Financial planning is important no matter where in your financial life you are. That said, it can be a bit daunting when trying to figure out exactly how to do this, which is why having a personal financial plan example can really help.

After all, without some kind of sample to work off, it’s hard to know just what to include.

Is it like a long term budget? Or is it more of a place to set out your goals?

Well, in many ways, it’s basically both of these, with some extra features thrown in for good measure.

TAKE BACK CONTROL OF YOUR FINANCES

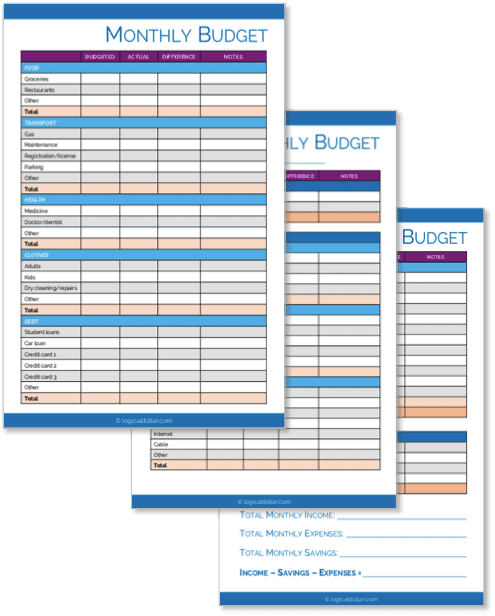

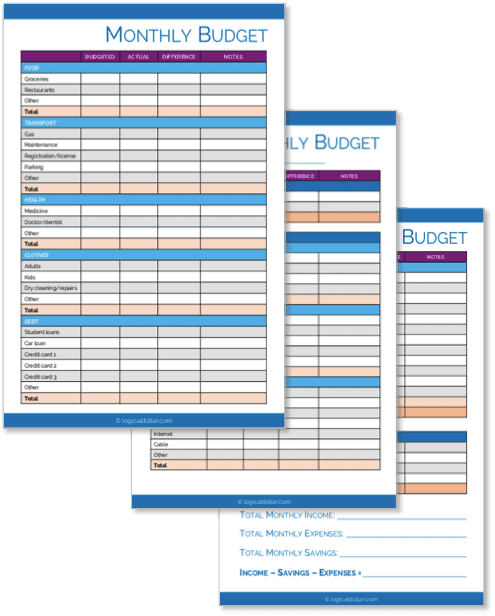

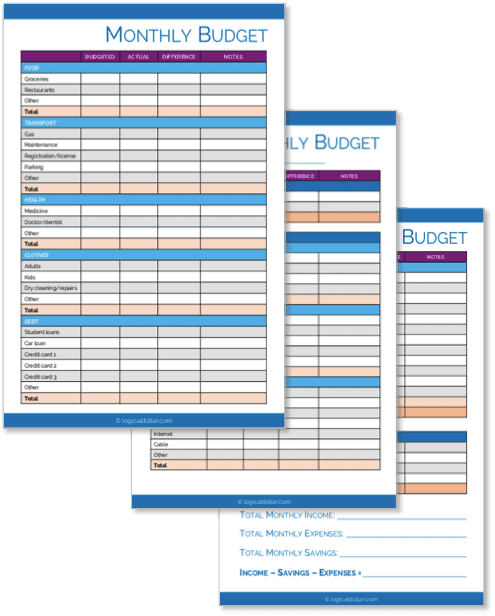

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

But the overall goal of a personal financial plan is to see where you are and where you want to be from a financial perspective, as well as how to get there.

So keep reading to find out how you can do just that.

What is a personal financial plan?

A financial plan is a strategy that clearly sets out the financial goals you want to achieve, as well as how you plan to do this.

This means that it involves looking at your current financial situation, particularly your net worth, and spelling out the exact money steps you need to take from here.

It’s also a good opportunity to see where you’re doing well and where there are areas you can probably improve with respect to your money management. In this way, it’s kind of like a long term budget.

This means, of course, that you’ll have to continue to keep an eye on your money management as you go forward, including to make sure that you’re doing all you can over the coming months and years to reach the steps set out in your financial plan.

For that, we always recommend Personal Capital. In our experience, it’s by far the best app for giving you a free, ongoing perspective of your financial situation, along with personalized tips on how to manage your money even better.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

What are the benefits of having a personal financial plan?

Having a personal financial plan is a great way to make sure that you’re setting yourself up for future financial success.

Instead of vaguely thinking that you, for example, have to save for retirement, it gives you actionable steps to reach an actual goal of, say, how much money you think you need to retire.

More specifically, some of the benefits of having a financial plan can be seen below.

1. Knowing your exact net worth

Having an idea of your exact net worth is an underrated aspect of financial management. Many people write this off as being unimportant and choose to focus instead of things such as how much debt they have left to pay off or the value of their retirement accounts.

But calculating your net worth is super important for knowing how you are performing financially. By balancing out your assets and liabilities, you’ll have the exact starting point for developing your strategy of how to reach your financial goals.

(After all, in any journey, it’s pretty much impossible to know how to get to a destination if you don’t know where the starting line is.)

