It’s no secret that maximizing your savings is a major part of getting your finances under control. But we’re all constantly short on time, meaning that any way that you can find to automate these savings can be a life saver. And as you’ll see from this Truebill review, we may have just the app to help you do this.

In particular, there’s a reason that wealthy people with multiple sources of huge incomes often hire people to help them with this. But even if you don’t have the cash to hire financial help, there are now some great apps that basically do the same thing.

Enter: Truebill. Its goal is to help you to better manage your bill payments and to help you save money on subscriptions you’re no longer using. It can even automatically renegotiate your recurring bills.

So are you the kind of person who keeps forgetting to cancel that charge on your account for a bill you knew nothing about? Or is there a chance you’ve overlooked that hidden subscription you’ve been paying for unknowingly for months?

Well, by embracing automated tools like those offered by apps like Truebill, you can easily reduce your monthly bill payments and boost your savings. In fact, they claim an 85% success rate at negotiating bills.

Keep reading to find out more about this from our Truebill review – including whether there may be some alternatives that actually suit you better.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

What is Truebill?

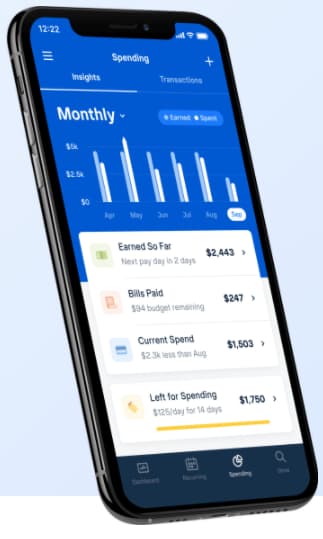

Truebill is an app that aims to help you to lower your bills. By finding unwanted subscriptions and assisting you in renegotiating or even canceling them, as well as providing you with expenditure data, Truebill can help you to save money on these recurring expenses.

It also provides a dashboard where you can consistently keep an eye on your expenditure data, including details about which bills are due and which ones are coming up, to help you stay on top of your bills and avoid late fees or overdrafts.

This means that the Truebill app is going to be great for people who are too busy to monitor each of their recurring bills, especially if you’re someone who prefers auto-renewing subscriptions.

After all, these can be very convenient – but they’re also the bills that you’re most likely to forget about over time.

What kind of Truebill savings do you get?

With Truebill, you will be able to manage your subscriptions, monitor your outages to get money back for these, seek refunds on fees and lower your bills.

This means that its features can really help anyone who knows they should be saving more but struggles to find the time to manually go through their expenses and identify any problem areas. Instead, the Truebill app can do it for you.

Let’s delve into some of the Truebill savings you can get.

Related: 10 Easy No-Spend Challenge Ideas to Save Money

Monitoring recurring bills and subscriptions

Truebill’s main goal is to help you to save money on recurring bills, which includes those subscriptions which may seem small when they’re charged each month but can really add up. These are probably the same subscriptions that you promise yourself you’ll cancel next month…and then forget to do before the next charge comes in.

This means that the first step that the system will take is to find out whether you have any automated bill payments scheduled.

The moment it identifies any recurring charges, it will flag this to you so you can decide whether you want to continue paying for the service or not. If you do want to cancel any recognized service, you can simply let Truebill know by selecting this option on the app.

Truebill will then do a follow-up with the service provider and cancel the subscription for you. For anyone who’s ever spent time on hold for hours, you’ll know just how much frustration this can avoid, not to mention the actual money saved.

Negotiating bills to lower their prices

Another feature that Truebill offers is that it can renegotiate bills on your behalf, either when it notices that your monthly fee has gone up or when it identifies a better deal has become available.

This is another one of those things that many of us know we should do, but the time and effort it takes is a massive deterrent. So Truebill can simply do it for you!

Take a look at the Truebill website for the dozens of companies that it’s able to do this with.

