automated synchronization across desktop and mobile interfaces? Check. Goal tracking and ongoing analysis of your finances? Double check.

Connecting multiple bank accounts, customizing spending categories, free workshops and budgeting advice? Of course.

This is why, if you’re a couple looking for a budgeting app, you really can’t go wrong with YNAB.

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

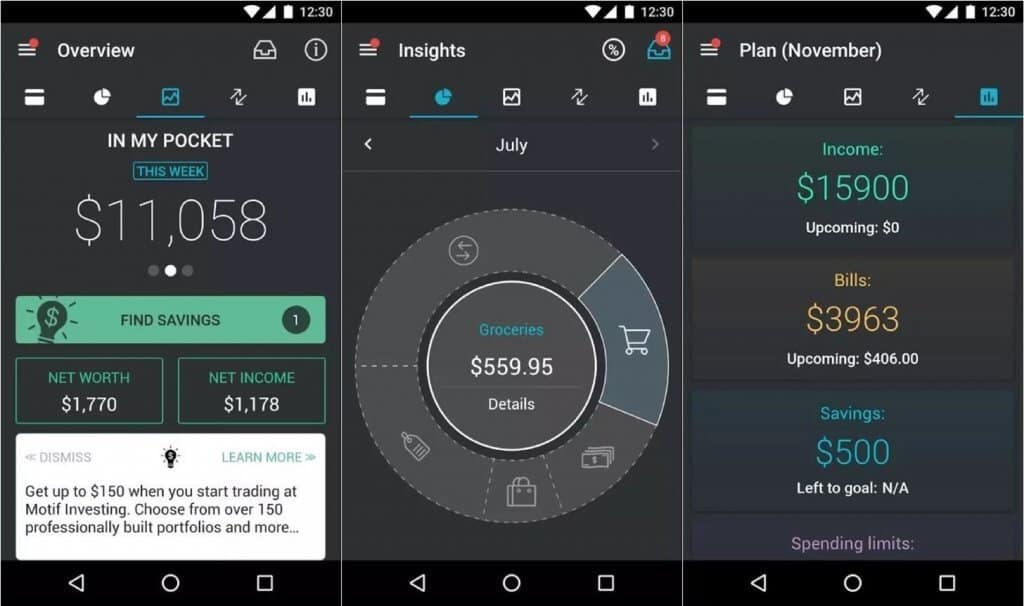

Best app for couples that want to keep things simple: PocketGuard

- Cost: Free

- Summary: A good way to get an at-a-glance overview of your spending at a moment’s notice

Having a bunch of things to play with in your budget is nice, but what most of us are concerned with is how much you’ve spent and how much is leftover.

PocketGuard is the best budgeting app for couples who want to do exactly that. By linking multiple accounts to it, it will show you exactly how much you have left to spend based on an up to date summary to what you both have spent, including contributions you’ve made towards any financial goals.

You can even break it down further into categories if you really want to see where your money’s going.

And as an added feature, the app will keep an eye on any recurring bills you have and will recommend any better deals it finds.

This makes it not only a great budgeting app for couples, but a great way to reduce your spending too.

Related: The Only Three Budget Categories You Need to Stick to Your Budget

Best for couples that want an easy budget tracker: Mint

- Cost: Free

- Summary: One of the oldest in the budgeting game, but for a reason – in terms of tracking transactions, it’s got everything you need

Mint is one of the best connected budgeting apps out there, with one of the biggest lists of banks, card issuers, lenders and other financial institutions that you can connect your account to.

Its budgeting tools are the best part of this app, with automatic categorization of expenses (including, if you want, splitting them into two categories if that makes more sense) while tracking these against budget limits you’ve set. You can even receive notifications when you go over budget.

One of my favorite features of Mint is the fact that it sends budget summaries every week or month, depending on what you choose.

For couples, this offers a great opportunity to discuss how you’ve been doing financially – and how you could perhaps improve.

Can couples use Mint?

Couples can definitely use Mint – with the one caveat that if you’ve already been using the app, you can’t merge two existing accounts.

The solutions are either to:

- Create a new account for both of you. The downside is that you’ll lose your financial history from the original account; or

- Use one of your existing accounts and share login details with your partner.

Assuming you use one of your existing email addresses for these options and not a new, shared address, Mint has a nifty feature where you can add a second email address to your account.

