When you realize you’re losing control of your spending, a no spend challenge could be just what you need to hit the reset button.

Whether it’s a no-spend month challenge or even just for a week, forcing yourself to stop all non-essential spending for that period can be a great solution to save some money. Even better, it can also help you to step back and see what the real problem is.

After all, with that random purchase here and a bit of online shopping there, it shouldn’t really be a surprise when your budget gets completely busted.

And this is why implementing a one-month spending freeze can be a good strategy for showing you that, yes, you really can survive without all those extra expenses.

That said, it can definitely be hard to stick with a no-spend challenge for the entire time. This is why we’ve got a few ideas to show you just how you can easily stop spending money for 30 days.

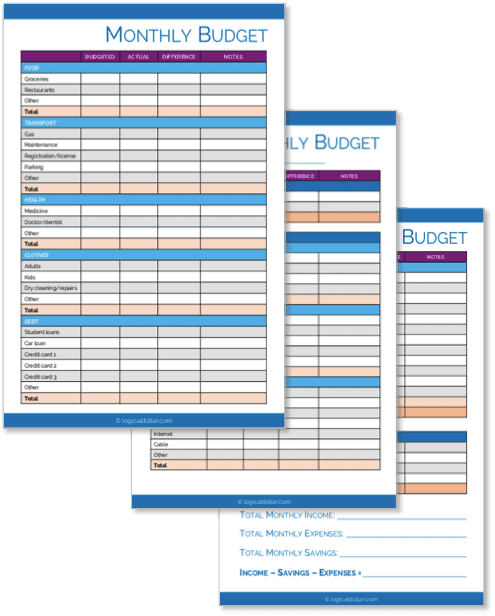

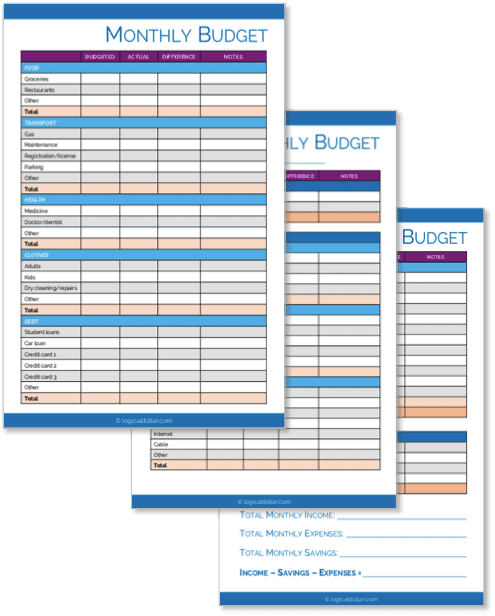

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

What is a no spend challenge?

A no-spend challenge involves trying not to spend anything for a certain period of time, usually a week or even a month. This generally involves still spending money on necessities or items that have already been included in your budget, but the goal is to avoid all extra spending.

Doing a no spend challenge month or even just for a week can be a great way to bring your spending under control.

For anyone who’s ever been in the position where you get to the end of the month and have no idea where your money has gone, this can be like pulling an emergency brake by resetting your spending back to zero.

This can also be really effective at helping you see where you can make ongoing cuts, even when the no-spend challenge month (or week or even a weekend) is over. You’ll start to see that you really can survive without buying X, Y and Z, meaning you can – ideally – continue to avoid buying those same things going forward.

This means that a no-spend challenge can be a great strategy for helping you to save money in the long term, not just during the challenge itself.

Free no spend challenge printable tracker

We’ll go through some tips and tricks to help you survive no-spending months in a moment, but one way to really help you get through this is with a no spend challenge printable.

You can grab our no-spend month tracker for free at the link below. This printable will help you not only track your progress throughout the month, but it also gives you the chance to take note of any exceptions or reminders.

For example, perhaps you can only spend money on essentials, like groceries and gas. If so, put that under the “Exceptions” column.

You can also make any notes you need to get through the month, like any tips and tricks that have helped you to stick to your spending freeze. Plus, you’ve got an extra sheet to reflect on how you did – and what spending lessons you can take into the next few months.

