Whether you’re looking forward to your next vacation, want to pump up your emergency savings account or have the (great!) goal of getting rid of your credit card debt, learning how to save $5,000 in 6 months for this purpose is definitely a good thing to do.

As a bonus, you’ll be happy to hear that it’s really not as difficult as you first think. After all, it comes out to just under $200 a week which, as you’ll see below, is more than doable.

And here’s a pro tip: you can even use these same tips to literally makeover your finances. I mean, why end at saving $5,000 in 6 months when you can save the same amount for the six months after that and the six months after that…

…until, before you know it, you’re well on the way to a solid, comfortable retirement.

Keep reading to find out how to easily hit this money goal – and even much more, if you stick with it!

How to save $5,000 in 6 months

1. Create a budget

Everyone knows budgeting money is super important – but often people don’t do it because they don’t know how! That’s why the key to living on a budget is to keep it really straightforward by following the 50/20/30 budgeting method.

This is a super simple, yet extremely effective way to do your budget, as it involves having the objective of dividing your money up as follows:

- 50% of your money should go towards your needs

- 20% of your money should be allocated to your goals

- 30% of your money can then be spent on wants

To put this into practice, the first step is to list all of your income sources (after tax). This could be your salary, any money earned from a side hustle, cash from a one-off sale or dividends paid out on an investment.

Then, sit down and write out all the items you absolutely must pay for each month, no matter what. This includes things like rent or mortgage repayments, the average cost of your utilities bills, transport costs, debt repayments like credit cards, how much you want to spend each month on food etc.

From there, you’ll be assigning each of your expenses to one of the three basic budget categories. Make sure you don’t confuse things that are “wants” with “needs” – so sorry to break the news to you, but your Netflix subscription is definitely a “want”.

And once you’ve done that, calculate the total amount of each category as a dollar amount (or whichever currency you’re using!) and then figure out your spending in each budget category as a percentage of your total income.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

At this point, you’ll be able to see if you’re spending too much in one category – meaning you’ll also be spending too little in another.

For example, if 40% of your income is going to wants but only 10% is going to goals, it’s time to assess where you can make cuts to your wants so that this money can be targeted towards your financial goals instead. And that includes budgeting another money to save $5,000 in 6 months (which equates to $833 per month).

You’ll have to continue assessing this on an ongoing basis, so that you can adjust your spending each month so that you stay within the limit of each budget category. But just the simple act of setting limits and continuing to monitor your spending is easily one of the most effective ways to save money to put you on the path to your $5,000 goal in the next six months.

Related: 12 Reasons Why You Should Save Money – Starting Today

2. Use cashback apps

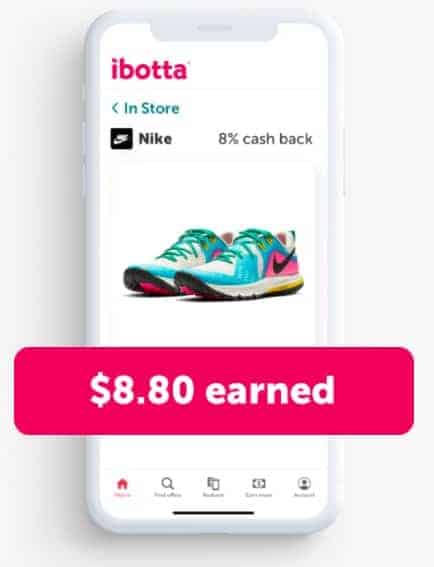

An easy way to save some money on your expenses is to make sure you’re using free cashback apps for everything you buy.

How they work is that when you shop at one of the stores in their network, they’ll give you back a percentage of what you buy, making it a super easy, automatic way to get a discount on literally everything.

My personal favorite for this is definitely Ibotta. It costs absolutely nothing and gives cash back at thousands of in-store and online retailers, including most major ones you probably already shop at. Plus you’ll get a free $20 sign up bonus just for downloading the app!

Ibotta

Free sign-up bonus: $20

Ibotta’s a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

In fact, users make $150 per year on average – not including your free $20 welcome bonus – with over $682 million having been paid out, so you know Ibotta is definitely legit.

3. Set up an automatic savings transfer

One of the easiest, most hands-off ways to save $5,000 in 6 months is to set up your accounts so that the savings are automatically transferred out each month.