This means that both of you can receive the same email updates at the same time about your account activity, including the weekly/monthly updates.

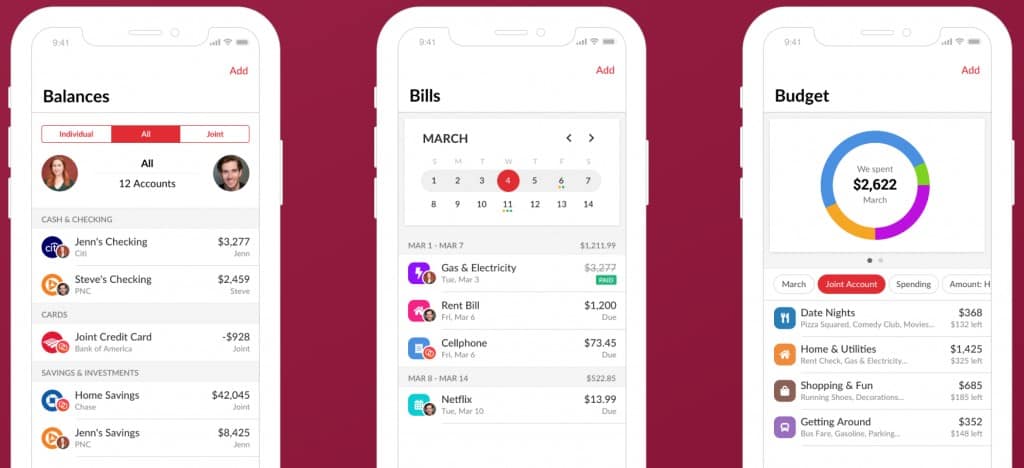

Best for those that want a dedicated couples budgeting app: Honeydue

- Cost: Free

- Summary: If you’re looking for the best budgeting app for couples, you can’t go wrong with an app made for that exact purpose

Honeydue is the perfect solution for couples that want to combine their financial management, but not necessarily their accounts – although it can absolutely handle a combination of joint and separate accounts too.

It automatically tracks and categorizes expenses from any account you add to it and also lets you add comments to transactions if there’s something you want to remember about it (or remind your partner of).

Honeydue is also great for managing bill payments. In addition to alerts about upcoming payments that are due, you can also tag bills as being paid. This will give you the assurance that someone’s taken care of it before a late fee comes rolling in.

Silver medal: Zeta

- Cost: Free

- Summary: Another solid option for helping you and your partner share the money management load

Zeta is built for couples who are budgeting together and has everything you could need to do this.

By syncing multiple accounts – either shared or joint – to the app, it will track both of your spending alongside any financial goals you set, which can either be shared or your own personal goals.

This makes it perfect if, say, one of you is carrying some debt you’re trying to get rid of without the other having to contribute.

The interface of Honeydue is just a little bit more slick, which is why we decided it edged out Zeta in this competition.

That said, given they’re both free, you could always try them both out and see which one clicks best for you.

Best app for couples who don’t want to make their own budget: Honeyfi

- Cost: After a 30-day free trial, you’ll pay $9.99 per month or $59.99 annually

- Summary: Can’t be bothered making your own budget or not sure where to start? There’s an app for that

Honeyfi is another app built specifically for couples. This means it does the same as many of them: syncs your spending from multiple accounts to show all your transactions in one place.

It’s also good for helping you to communicate effectively with your partner about both of your spending, by giving you the option to add comments or other notes to transactions so you both keep an eye on how things are going.

But the best feature offered by Honeyfi is that the app can analyze your spending habits. Based on what you’ve spent your money on and how much, it will then recommend a household budget for you.

Based on this budget (which you can edit if you want), the app will send you alerts to make sure you’re sticking to it – and will update the budget over time as you both start to work on your spending habits.