Monitors outages and seeks refunds on your behalf

If you are paying for services, you ought to receive refunds whenever there is an outage. However, many providers do not automatically refund by way of compensation for the outages, especially those that may go unnoticed.

However, Truebill can track your outages on things like phone services, cable and internet and will seek out any potential refunds on your behalf.

Gets refunds on bank fees

Truebill can also help you to get refunds for connected bank accounts on any late fees or overdrafts you’ve been charged.

This process can be initiated through the Truebill dashboard after you’ve successfully set up your accounts. Just note that not all banks allow Truebill to do this on your behalf so it’s worth double checking with them if you’d like to take advantage of this feature.

Related: How to Live Cheap: 54 Frugal Living Tips to Save You Money

Offers savings on utility bills and car insurance

In areas with deregulated electric power, there’s always room for fluctuating prices. Truebill takes advantage of these opportunities to help you get a lower price per kW on your utility bills.

Similarly, simply by connecting your car insurance to the Truebill system, it will show you some other (cheaper) options you may want to consider

Helps you achieve your savings goals

Truebill comes with a smart saving feature that helps you even more to stick to your budget and increase your savings rate.

How it works is that it tracks your spending in different budget categories. You can also save some of your available funds in an automated monthly schedule to help you achieve your savings

While this is a great feature and really reinforces Truebill’s main goal of helping you to save, I probably wouldn’t sign up specifically with Truebill just for this. Instead, if you’re looking for the ideal savings app that automatically tracks everything for you AND that’s free, I’d recommend taking a look at Personal Capital.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

How does the Truebill app work?

As mentioned, Truebill works to automatically help you to lower your monthly bill payments, including by identifying those you’re no longer using, helping you to cancel them and even allowing them to be renegotiated.

To get started, you’ll have to sign up for the app itself and connect some other accounts to this so Truebill can review these and work its magic. Fortunately, the process is very straightforward.

1. Download the Truebill app

The first step will be to download the Truebill app, which is free in the Apple Play and Google Play stores.

You can download the iOS app and the Android app here.

2. Truebill sign up and sign in

Once you have downloaded the app, you’ll need to create an account.

This is as simple as providing your name, email address, and preferred password. Pick a secure one, as these are the credentials you’ll use going forward in the Truebill sign in process.

You will then need to take a few minutes to connect your credit cards and bank accounts. Don’t worry, as we’ll go into more detail about below, Truebill is safe when it comes to looking after these kinds of things.

3. Search for your bill providers

One of the first things that Truebill does after signing in is to prompt you to connect your monthly bills to their platform.

There’s actually a surprisingly comprehensive list of service providers. This includes more mainstream companies like DirecTV, Comcast, Charter, and AT&T, as well as many that are much more obscure.

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

4. Upload and connect your billing statements to Truebill’s database

There are two ways of doing this. That is, you can either manually upload an image or PDF of the bill or directly log into your billing account via the Truebill platform.

(And while it’s fair if you find this step to be a bit nerve wracking in regards to online security, we’ll discuss a bit further below the security measures that are in place.)

5. Provide the required details to enable TrueProtect

Opting in for Truebill’s TrueProtect program allows it to automatically renegotiate your bills whenever a new deal on one of them appears or when the price increases. It involves entering your contact number.

It’s worth noting that while TrueProtect provides great convenience, keep in mind that there are Truebill reviews out there which note that this program actually involved the platform changing their cable subscriptions and cell phone details for the sake of saving money.

This might be problematic, especially if they cancel channels or features you need or want. You’d also still be charged the fee involved in this given that, technically speaking, Truebill would have saved you money. This means that it’s worth keeping your eye on this if you do opt into the TrueProtect program.

Related: 12 Reasons Why You Should Save Money – Starting Today

6. Authorize Truebill to charge your credit card

Before any negotiations are done, Truebill has to – understandably – ensure they have a way to claim their fee from you, which is only charged after they’re successful in lowering your bill.

