Whether you’re just trying to stick to your budget or have realized that you really need to get your spending under control, finding tips for how to live cheap can be a game changer for your finances.

After all, there are basically two things you can do when trying to take control of your money: spend less or earn more (or both!)

So here, we’re focusing on the first one!

How to live cheap

With this list of frugal living ideas, we’re sure you’ll find some ways to drastically cut your expenses by seeing just how to live cheaply.

These are especially good for those who are trying to figure out how to live on a budget. This is because, in most cases, the main problem that people have in doing this is actually sticking to their allocated amounts for each budget category.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

This means that you may want to look for the cheap living tips on this list that correspond to those budget categories where you know that cutting back will have the most impact for you.

For example, do you perhaps need to live more frugally when it comes to your food expenses? Then pay close attention to that category below.

Or just take a look through for some more general frugal living ideas to implement in your life!

(And starting with improving your overall money management doesn’t hurt either…)

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

How can I live more frugally with my shopping?

It’s clear that everyone needs to buy things occasionally, so we’re not advocating for a complete spending freeze.

At the same time, most of us have areas that we can work on to save money when it comes to our shopping habits.

So take a look to see which of these you could put into practice when you go to the store to help you to live cheaply.

1. Always use cash back apps when you shop

If you’re not using a cash back app when you go shopping, you’re practically throwing away money.

This is why we always recommend using Ibotta.

Ibotta

Free sign-up bonus: $20

Ibotta is a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

In fact, users make $150 per year on average – not including your free $20 welcome bonus – with over $682 million having been paid out, so you know Ibotta is definitely legit.

It’s a completely free app that gives you money back at over 500,000 retailers on a ton of things you’re probably buying already, like groceries, medicine, clothes, beauty products and more.

And to get you started, they’ll give you a free $20 welcome bonus just for redeeming your first offer!

2. Don’t shop just because you’re bored

So many of us choose to go wander around a mall when we’re bored, but this can be very dangerous for your wallet.

This is especially the case if you don’t think you have the self-control to stop yourself “only buying one thing”.

Instead, either find another way to kill time or make sure you only take a small amount of money with you (like one $20 bill) or even none at all.

3. Apply the 30-day rule to “wants”

The 30-day rule is a great way to prevent impulse buys.

What it involves is that if you want to buy something (except for things you absolutely need, like food or medicine), put it on a list along with the date you added it to the list. This doesn’t have to be fancy – a list in an app on your phone does the trick.

Then tell yourself that you can’t buy anything on the list until it’s been on there for 30 days. That way, you’ll be able to see if you really, truly want it.

In the vast majority of cases, this leads to you spending far, far less on your wants.

(And you could even take this to the next level by doing a no-spend challenge for a month!)

4. Cut up your credit card if you can’t resist it

Credit cards can be a great way to manage your money – if you do it properly.

However, for many of us, they become an accidental gateway to more debt piling up.

So if you find yourself spending more on your credit card than you can afford to pay off each month, it’s probably a better idea that you not have access to it until you’ve worked on your credit card management skills.

And the best solution to this is to simply cut it up. That way, you’ll only be able to take cash with you when you go shopping, which serves as a great way to limit how much you can spend.

How to live cheap through better money management

Effectively managing your money is one of the best cheap living tips out there.

Once you’ve got a hold of your finances, you’ll find yourself keeping a closer eye on just where your money is going. Meaning less spending your money randomly and more using each dollar to work towards your financial goals.

5. Start a budget – and stick to it

If you’re looking for how to live cheap, starting a budget – and actually sticking to it – is one of the best things you can do.

That way, you’ll be able to see where you may be spending more than you realized and take action to cut your expenses in those areas.

To get started, download our free budget template and see how you can use it to work on sorting out your finances.

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

6. Cancel all unused subscriptions

Reducing your recurring expenses is one of the best tips for those figuring out how to live on a budget and this especially includes subscriptions to products or services you may not actually be using.