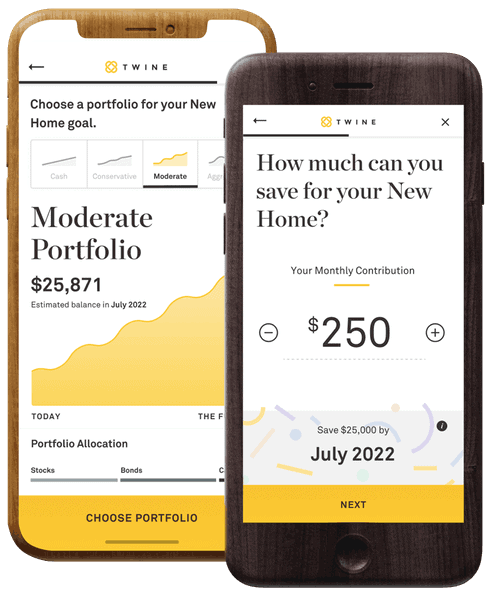

Best for couples with a shared financial goal: Twine

- Cost: Free for saving cash, 0.6% of the balance for investments

- Summary: Built specifically for couples to achieve shared financial goals by making sure you’re allocating money towards these every month

Whether you’re saving for a house deposit, a vacation or towards a longer-term goal like your retirement, Twine is the best budgeting app for couples looking to achieve their financial goals.

Offered by John Hancock, it essentially acts as a joint account which you can both transfer money into. That money is then held in a savings account, which is generally better for short-term goals when you don’t have time to recover if the market goes down.

Alternatively, you can choose to keep your money in one of Twine’s investment accounts. These are categorized as either conservative, moderate or aggressive, which you can select based on your risk tolerance.

Be careful here about fees, as while 0.6% doesn’t sound like much, you’d get much lower management fees by investing in a standard ETF.

That said, if you need a bit of a push to make sure you’re both actually allocating money towards your investments, using Twine and paying that bit extra for this service could be worth it for you – at least to get into the habit of investing.

Best app for couples that want to start investing: Betterment

- Cost: 0.25% annual fee with no minimum balance

- Summary: Offers high-level automated investment advice for couples that know they should be investing, but don’t really know where to start

Betterment is a robo-advisor that offers joint accounts so you can both start contributing to growing your wealth together.

You can also link outside accounts to your Betterment account to get an overall picture of your financial position, as well as set goals for both of you to work towards.

Like Twine, the fees are a bit steep compared to if you simply invested yourself in a low cost index fund. Betterment’s investing options are also automated in that it selects where your money is invested based on the strategy you select, which may be a negative for you if you’d like more control over your investments.

That said, its portfolio options are really good for those who don’t want to do the research themselves. In particular, for couples who want to start investing but don’t know how to do so, Betterment offers a way to get reliable advice on where to put your money.

It’s also helpful for making sure you both get into the habit of contributing some money each month towards your financial future, which could be more than worth the additional fee for you – at least until you’re comfortable doing it yourself.

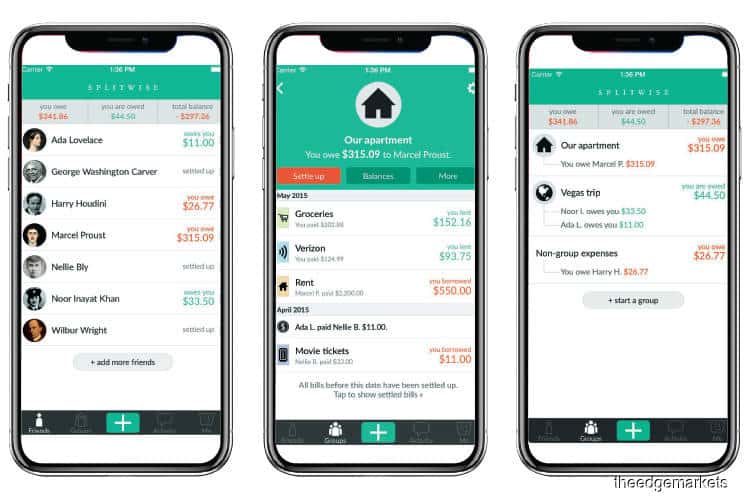

Best for couples that don’t share accounts: Splitwise

- Cost: Free

- Summary: A simple, effective option for splitting expenses, especially if you don’t want to share an account

Splitwise isn’t just for couples, but it’s easily the best budgeting app for couples that don’t want to combine their finances.

You simply enter each transaction, who paid for it and how much each person is responsible for the payment. This is great for those expenses that aren’t necessarily 50/50, such as if you pay for something that’s solely for your partner or you go shopping and you get one shirt but he buys three.

It then keeps a running tally of how much one of you needs to pay the other to square off your debt to each other.