This is why, at this point of the Truebill sign in process, you’ll be shown a screen asking you for your credit card details.

Does Truebill really work?

Truebill really works at its goal of helping people to save money on their bills and other recurring subscriptions. While its fees are relatively steep, it claims an 85% success rate at negotiating bills and it certainly has a number of features that can continue to reduce its users’ ongoing expenses.

This is emphasized by the hundreds of positive Truebill reviews online. This includes the fact that it has a score of 4.3 out of 5 on Trustpilot.

This perhaps isn’t surprising, as the app has a lot of solid features that can make you a better financial manager. Specifically, if you’re a fan of automatic billing and you occasionally incur unwanted expenses, then Truebill will work perfectly for you.

And even if you have a keen eye and excellent money-saving skills, Truebill may come in handy in detecting those one-time unexpected and unintended payments.

What is the cost of Truebill?

There is a free version of the Truebill app but, for the full Premium level of membership, users can choose their prices within the range of $3 to $12 a month or an annual cost of anywhere between $36 and $48. There is also an additional cost of 40% of the amount that Truebill saves you annually.

That 40% fee is the main thing that may cause you to think twice about signing up for Truebill and is also the main reason for some negative comments about this in most Truebill reviews – understandably, as it’s pretty steep.

While it does still mean that you’ll be keeping 60% of what you saved, which is great, having to hand over 40% of your own savings may mean that you’d prefer to do this yourself.

Is the Truebill app free?

The Truebill app is free to download and you can continue to use it for free after this. However, the amount of features to which you will have access will be limited and you will also see advertisements while using the app.

This means that if you would like to enjoy all the Truebill app features (including no advertisements), you’ll have to upgrade to the Premium version.

Looking for other freebies? How about:

- 16 Companies That Will Send You Products to Review For Free

- 43 Simple Ways to Get Free Books Mailed to Your Home

- 17 Easy Ways to Get Furniture for Free

- 12 Simple Ways To Get Free Shoes Sent To Your Door

Is Truebill Premium worth it?

Truebill Premium comes with a range of advanced features that may be worth paying for if you’re someone who enjoys relying on recurring subscriptions but doesn’t have the time to continually monitor these. In particular, Truebill Cancellations Concierge is one Premium-level service worth the upgrade.

Some of the services that come with your Premium subscription include Premium Chat, Cancellations Concierge, Syncing your balance, Smart Savings, Unlimited Budgets, Custom Categories, among others.

Keep in mind that you can upgrade to the Premium service for a limited time and take advantage of its features before reverting to the free service after a few months.

Find out more here about what Truebill Premium offers you.

Is the Truebill app safe?

The Truebill app is safe and has a number of measures in place to ensure that your information and your money is kept secure. For example, your bank data is encrypted and the software it uses to connect your Truebill dashboard with financial institutions means that Truebill itself will not receive your banking credentials.

In addition to this, Truebill has a strict policy against selling your personal data to third parties.

It’s also worth noting that none of the Truebill reviews I found made any mention of data being misused or otherwise breached. This indicates that you can be confident that your information will be safe.

Is Truebill FDIC insured?

Truebill’s Smart Savings accounts are held in a FDIC insured US-based bank account. For the purposes of security, any deposit made to the Smart Savings account can only be withdrawn through the same checking account that it came in from.

FDIC insures funds up to the maximum amount allowed by the law which, at the moment, is up to $250,000 per account owner.

Is the Truebill app legit?

From the many positive reviews as well as the security measures it has in place, Truebill is definitely legitimate. Many users have reported significant success with the app, with a lot of them noting that it’s better than other financial apps they have used before. There are, however, some complaints, primarily related to its fees.

That is, it’s clear that Truebill can definitely help you to save money. The company claims to have saved customers millions of dollars to date and when we look at the features on offer, you can see why. In addition, Truebill has an average rating of 4.3 out of 5 on Trustpilot, which is pretty impressive.