Download your free no spend challenge tracker here!

How can I stop spending money for 30 days?

Working out how to not spend money for a month can definitely be hard – which is understandable, or else it wouldn’t be called a challenge!

So to help you to stop spending money on unnecessary things, we’ve collected these no spend challenge ideas. They’ll help you set yourself up before the start of the month while also showing you great ways to stick with your spending freeze, to put you in the best position possible to successfully stop spending money for 30 days.

1. Set the rules upfront

“No-spend” doesn’t necessarily mean spending money on nothing at all for an entire month. Instead, it’s better to interpret this as not spending money on anything extra, meaning that all essentials are allowed.

This means that it’s important to define just what these essentials are. Things like any debt repayments or rent will definitely fall into this category, as will utilities. Groceries should also be on this list, although you may want to add a spending limit here to avoid you “accidentally” adding extras to your shopping list as replacements for the non-essentials you’re not buying this month.

Some people also choose to add exceptions if something important is coming up during the month, although be careful not to go overboard on these. For example, if it’s your mom’s 70th birthday dinner at her favorite restaurant, it’s a good idea to give yourself one night off from your no-spend challenge for that.

(Although there are still ways to save money there, like with these cheap homemade gifts.)

2. Choose your timing

While doing a no-spend challenge is great, it’s also true that they won’t be possible at all times depending on what time of year it is or what’s going on in your life.

For example, it’s going to be close to impossible to do a no-spend month around the holidays (better to start a Christmas saving plan at that time of year if you’re looking to save money). Similarly, if your family always goes away for a few weeks during the summer, it’s best to schedule the challenge around that.

3. Get your household on board

There’s no doubt that doing a no spend challenge is a great thing for bringing your spending under control, but let’s be honest: it’s not always fun. It can also be really hard to do if you’re constantly faced with temptations to spend money – especially if those temptations come from people you live with.

So rather than “surprising” your household the day the no-spend challenge starts that this is what life will be like for the next 30 days, talk to them beforehand to explain why you’re doing this and how their support will help.

By helping them to see the benefits of controlling your spending – and maybe even getting ideas from them on what you all can do for free for the next month – you’re much more likely to succeed.

4. Become good at planning

As a general rule, one of the reasons why it’s so hard to not spend money for some people is that they don’t plan ahead.

For example, we all know that buying lunch at work every day can quickly add up. But so many people claim to not be organized enough to bring their own lunch from home – even if you’ll end up saving literally thousands of dollars every year by doing this.

Similarly, it’s been proven that you’ll spend more if you go shopping when you’re hungry – and not just at the supermarket.

So whether it’s setting aside time on the weekend to meal prep for the upcoming week (ideally using these cheap food ideas) or making sure you don’t go to the mall during snack time, some planning will make your no spend challenge much easier.

5. Only go shopping with a list

This is a great strategy at any time of the year, not only when you’re looking for reminders to not spend money during a no spend challenge month.

That is, by only going shopping with a list of actual essentials you need (and actually sticking to it), you’ll be amazed at how much money you end up saving. Just make sure you’re not tempted to stray from the list…

(And if you’re dying for new things but want to save money, why not check out this list of companies that will send you products to review for free.)

6. Bring only as much cash as you need for essentials

By only taking cash with you when you go to the store – ensuring that it’s only as much cash as you need for essentials and no more – you’re basically forcing yourself to only buy exactly what you need.

This means no credit card and no Apple Pay or Google Pay on your phone. Instead, work out how much your budget allows for essentials and what you need on this shopping trip.

From there, so you can force yourself to save money, take only exactly the amount you really need in cold, hard cash.

7. Unsubscribe from all shopping-related newsletters

When it comes to things to stop spending money on, basically any sort of online shopping will fall into that category.

And as one main way to stop spending money for 30 days is to remove as much temptation as possible, unsubscribing from all those newsletters for online outlets is a great strategy to achieve this.

If you’ve struggled to control your online shopping in the past, the ads you’re getting in these newsletters are likely some of the biggest wastes of money in your budget. So the fact that this means that these newsletters still won’t arrive even at the end of the no spend challenge is just an added bonus!