After all, these costs can really add up over time even if you don’t notice only paying $20 or $30 a month on a subscription, meaning that any savings you can make in this area can have a big impact on your finances in the long term.

One really quick way to do this is to use an app like Trim to do it for you.

Trim is an app that works to automatically cancel your subscriptions. It’s completely free, although will take a small percentage of any money it saves you.

Click here to find out more about Trim.

7. Negotiate with your bill providers

If you’ve been with your bill providers for some time, there’s a good chance that there are better deals on the market now. But you’ve probably never looked into whether you can get a better offer as it seems easier to just stick with your current contract.

So remember Trim, the app we just mentioned? It can also automatically negotiate your bills on your behalf to save you money on things like your cable and internet.

Of course, you could do this yourself by looking into what your provider’s competitors offer. But if you can’t be bothered or aren’t really sure where to start, Trim is a great way to have this done for you – especially given that it’s free.

8. Switch to a fee-free bank account

If you’re paying fees on your bank account, unless you’re getting some amazingly great benefits from the bank, you should definitely look into switching to a fee-free account.

Take a look at the Savings Builder account from CIT Bank. The interest rate is 22x the national average and there are no fees for opening or having the account.

All you need is a $100 minimum opening deposit and you’re good to go!

9. Consolidate your loans

Consolidating your loans is a great step for those looking for how to live cheaply, as it can save you literally thousands of dollars over the life of your loan.

It involves combining multiple loans into one single loan. This helps to simplify the process of paying these off and, ideally, results in you having a lower interest rate on the consolidated loan than when they were split.

A good first step is to check a website that shows you deals from a range of different providers that offer loan consolidation.

I always recommend Credible for this. It’s quick, free and shows you information from all the top lenders based on your individual circumstances, including whether or not you have a good credit score.

Click here to see what loan consolidation options may be available to you.

10. Refinance your debts

Refinancing your debts involves replacing your debt with a new one, preferably with better terms like a lower interest rate.

That way, you’ll be able to save money and have easier repayment obligations to manage over the course of paying off your debts.

Credible is also a great option for this, with a ton of options for those looking to refinance.

For example, you can click here to see which lenders have offers for you to refinance your credit card debt. Alternatively, you can also check out how you could be able to refinance your student loans here.

In fact, their offers for refinancing your student loans are so good that they’ll even pay you $200 if you manage to find a better deal elsewhere.

11. Aggressively pay off debt to stop paying interest

Interest is what most people struggle with when trying to take control of their money. Before you know it, the interest accrued on your debts can spiral to a point where you’re struggling to pay it all off each month, let alone the debt itself.

This is why focusing on aggressively paying off your debt is one of the most important things for you to do if you’re trying to work out how to live on a budget.

By paying off your debt as quickly as possible, you’re reducing how much money you have to spend on interest. And once that’s gone, you’ll be able to find it much easier to live cheap!

12. Shop around when it’s renewal time

Whenever you receive a renewal notice for something that you’re paying for, it can be easy to just pay it and forget about it for another year.

But by doing this, you’re losing a great opportunity to save money.

Instead, shop around to see what else is on offer. That way, you can either switch providers or use the information you’ve found on your provider’s competitors to negotiate a better deal for yourself.

13. Avoid lifestyle creep

Lifestyle creep is a killer for anyone trying to save money.

If you’ve ever felt yourself buying something because “someone else has it” or because you think you need it to fit in anywhere, congratulations, you’ve experienced a case of Keeping Up with the Joneses!

Instead, it’s important to stick to your plan of how to live simply and cheaply. It can be hard, especially when a neighbor or friend gets a shiny new toy.

But you know those stories you’ve heard about people on 6-figure salaries still struggling to pay for everything? In the vast majority of cases, it’s because of lifestyle creep.

Having a solid grip on your finances is far more important for your overall happiness though, as it means that rather than your debt controlling you, you’re the one controlling your own financial future.