The various encryption methods and other forms of protection are also a good indication that the Truebill app is legit. This is certainly reassuring given the nature of information you’ll be providing to them.

Like any service, there are some complaints mainly in relation to the 40% fee on any savings. This doesn’t mean that the app isn’t legit, but it does mean that it’s worthwhile for you to undertake your own Truebill review to see if the fee is worth it for you.

Truebill alternatives

There are several other promising alternatives to keep track of your subscriptions and negotiate lower prices for your daily bills, with the main ones being below.

Trim vs Truebill

Trim and Truebill are both financial apps that help you save by examining your bills and recommending ways to cut costs. Both apps work similarly in terms of cancelling or renegotiating your bills, with the main difference relating to the fees charged. That is, Truebill charges 40% of your savings while Trim only charges 33%.

In addition, Trim doesn’t charge anything to review your subscriptions for potential cancellation, although actually cancelling subscriptions is only possible in its Premium version.

Truebill, on the other hand, only includes this in their paid Premium service.

When it comes to their Premium service, Truebill is actually cheaper as Trim’s costs $99 per year. However, you can get a free 14-day Trim trial here to see if Trim is for you.

Is Mint or Truebill better?

Mint is primarily for those who want to manage all of their money in one place. Truebill, however, is focused on helping you to save money on your bills and other similar expenses. As such, one isn’t necessarily better than the other as they serve different purposes.

That is, when it comes to the question of Truebill vs Mint, the latter is great for your typical financial needs like budgeting and having saving goals.

At the same time, Truebill can help you go the extra mile with your savings by helping you lower your bills and save money by cutting those expenses.

There is some overlap between the two and, in those cases, Mint is better largely because it doesn’t charge for them. This includes things like checking factors that affect your credit score or taking advantage of the automated expense tracking.

Pros and cons of Truebill

Pros

Cons

Thoughts based on our Truebill review

In a nutshell, Truebill is a great money-saving app that comes with some solid features to help you reduce your spending. In particular

- Ease-of-Use: 4 out of 5 – The app has a user-friendly interface that is easy to navigate through without wasting time. In terms of ease of use, the app can be rated 4 out of 5.

- Features: 4 out of 5 – Truebill has advanced features for both the free and Premium versions, although the limitations in the free version can be a bit frustrating.

- Customer Service: 3 out of 5 – Truebill customer service representatives are always available to respond to your questions from Monday to Friday, 9 AM to 5 PM ET. This, however, can inconvenience customers who might need assistance over the weekend or during the late hours of the night.

- Value for Money 4 out of 5 – The Truebill app is great for people who don’t have the time (or simply the energy) to monitor things like their recurring payments or even service outages. If you’ve found yourself thinking that you know you should double check these sorts of expenses but just haven’t gotten around to it, Truebill is worth a second look for you. That said, that 40% fee on any savings really stings, so it will simply come down to whether getting 60% of savings is better than zero OR if you think you’ll actually get around to checking these recurring subscriptions yourself…one of these days.

FAQs on our Truebill review

Can Truebill lower bills?

Truebill can lower your bills through the negotiation of the rates being charged. Truebill mostly negotiates lower rates for telecom services like cell service providers, internet and cable. It does this by identifying when there are new offers available or when it notices that your monthly rate has increased.

It also lowers your bills when it arranges for them to be cancelled – which is basically as low as they can go!

How often does Truebill sync?

Truebill syncs and updates your account balances every 24 hours automatically. In addition, Premium members can load real time balances by using the sync button on the dashboard. It takes about two minutes for Truebill to check all of your accounts and provide the relevant, up to date information.

When you select the option to sync your accounts, Truebill will get information on the status of all your current bills loaded in their system, including whether these can currently be renegotiated for lower rates.

Does Truebill work with the Cash App?

Financial apps like Digit, Venmo, and the Cash App are not currently supported by Plaid, the secure third party application that Truebill uses to connect with users’ bank accounts.You can find the full list of bank accounts that connect with Truebill on its website.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.