That is, add an automatic transfer for $833 to be moved out of your daily account into your savings account the day after you get paid. This assumes that you’re paid on a monthly basis, so feel free to adjust this amount if, say, you’re paid biweekly.

Not only does this mean that you don’t have to remember to save this amount each pay cycle, but it also means that you won’t have a chance to touch that money for the month. That reduces the risk of getting to the end of the month and realizing you don’t have enough to meet your financial goal.

As the cherry on top, make sure your money is being transferred to a high interest savings account so it’s working as hard for you as possible. My top pick for this is easily CIT Bank, especially as it’s got high interest rates and no fees!

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

4. Start a side hustle or side hobby

When you’re looking to save money and live better, there are actually two ways to do it: reduce your expenses or increase your income (or, ideally, both!). While it’s great to cut your spending as much as possible, it can also really help to boost your earnings – especially if you commit to putting all that extra income straight into your savings account.

So to hit your goal of being able to save $5,000 in 6 months, consider starting a side hustle. It could be something online, like starting a blog, freelance writing or tutoring, or even in-person, like walking dogs, selling things you make or babysitting.

And as a bonus, starting a side hustle can definitely help you save a lot of money too.

Why? Because a lot of people typically spend money in the evenings/weekends eating out, going out with friends, or anything else that costs money.

When you take that time to “work” on your side hustle, you’re saving money you would otherwise be spending. While I’m not saying you have to completely cancel your social life (and there are definitely fun things to do with friends that don’t cost a cent), doing something on the side can be a really productive way to both make and save money.

5. Cut as many subscriptions as you can

Well, here’s one of the ways to live cheap and save money that you’ve heard time and time again, but it goes a really long way to saving you money every month, especially over the long term given that these are recurring expenses.

For instance, you may find yourself subscribing to a $50 gym membership, $10 magazine subscription, several online movie/TV streaming services, and other random things.

Do you use all these things to their fullest? No. Of course not. Does anyone? Perhaps a thing or two…. right?

So drastically cutting your expenses by reducing this to just, say, a $10 budget gym membership and Netflix can really help your bottom line every month.

This is why it’s a good idea to take a look at all your monthly recurring fees. Then find the items you can totally live without – and live without them! That way, you’ll only be keeping the subscriptions that give you tremendous value or truly fill a need you have.

FYI: Did you know that there’s an app called Trim that will do this automatically for you?

How it works is that it looks at where you are spending your money. Then, it will let you know if there is a service you are paying for that you are not using. It can even renegotiate or cancel your subscriptions for you if it finds better deals – saving you even more time compared to if you had to sit on hold with customer service for hours.

To see just how much money you can save on your bills (automatically!), get your free 14-day trial of Trim here.

You should also think about switching to lower cost subscriptions/alternatives if it’s a “must have”.

An easy way to do this is often with a gym membership. While those fancier gyms are cool, how often do you really use the LED sauna? Instead, you may find that while your “new” gym is smaller and has a budget feel, you’ll be saving a ton of money each month which is definitely a win overall.

6. Try the 100 envelope challenge

The 100 envelope challenge is a simple saving method where you take 100 envelopes and write the numbers 1 to 100 on them.

You then select an envelope at random every day and put an amount of cash in it equivalent to the number on the front of the envelope. After 100 days, you’ll have saved $5,050.

This is a great, really fun saving method where it feels like you’re only saving relatively small amounts but then come out the other side with more than $5,000. And for anyone looking to save $5,000 in 6 months, this can be the perfect saving challenge to achieve that goal.

You can also try to save $10k in 100 days with the envelope challenge.

How can I save $5000 in 6 months with 100 envelopes?

There are 182 days in six months so to save $5,000 in 6 months with 100 envelopes, you won’t put money in an envelope every day. Instead, given there are 26 weeks in 6 months, you’ll put money aside on four days per week, with the final week being a break.

That way, you’ll save $5,050 in 6 months with 100 envelopes – not just meeting but beating your target!

Here’s the full process for how you can save $5,000 in 6 months with 100 envelopes:

- Find 100 empty envelopes.

- Number each of them in order from 1 to 100.

- Shuffle the envelopes and put them in a safe place. Just a simple box or something similar will do the job.

- Each day, from Monday to Thursday, choose one envelope at random.

- Put the labeled dollar amount in the envelope.

- Set the envelope aside from the remaining empty envelopes.

- After 25 weeks, you will have filled all of the envelopes. This gives you the last week of the six-month period to celebrate!