It’s not automated, but this can be good for keeping a constant eye on how much you’re both spending.

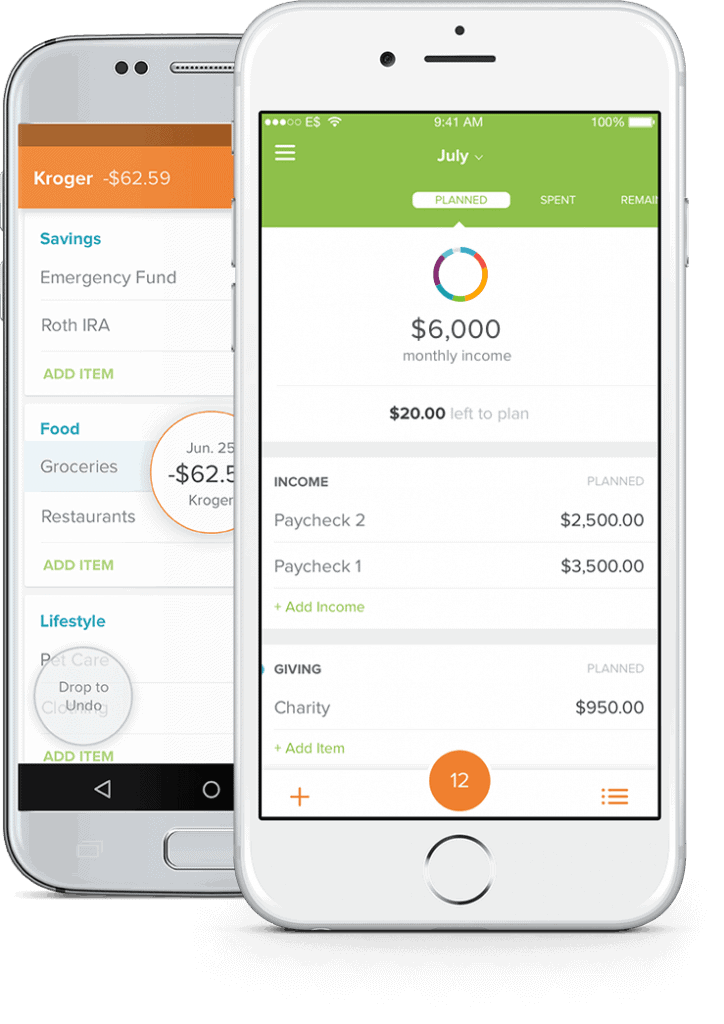

Best app for couples looking to get out of debt: EveryDollar

- Cost: Free or $129.99 per year for the Plus account

- Summary: Great for tracking your spending and making sure that you’re laser focused on paying off your debt

EveryDollar works to make sure every dollar is being put to its best use. It claims that you can make a budget in 10 minutes and, from there, the app will do all it can to help you stick to this budget.

Dave Ramsey is the brains behind this app, so it’s focused towards those who need to get rid of their debt by using the same strategy behind Dave’s Baby Steps. This means that it’s especially good for those who may end each month wondering just where all their money has gone.

The free version is pretty good if you’re happy to track your transactions against your budget manually.

While it’s true that the Plus version is a bit expensive, $129.99 is probably way more than you’re spending each year on interest on your debts.

This may mean that the fee could be worth it if you need some help in getting rid of your debt – and the (way more expensive) interest payments. And there’s also a free trial of this version if you want to try before you buy.

The paid version has all sorts of great extra features like letting you connect external accounts to track spending automatically. It also gives you access to Dave’s renowned Financial Peace University.

Best for couples that budget with the envelope method: Mvelopes

- Cost: $6 per month or $55 per year

- Summary: Does all you need for making sure that you’re only spending as much in each budget category as you can afford

The envelope budgeting method is another Dave Ramsey favorite. It involves assigning a set amount to each budget category for the month and when you’ve spent that much, you’re done.

Many of you may know this in the cash form – that is, you have one envelope for groceries, one for bills, one for savings and so on. You then put a set amount of cash in each one and that’s your spending limit.

But for those of us who prefer more digital ways of spending (not to mention the security of not having cash lying around the house), Mvelopes is the best budgeting app for couples looking to do exactly the same thing.