Related: The Personal Financial Plan Example You Can Use To Reach Your Financial Goals

14. Start a side hustle

If you’re looking for how to live cheap because you’re trying to increase your savings rate, a bonus way to do this is to increase your income.

That way, not only are you reducing the money that’s coming into your account, but you’re increasing how much is going out.

So look into ways that you could make some extra money on the side. Maybe you have a particular skill that you could teach others? Or perhaps you’re super creative so can make things to sell? Have you ever thought about starting a blog?

Whatever it is, starting a side hustle can often be the solution many are looking for, especially if you’re struggling to find ways to cut your spending even further.

Cheap living tips for food

Food makes up one of the biggest parts of any household budget, meaning that if you’re trying to find ways to live cheap, this can be a great area in which to save money.

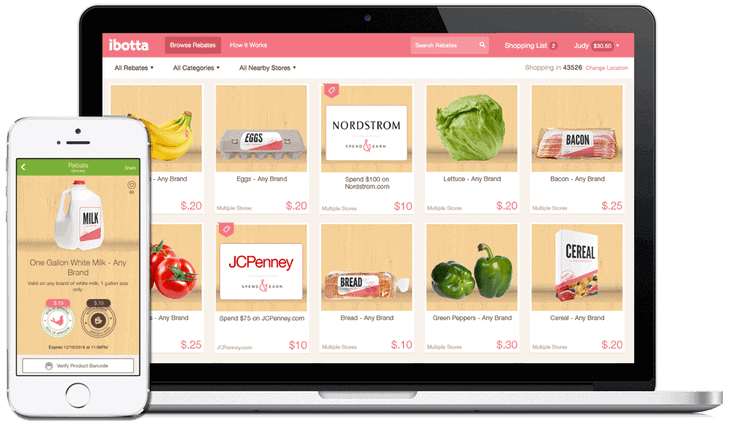

15. Use coupon apps at the supermarket

Gone are the days where we have to spend hours going through coupon books to find deals. Now, there’s an app for that!

I always recommend Ibotta for anyone looking to save money on their grocery shopping. It’s a free app that gives you cashback on literally thousands of products, whether you buy them in-store or online.

And as the cherry on top, it will give you a $20 sign-up bonus just for redeeming your first offer.

Sign-up with Ibotta for free to see where you can save money on things you’re probably already buying.

16. Meal plan

Having a meal plan is essential if you’re trying to live cheaply, as it’s the best way to make sure your household is eating as many frugal meals as possible.

After all, it lets you plan meals around whatever is already in the cupboard and other cheap food options. Plus, it’s the easiest way to plan what you’re going to buy at the supermarket, to make sure you’re only buying what you need and not wasting food (and money!)

You can certainly do this yourself but if you know that you’re the kind of person who really can’t be bothered with that sort of preparation, there’s a super cheap alternative.

$5 Meal Plan is a website that charges $5 per month to send you a full four-week meal plan.

It seriously saves so much time – and you’ll definitely save more than $5 in a week by meal planning, let alone a month!

And to try it out, click here for a FREE two-week trial.

17. Avoid eating out whenever possible

It’s no surprise to hear that eating out costs way more than eating at home.

So for those looking for how to live cheap, it’s best to limit yourself to cooking at home as much as possible.

There are other, cheaper ways for you to eat outside if you’re sick of being at home. Making a picnic and meeting friends at a park to eat can give you the best of both worlds – while also helping you to save money.

18. If you do eat out, use these money saving tips

…of course, it can be hard to completely stop all eating out. So if you find yourself doing the very, very occasional night out, here are some money saving tips for how to live on a budget and still have a meal outside:

- Use a cash back app – Ibotta doesn’t only give you cash back on your purchases. You can also use it to get money back at certain restaurants – as well as for buying alcohol! Sign up with Ibotta for free here to see what’s on offer for eating out in your area (plus to get the free $20 sign up bonus).

- Go out for breakfast or lunch, not dinner – Restaurants almost always charge more for their dinner menu. So if you’re craving a meet-up with your friends but are still budget conscious, consider meeting for another meal, like breakfast or lunch.