7. Start a health kick

Want to save money and improve your health at the same time? A lot of people equate getting healthy with eating a lot of expensive organic foods and buying supplements – but that isn’t always the case at all.

The other side of getting healthy is about eliminating all the “bad” things you put your body through – many of which cost a lot over time. For example, it’s obvious that drinking more alcohol than you probably should and smoking can really add up financially over time.

But they’re also taxing on your health too, which can itself have long term financial implications. So why not take one month to start the process of working to eliminate all your bad health habits.

This can be a great way to save money, with a bunch of other benefits for your life too!

8. Review your insurance coverage

While it’s not always cheap to insure everything in your life, such as your home, car, contents and, if you have it, health insurance, these aren’t things you should cut when trying to save money given how much these policies can save you if something were to happen.

However, many of us find ourselves just paying for the policy when the renewal notice comes around each year. The insurance companies bank on you doing that too, as it costs them a lot more to attract a new customer than to retain an existing one.

Well, it’s time to not make it so easy on them. Put a reminder in your calendar when your next renewal cycle is coming around and start researching. Once you have some quotes from other insurance companies, call your existing one to see if they can beat it.

If they can, great! And if they can’t, switch.

This can save you literally thousands of dollars, putting you well on the path to being able to save $5,000 in 6 months.

9. Start cooking at home

This tip is exactly like it sounds. You cook at home for one month straight and you’re not allowed to eat out. You’ll also need to pack lunch every day too!

When I did this challenge, I got a lot better at cooking and especially meal planning (these frugal meal ideas should help you there). I also became a more conscious shopper and really made sure I started checking for deals.

Before trying this, I used to eat out for lunch daily while at work and would go out for dinners a few times a week. This alone was costing me roughly $150-$200 a week. Not cool.

If you’re someone who also eats out a lot, even if it’s just lunch at work, you’ll quickly see that putting some cheap food ideas into action is one of the ways to save literally hundreds of dollars a month.

10. Try a 30-day “cash only” challenge

Challenges can be a fun way to control your spending and one great example of this is the cash only challenge. How it works is that you’re not allowed to use any debit or credit cards for an entire month. All your spending will be physical bills only.

This challenge is incredibly powerful because you’ll physically be pulling money out of your bank account, exchanging it when you buy things, and digging into your wallet when you need cash.

The psychology behind this is great for helping you to save. After all, when you physically pull money out of your wallet to spend it, your mindset is different from when you just use a piece of plastic.

And then when you actually hand your hard earned money over, or even just think about doing so, you’ll likely begin to get real conscious about spending that money.

You may even find that you put back more shopping items you pick up! For me, personally, I definitely think more carefully about how much I actually need the item.

It’s a huge win overall!

11. Do a no-spend month

A “no spend” month is truly the money challenge of all challenges, as it involves you spending a total of zero dollars on anything unessential.

During a no-spend challenge, you’ll only spend money on essential items to survive, such as food, clothing (but only what you actually need, not that awesome shirt you saw the other day), and shelter. Anything else is “extra”.

You’ll also want to keep your spending on the frugal side when covering your basic needs.

Remember, the goal is to save money. And if you’re looking for ways to save $5,000 in 6 months, what better way to do so than to (almost) stop spending altogether!

This is a challenge that you obviously can’t do long term as you may need, say, clothes at one point. But it’s great for one month or perhaps even a few times a year.

Yes, it may seem very restrictive (because it is!) however just remember that it’s a short term challenge to save money. You can go back to your usual ways after the challenge is over – with better spending habits hopefully!

And if you’re not sure how to spend your time if you’re not spending money, check out this article on 50 free things to do this weekend as a starting point!

Can I save $5,000 in 6 months?

Yes, you can definitely save $5,000 in 6 months. This is equivalent to saving $833 per month or $192 per week. You can do this by either reducing your expenses or increasing your income by that amount – or even doing both.

In fact, breaking it down like this can make it a much more manageable goal. Hearing you have to save $5,000 sounds like a huge amount of money, but if you hear that you need to find less than $200 each week, the goal posts are suddenly a lot closer.

The best way to tackle this is to set concrete targets, track your progress regularly and readjust as needed. That way, if you spend a bit too much one week, you’ll be able to quickly reassess your spending (or earning) and go from there to make sure that the rest of the six month period is a huge financial success.