Related: 18 Best Frugal Mom Blogs to Save You Money

8. Have your friends do a no-spend challenge too

Having support from your family members for this is a major advantage in any no-spend challenge, but getting your friends on board is also a great way to get through the 30-day period.

One way this helps is that it avoids a situation where your friends are asking you to come and do something (that involves spending money), leaving you feeling like you’re missing out.

Instead, by all being in this together, you can actually work out fun things to do with your friends – that are free!

For example, instead of going out for dinner, why not host a potluck where everyone has to bring a dish made from ingredients that were already in their fridge? Or instead of going for a yoga class together, how about you go to a park and one of you leads the others based on a free workout you found online?

There are plenty of ways to successfully get through your no-spend month but having others doing it alongside you can definitely help make it easier.

9. Use a no spend challenge tracker

Using a no-spend challenge tracker is great for helping you to see how well you’re progressing. While it may not seem like much, the idea of being able to cross another successful day of not spending off the list is super motivating for helping you to make it to the end of the month.

Of course, you could simply do this by making a list of each day and ticking it off. But to make this easier, why not simply grab a copy of our no spend printable?

As mentioned a bit earlier, this free no spend tracker lets you follow along with how you’re going, as well as making any notes to guide you throughout the month. It also comes with a review sheet so you can consider what worked and what didn’t, to help shape your spending habits going forward.

10. Take note of how much you’re saving

Given that the reason you’re doing a no-spend challenge is to control your spending and save money, it can really help to see just how much you’re saving.

While the idea of saving $5 here and $10 there may not seem all that impressive, keeping a running tally of your overall savings can actually show you just how beneficial this is.

And not only does this help you keep going throughout the no-spend month challenge itself, but it’s incredibly helpful for showing you just how big of an impact some changes to your spending could have on your overall budget.

For example, if you’ve been wanting to tackle your credit card debt but never seem to have enough money to do it, seeing how much you’re saving by cutting back on non-essentials may just give you the push you need to continue limiting your spending and really work at destroying that debt.

An easy way to do this is to use an app that automatically tracks your spending. For this, I always recommend Personal Capital. It’s completely free and is great for automatically showing you your financial situation based on what you’re earning and spending.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

Related: How to Calculate Your Savings Rate – and Why You Should

How do I survive no spending months?

The best way to survive a no-spending month is to effectively plan for it. This isn’t something you can simply do without any preparations. Instead, things like ensuring that the ground rules are in place, such as which essentials you can spend money on, and having your entire household on board will help you to succeed at your no-spend challenge.

There’s no doubt that it can be tough, especially if you’re not used to reining in your spending and living cheap. But by following the list we mentioned earlier, it will make it much easier for you to survive a no spending month.

That is, it’s not only what you do during the no-spend month challenge which is important for making sure it succeeds, but what you do to prepare for it.

For example, timing is a major factor that not enough people consider. You’re never going to be able to cut all your spending around the holidays, for instance. So rather than setting yourself up for failure, why not consider doing it just after the holidays as a spending reset?

It’s also good to make sure your entire household supports this before you start. Not only will this ensure that they won’t tempt you to spend money, even accidentally but they can also help to think of ideas of how to avoid spending – or even chip in to achieve this. For example, if everyone helps with meal prepping, it’s much less likely that you’ll be tempted to order take out.

How can I have no spending days?

No spending days are definitely easier than doing it for the entire month, but they can still be helpful for giving you a taster of what may be involved if you expend your no-spend challenge.

Some tips to help you get through a no-spending day include:

- Plan out your day ahead of time – Knowing even roughly what you’ll be doing that day makes it much easier for you to avoid any spending temptations. For instance, if it’s a work day, make sure you remember to bring lunch. Grocery shopping may be fine if you’re not counting essentials in your spending freeze, but get that shopping list ready so you don’t find yourself buying anything extra.