- Stick to water – The mark-up on alcohol in most restaurants is how they make their money. So as much as you may have been looking forward to a drink, stick to water at the restaurant. You can always invite your friends around for some drinks at your place another day.

19. Take your lunch to work

That $9 salad you get everyday at the cafe around the corner from your office? If you’re trying to live cheaply, it’s got to go.

Instead, make sure you include lunches in your meal plan. I find it works best to then make these on the weekend so they’re all ready to go in the fridge for me to grab on the way to work in the morning.

20. Only go to the supermarket with a list

Supermarkets are intentionally designed to make you buy as much as possible.

So one of the best frugal living ideas out there is to make sure that you don’t step foot inside a supermarket without a list – and that you actually stick to it.

It should be easy to make this if you make a meal plan. And by following a list at the supermarket, not only are you going to avoid being tempted to buy extra goodies, you’ll also avoid food wastage by not buying things that you don’t end up using.

And with Americans wasting $240 billion in food every year, there’s a lot of money to be saved here.

21. Only drink water

Drink prices, both at supermarkets and restaurants or bars, are incredibly marked up for what you get.

So if you’re wondering how to live on next to nothing, you should try sticking to water as much as possible.

It’s (basically) free, not to mention good for you.

Sure, you might be worried about looking a bit stingy if you do this when out with friends but, really, who cares?

22. Make coffee at home

This is a classic tip for how to live cheap – the idea that if you stop buying a coffee on the way to work, you’ll be able to afford a house deposit.

That may be an exaggeration (usually used by the same people who say that eating avocados is bankrupting millennials) but it is true that your coffee habit could be costing you more than one thousand dollars per year.

Meaning that if you adjust your coffee addiction to either have it at home or to bring supplies to work to make it there, you could save a small fortune.

23. Eat less meat

If you’re wondering what should you eat on a very tight budget, the solution is: less meat.

In terms of bang for your buck, meat is far more expensive than beans and legumes.

(It’s also war worse for the environment, if that helps you make the switch.)

I’m not saying you have to become vegan. But having a few meatless meals each week is good for you, the planet and your wallet.

And with thousands of recipes online for you to make with things like lentils and chickpeas, you’ll be amazed at what you’re able to produce without adding meat to your plate.

24. Buy generic brands

For those who are at the point of having to ask “What should I eat when broke?”, the answer is to stick to basics that you can buy in bulk. Meals based on rice and beans are a really cheap, healthy, filling place to start.

And it also helps that a lot of basic food like this comes in generic options that are crazy affordable. In fact, in most cases, there’s absolutely no difference between brand name and generic food options.

So when you have the choice, always go generic to save a ton of money on your shopping bill.

25. Avoid pre-made food

It’s true that pre-made food can be super convenient. But you’re also paying for that convenience.

For example, microwavable rice costs $0.39 per ounce whereas buying the same rice for you to cook yourself costs only $0.10 per ounce.

That is, you’re paying literally four times as much for exactly the same food.

So for those trying to live more frugally, take the extra time to buy food to make from scratch.

26. Don’t shop hungry

Studies have shown that if you shop when you’re hungry, you’ll spend up to 70% more.

This means that a very simple way to live cheaply is: make sure you have a snack before you head to the store.

27. Buy frozen fruits and vegetables instead of fresh

Frozen fruits and vegetables are far cheaper by weight compared to when you buy the same items fresh. They also last a lot longer, so the risk of wasting food that’s gone off is almost nil.

This means that it’s a good idea to buy frozen versions of these if you’re trying to live cheap.

28. Always check the price in terms of weight

This is a classic trick that supermarkets try to pull on consumers. That is, while the price of a certain item may look like a good deal, it’s always worth checking the price in terms of the weight of the item.

You’ll often find that the slightly more expensive item comes with far more product, making it the cheaper option overall.