This is a super effective way of budgeting if you don’t trust yourself (or, ahem, your partner) to not overspend. And with the app automatically synchronizing with all your accounts, you’ll both be able to see how much you have left in each category in real time.

Related: The Household Budget Percentages You Should Be Using

What to consider when choosing the best budgeting app for your relationship

When choosing the best budgeting app for you and your partner, it’s best to consider what you both really need – and what’s most feasible for you to follow.

For example, if one or both of you are having problems controlling your spending, you might want to consider one of the apps that involve you entering transactions manually.

Alternatively, you may already know that you probably won’t have the time or willpower to do this. Meaning that one of the more automated options would be better for you.

Or maybe your spending is actually pretty good but you know you and your partner need to focus on some longer-term financial goals, like getting ready for retirement. In that case, one of the goal-based apps that help you invest could be more your style.

Most of the options on this list of best budgeting apps for couples are either free or have free trials. So try a few of them out to see which one you and your partner are most likely to continue to use.

(And if you or your partner really prefers using paper for your budgets, check out one of these amazing budget planners.)

Are budgeting apps safe?

All of the budgeting apps on this list have the highest levels of safety and security for your money and personal data. We wouldn’t recommend them otherwise.

That said, you should always do your own research to be sure. Things can change or apps can always be hacked, so it’s good for your own comfort and knowledge to confirm that there haven’t been any recent “incidents” that you should be aware of.

One other thing to check, for those budgeting apps that ask you to link your external accounts to them, is to make sure that the institutions that provide your accounts allow you to do this.

In most cases, this shouldn’t be a concern. But some banks do say that if you give your account details to another app to access, in the event of a breach which results in you losing funds, the bank won’t cover you.

So it’s worth checking the terms and conditions of your account or giving your provider a call, just to be sure.

Should couples share bank accounts?

Many people assume that couples, particularly those who are married, should share bank accounts. But this absolutely isn’t the case.

And not sharing accounts doesn’t mean that one partner has something to hide or that they don’t trust the other one.

Of course, it can be convenient to have at least one shared account. That way, you can both contribute agreed amounts to this for joint expenses or shared financial goals.

But if you prefer to keep your finances totally or partly separate, this can work too.

Some reasons are because one of you is still paying off some debt or because you simply want to deal with your individual expenses separately.

Trusting each other financially is one of the most important things in any relationship. And this trust doesn’t necessarily come from sharing bank accounts.

When should couples combine finances?

Couples should combine finances whenever they’re ready and want to do so – which may actually be never.

Alternatively, you may prefer to partially combine your finances, like in a joint savings or expenses account.

But the more important financial feature for any relationship is knowing where you both stand.

No financial surprises

One of the most toxic things for a relationship is financial surprises brought about by one partner hiding something or not being totally upfront.

If one of you is carrying debt, the other should know about it. You should also both know each other’s spending habits, to avoid things like hidden credit cards.

Similarly, before committing to someone long-term, it’s good to know about their financial goals. Do they want to retire early? Do they have a plan to buy a house by a certain age?

And how about kids? How many? Do they want to send them to private schools or pay for their college fees?

These are all some of the most important conversations you can have with your partner to ensure ongoing financial trust.

And keep having these conversations throughout the life of your relationship. Sure, they’re not always the most fun topics to discuss.

But they’re far more important for the viability of your relationship than simply combining finances.

Why should couples budget?

It’s important for anyone to budget, including couples.

After all, this helps to make sure that you’re using your money the best way possible for setting up your financial future.

Making good financial decisions now can be one of the most critical ways for you and your partner to be financially secure going forward.

A budget can be one of the best ways to guarantee that. This is why using one of the best budgeting apps for couples on this list could be a real game changer for you and your relationship.

(Alternatively, you could consider starting off with one of these free budget printables.)

Final thoughts

If you and your partner are talking about budgeting together, this is definitely a great step for your relationship.

And picking from one of these best budgeting apps for couples to do this could be the key to your financial success.

By making sure you’re both on the same page financially, you’re setting yourself up to avoid future economic stress by being prepared for any bad surprises.

You’re also hopefully contributing to goals that will make sure you’re financially secure in the years ahead and being transparent with one another in terms of your money management.

All of which are some of the best things you can possibly do for taking your relationship through whatever the coming years throw at you both.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.