- Make sure you have enough food on hand – Nothing destroys a no-spend day faster than ordering take out, so checking you have enough on hand to get you through the day (ideally with some seriously frugal meals) is important. This includes planning for any meals you may have to have outside of your home, like the one we just mentioned about taking lunch to work, or even snacks you may want to have if you’re going to be about and about.

- Get your entire household on board (or even some friends) – Moral support can be great for helping you to get through your no-spending day, but it also helps for avoiding any temptation. After all, it’s going to be hard to commit to your spending freeze if your partner is insisting on going out for dinner that night. Also, by getting your friends involved, this can help all of you combine your creative juices to think of some free things to do together.

- Take note of how much money you’re saving – By writing down in your notes app each time you would normally have spent money – and, ideally, how much you saved – this can be great motivation at the end of the day for showing you that you really could do it. It can also help you to implement better spending habits in the long term. After all, if you managed to save $30 by not going out for brunch with your friends on one Sunday, why couldn’t you do it on every second Sunday going forward?

- Don’t see this as an excuse to spend more in the days before or afterwards – One big problem with no-spending days is that some people see it as an excuse to overcompensate the day before. Alternatively, they may be tempted to “reward” themselves by spending what they saved in the days after the challenge. The problem with this is that it doesn’t actually help you to reduce your spending overall, which is the main goal of this. Instead, it’s much better to assess what you saved and see how you can change your spending habits in similar ways on a more long term basis.

- Find free alternatives to what you would otherwise be doing – For example, if you usually pay to go to a gym class, go for a run outside or find a free workout on YouTube. If you tend to get a glass of wine with friends after work, invite them to your house to open that bottle you already bought. There are almost always free alternatives available to drastically cut your expenses that can be just as fun as your usual plans.

Looking for other free options? Why not try:

- 43 Simple Ways to Get Free Books Mailed to Your Home

- 12 Simple Ways To Get Free Shoes Sent To Your Door

- 17 Easy Ways to Get Furniture for Free

- Best Amazon Gift Card Deals to Get Free Amazon Credit

Is there a no spend challenge app?

You can simply use a habit tracker app to help you to keep track of days where you successfully didn’t spend any money, instead of downloading a specific no spend challenge app. HabitBull is great for this, with its free version being more than enough for this purpose.

How it works is that you add the “habit” that you want to implement and how frequently you want to do it. For example, you can easily set it up to do a complete no-spending month.

But you could also adjust this to, say, have no-spend days three times a week every week. Something like this could be better if you’re looking to make longer term changes to your spending habits.

From there, simply mark off each day where you did or didn’t manage to spend anything. The app can also remind you to tick this off every day and will show you how you’re going over the previous days and weeks, which is great motivation to stick with your no-spend challenge.

(And this also works well for other savings challenges, like as a way to track your progress in a 100 envelope challenge.)

Related: 10 Steps to Save $10k in 100 Days With the Envelope Challenge

What does no spend mean?

While some people interpret “no-spend” as meaning not spending anything at all, it’s much more realistic to define it as not spending money on anything that’s not essential. Spending some money on things like groceries, housing and utilities is inevitable, so doing a no-spend challenge where you can still spend money on these items is much more practical.

One major problem with defining “no-spend” too strictly, so that you don’t spend money at all, is that you’re setting yourself up for failure. That is, when you’re trying to live on a budget, that budget has to include at least some spending on things you need.

But most of us can limit our spending on “wants”, although you shouldn’t cut this altogether for the rest of your life as it’s just not sustainable. However, committing to this for a short period – like a no-spend month – can be great for bringing your spending under control.

Final thoughts on doing a no spend challenge

When you need to hit the reset button on your spending, a no spend challenge could help you do just that.

While it’s not something you’d want to do every single month, limiting your spending for just 30 days can be a great way to help you see just how easily you could survive by cutting back on all those non-essential purchases.

And, ideally, you’d then be able to take these lessons learned forward to your longer term spending habits.

If it all sounds a bit daunting, starting off with a no-spend week may be just what you need. But once you’ve dipped your toes in that pool, consider extending it to a 30-day no-spend period. After all, with these no spend ideas on how to get through it, there’s no doubt that you’d find yourself being able to survive no spending months in no time.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.