Frugal living ideas for housing

Housing is a huge cost in anyone’s budget, so it can be a good idea to consider ways to save money here if you’re looking into how to live cheap.

29. Move somewhere smaller

This may be easier said than done if you own your home rather than rent. But even if that’s the case, moving somewhere smaller can save you thousands of dollars.

And it’s not only about how much you can save on rent or mortgage payments. Land taxes, heating and cooling costs, maintenance, the price of furnishing a larger home…these can all really add up.

So moving somewhere where you only have “as much house as you actually need” can be a good solution.

In fact, it’s also worth asking yourself if you can live without a house. The dream we’re all sold is a picket fence, but that land can cost money.

Instead, if you can survive in a smaller apartment, it can not only be cheaper but will save you hours of time in yard maintenance/

30. Move somewhere with a lower cost of living

Cost of living is a massive factor for why people in certain areas are struggling more than others.

The classic example is San Francisco, where a 6-figure salary is considered “low income”.

This means that it can be a good idea to ask yourself where you can live to get the most value for money.

When considering where you can live cheaply, look at suburbs on the outskirts of or just outside the city where you work, preferably on a train line or other commuting path, as you don’t want to be stuck in traffic for hours every day just to get to the office.

Or you could look at these cheapest places to live and work.

31. Get a housemate

Getting a housemate is the answer for everyone who’s ever asked themselves how to live cheap as a student, but you don’t have to be at college for this to be a viable option.

In fact, if you have a spare room, getting a housemate can be a great way to help pay some of your mortgage or rent.

32. Move in with family

If this is an option for you, moving in with family for a while can be a good idea to help you live on next to nothing, at least for a while.

It doesn’t have to be forever and it certainly won’t work for everyone. But as a short term solution to save a pile of cash, it’s definitely worth considering.

33. Save on heating/cooling costs

Heating and cooling costs can make up a massive part of any household budget. However, you can save a good portion of your heating costs by setting the thermostat at what’s considered the ideal temperature of 68F (20C).

Similarly, save money on cooling by setting air conditioners to 75F (24C).

And to really maximize your savings, why not instal a programmable thermostat? That way, you can cut your expenses further by setting the temperature at night to be cooler in winter and warmer in summer than during the day.

34. Cut your energy bill

Besides setting your heating and cooling units on their most efficient settings, that are other ways to reduce your energy bill if you’re trying to live more frugally:

- Install energy efficient light bulbs – an LED bulb that replaces a normal (i.e. 60-watt incandescent) bulb will save $132 in electricity over the life of the bulb. While they may be more expensive to buy upfront, it will definitely be worth it in the long run.

- Unplug unused devices – “vampire power” is the power that your electronics are using even when turned off. Which, of course, equals wasted money. This means that unplugging them – or, better, buying a smart power strip that shuts down electronics when they’re in standby mode – can save you a ton of cash.

- Check your window seals – a drafty window is simply sucking money out into the air outside. Luckily, they’re easy and cheap to fix, especially when you factor in how much you’ll save in heating or cooling costs.

How to live cheaply and still be entertained

You can absolutely live cheaply and still have a good time. Here’s how.

35. Cut your cable

If you’re looking for how to live cheap, you should be seriously considering cutting your cable.

It’s an easy win and, while it may hurt at first, there are plenty of other free entertainment options you should be considering at this time.

36. Go to the library

The library is a goldmine of free entertainment options, not all of which are related to books.

Take a look at just some of the options here.

37. Find free events in your area

The websites of most local government authorities or community organizations frequently list the free events that are on in your area each week.

From concerts to group work out sessions, markets to food truck meet-ups, there’s almost always something on for you to try.

And given they’re free, there’s no reason for you to be bored while trying to live cheap!

38. Try a no-spend weekend

A no-spend weekend is one where you find activities to do that, perhaps unsurprisingly, involve you spending nothing.

Check out this list for some inspiration.

How to live on next to nothing and afford clothes

If you consider yourself a bit of a fashionista (or even just find yourself on ASOS more than you probably should be) but are wondering how to live your best life on a budget, don’t worry, you can still dress to impress.

You will, however, have to make some adjustments to your purchasing habits.

39. Shop second hand

If you’ve never been to a thrift shop to buy clothes, you’re missing out.

The range is incredible and you can often get completely new and even brand-name clothes and other accessories for a fraction of the price of normal stores. You should see the range of classic blazers I’ve gotten from various thrift stores, which were such a great find when I was trying to dress professionally on a budget in my first job after college!

Plus, you’ll often be helping charity by buying clothes there!

(And this can also be particularly good for saving money at a fancy event. Just see how to plan a quinceanera on a budget as a great example of this.)

40. Embrace the capsule wardrobe

The concept of the capsule wardrobe became much more fashionable over the last few years. Which is great, because it also aligns well with the idea of living cheaply.

It basically involves owning a wardrobe of only a few key pieces that you can mix and match. The idea is that you’ll save money (by owning less clothes) and time (by having less to choose from) – both of which sound pretty good to me.

41. Air-dry clothes

Using a dryer to dry your clothes costs money in terms of energy costs and because it’s bad for the quality of your clothes, meaning you’ll have to replace them quicker.

This means that air drying them can be far better for your wallet on several fronts.

If the weather isn’t great outside where you are, you can simply set up a drying rack in your lounge room.

Just make sure you open a window every now and then to avoid the room getting musty.

42. Don’t wash clothes each time you wear them (unless they’re really dirty)

This doesn’t apply to, say, your workout clothes that you sweat in. But for normal, everyday use, you rarely need to wash your clothes every single time you wear them.

Doing this can save on your operating costs for the washing machine, while also preserving the quality of your clothes, saving you even more in the long run.

How to live cheap and still have transport

Even if you’re trying to live cheaply, you still need to get around. Fortunately, there are ways to do this while living on a budget.

43. Only own one car (or none)

If your household owns two cars, but you’re trying to save money, it’s time to stop and think about whether you actually need both of them.

Sure, it’s probably more convenient. But with some adjusting of your schedules, you may find that you’ll manage with just one car – or even none at all!

44. Downsize to a smaller, second hand car

Another thing to consider with your car ownership is whether you really need the car you have.

Maybe it’s a 4×4 but the furthest you go off road is into your office car park. Or it’s a utility and you haven’t transported anything since you moved to your current house years ago.

Bigger cars equal bigger bills to pay. So if you don’t need it, consider downgrading to one that fits your lifestyle more.

45. Walk or ride a bike

Want to save money and your health? Then let me re-introduce you to bike riding.

This may be something you haven’t done since you were in elementary school. But bike riding is cheap, often faster than a car depending on where you’re going (as you can more easily avoid traffic) and you can park essentially anywhere.

The only cheaper option? Walking!

You’ll be surprised if you try how often you don’t really need to use your car, even if you’ve gotten into the habit of using it to get from A to B.

46. Use public transport

Owning and operating a car can definitely cost a lot.

Which is why, if you have access to public transport, it can be a miracle for your wallet.

If you commute to or from a major city center, it’s also often far more convenient. Not only do you generally avoid the traffic involved with commuting by car, having a bus or train drop you off in the middle of the city is much better than circling the block for hours, looking for a park!

Not to mention paying for the gas to do so…

47. Carpool or rideshare

With so many rideshare companies now operating, you can easily find a way to get around on the odd occasions when you really do need a car. Companies like Uber will work well here, but you can also rent cars by the hour these days when you need one.

And the hourly rates of these companies are undoubtedly less than the cost of actually owning the car yourself.

Other ideas for how to live on a budget

These are some other ways for how to live cheaply that may not fit neatly into one of the other categories.

That doesn’t make them any less useful though for showing you how to live more frugally.

48. Drop your cell phone back to only what you actually use

It can be tempting to get the deal on your cell phone plan that gives you, say, the most data you can afford or a ton of included minutes.

Realistically, though, how much of this do you actually use? As if you consistently have a lot of these left over at the end of each month on your plan, you’re basically throwing money away.

Instead, you should consider dropping your cell phone plan back to only what you actually need. It can also be a good idea to switch to a more flexible plan rather than locking yourself into a 24-month contract that you may end up regretting but can’t get out of.

It’s for this reason that I always recommend Republic Wireless. Their $15 plan comes with unlimited talk and text and you then pay $5 for each GB of data you use.

That means you only have to pay for what you actually need, meaning no extra money going to the cell phone company instead of into your pocket!

49. Exercise for free

If you’re trying to live cheap, you shouldn’t be spending money on a gym membership.

Fortunately, the internet has a practically unlimited supply of free workouts, particularly on Instagram and YouTube.

You can find basically anything, from yoga and pilates, to bodyweight training, to cardio workouts. Have a look around to find someone you like and start saving money on your gym fees.

50. Sell anything you’re not using

Got anything you don’t use lying around?

Not only does decluttering feel good, but you’ll be amazed what people will pay you for.

One man’s trash is definitely another man’s treasure, so look around your house and see what you can unload on to others. That bit of extra cash could be just what you need to stick to your budget this month.

(And if you’re looking for ideas on where to keep the things you do have, take a look at our article on storage ideas for small spaces on a budget.)

51. Stop smoking

We all know the health problems caused by smoking and, sure, you’re almost certainly aware of how much it’s costing you – but have you ever sat down and really done the math?

A pack-a-day habit will cost you, on average, just under $2,300 in a year or $188 per month.

If you’re trying to live cheap, that’s definitely money that could be put to better use.

52. Fix things yourself

One of the best parts of the internet is that it’s given many of us the chance to learn how to do something you wouldn’t be able to figure out otherwise.

And nowhere is this more true than if something needs to be fixed.

You may be tempted to pay someone to repair it for you. But more often than not, with a bit of time and learning, you can probably figure out how to do it yourself.

Sure, that doesn’t apply to things like wiring where you can get electrocuted if you do it incorrectly. But for most things, have a try at repairing things yourself, as the pay off can really be worth it.

53. Learn how to do your own beauty/grooming activities

Similarly, YouTube has transformed the beauty industry – in that there’s almost certainly someone out there who can show you how to get salon-quality results at home.

Things like your weekly mani/pedi or, worse, highlights and other hair treatments can seriously add up over time.

This means that by doing them yourself, you’re literally going to save thousands of dollars a year.

And if you’re looking for how to live on next to nothing, then this can be a game changer.

54. Get everything second hand

You may think that all second hand furniture is complete garbage, but that couldn’t be further from the truth.

Much of it is in almost perfect condition. Whether people are moving or looking to redecorate, you’ll often find second hand furniture online that is just as good as buying new – but for a fraction of the price.

What to do if you have no money?

If you’re wondering how you can live well with no money, like if you’re trying to survive without a job, you’ll need to make some urgent adjustments to your finances.

As mentioned at the start of this article, you have two options: save more or earn more.

And if you have absolutely no spare money, then you’ll probably need to try to do both these things.

The first step is definitely to make a budget so you know where your existing money is going.

It’s then time to aggressively cut back on your wants and, where possible, reduce your spending on your needs.

This list of ways to live frugally should help, but you’ll probably have to be pretty strict in terms of how you implement them.

Once you’re back on your feet financially, then you can consider loosening up a bit. For now, though, it’s important to really get a hold of how you’re managing your money.

Final thoughts on living cheap

Living cheaply, even just for a while, could be just what you need to turn your finances around.

This is especially the case if you’re struggling to make it to the end of the month. In that case, figuring out how to live cheap for a time could be what you need to get your spending under control.

It’s true that some of these frugal living tips may be more relevant to you than others.

But with some careful consideration of your finances and your spending habits, putting even some of these into practice will definitely go a long way to helping you to live more frugally.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.