This doesn’t have to be complicated. In fact, as just mentioned, Personal Capital will actually do this for you by connecting securely to all of your accounts and giving you the overall picture on one screen.

2. Tracking your finances

By committing to following a personal financial plan, you’re also indirectly committing to keeping a closer eye on your financial records.

This is because any sort of letter or other document you receive that relates to your finances will guide the ongoing development of your financial plan.

This includes bills, bank statements, pay slips, insurance policies and renewal notices, loan agreements, tax notices and anything related to estate planning.

Try Trim here.

3. Monitoring your cash flow

Very simply, your cash flow helps you see whether you have more money coming in or out.

A positive cash flow means you have more income than what you’re spending and a negative cash flow is the other way around – and, obviously, not where you want to be.

Many people think they’re breaking about even when they actually are spending more than they realize. It’s only as their credit card debt starts to creep up do they see that their cash flow situation isn’t quite where they thought it was.

So monitoring your cash flow is a good way to make sure that your spending habits are under control and that you’re not going into debt to support your lifestyle.

(And if you are, you should seriously consider drastically cutting your expenses.)

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

4. Planning for how to achieve your financial goals

Having financial goals is great. But, like any other goal, it has to be SMART – that is, Specific, Measurable, Achievable, Realistic and Timely.

This means, rather than simply planning to, say, pay off all your credit card debt to increase your credit score, you should be more specific and work it out using the SMART format. That is:

- Specific: You want to pay off your credit card debt in full.

- Measurable: You have $5,000 in credit card debt to pay off.

- Achievable: By only allowing yourself to get food delivered once every two weeks, taking your lunch to work and only going out for dinner once a month, you’ve calculated that you’ll free up just over $200 every month.

- Realistic: Based on the amount of debt and the timeline you’ve set, this goal is realistic to achieve.

- Timely: You’ve given yourself two years to pay this off.

And by having a financial plan, you’re not only setting financial goals but breaking these down into manageable steps based on your actual financial situation, making it far more likely that you’ll actually achieve them.

Related: Why Living Stingy Could be the Key to Achieving All Your Financial Goals

What is included in a financial plan?

Your financial plan can include as much or as little detail as you want, although more is generally better, especially when working out your current situation as well as your strategy to move forward from there.

One good way to draft your personal financial plan is to base it around what are often referred to as the “7 key components of financial planning”.

What are the 7 key components of financial planning?

These are the main components that many experts say should be included in anyone’s personal financial plan, given how important each one is to securing your financial future.

1. Retirement plans

No matter what your other financial goals are, any plan should include a strategy for building towards a financially secure retirement.

2. Investment management

Your investment objectives may overlap with some of the other components, such as if you’re investing for retirement.

But that’s to be expected – what this part of the plan does is look at your investment objectives and risk tolerance, then determine how you will manage this with respect to your asset allocation (that is, the mix of assets in your portfolio).

For example, you may plan to manage your investments quite aggressively for the next five years while you’re young and your risk tolerance is higher, then plan to scale back to a more conservative portfolio after that.

3. Social security planning

If you currently receive any social security benefits, these should be included as part of your plan, including to take into account when these may increase or, alternatively, when they may no longer be available, forcing you to cover the benefits through other means.

Similarly, you may be expecting to receive benefits in future, such as when you retire. These should also form part of your plan as, to continue this example, this could help a lot in determining what actions you need to take now to fund your retirement.

4. Risk management

This doesn’t involve simply considering your situation based on the current risks you face, but also planning for other, more unexpected risks.

For example, what if you have an accident and are no longer able to work to support your family – how will your finances fare in a situation like this?

5. Tax planning

It can be a good idea to speak with a tax accountant who can advise you on the tax consequences of your financial plan, as well as to potentially include legal tax reduction strategies as part of your plan for the future.

6. Estate planning

Estate planning – or what happens to your finances and other aspects of your estate when you die – is important for anyone to consider, no matter where you are in life.

Having a valid will is only one aspect of this. Depending on your circumstances, you may also wish to consider medical directives, durable power of attorney and guardianship for any children.

7. Cash flow and budgeting

As mentioned earlier, knowing the status of your cash flow is imperative for anyone looking to take their finances to the next level. This is especially the case if you have a negative cash flow, meaning you’re living beyond your means.

So as part of any financial plan, getting your spending under control is critical to then address the other aspects of your plan. And the best way to do this for many people is to start – and stick to – a budget.

What makes a good financial plan?

What makes a good financial plan for one person won’t be the same for the next, as it very much depends on your personal circumstances.

That said, there are some key features that are the same across all good plans, including that they:

- Include realistic, achievable goals

- Have room for adjustments as you go forward and (ideally) come closer to achieving your goals

- Address all possible financial issues, not just those that you’re facing right now

- Prepare you for the unexpected

- Are relatively simple to monitor over the long term

- Have the ultimate aim of making sure that you are financially secure for retirement

Personal financial plan example

Looking at a personal financial plan example may help when figuring out how to do your own.

So let’s look at how Fred’s money management is going.

What does a financial plan look like?

Fred’s personal financial plan example makes a few assumptions:

- He’s currently earning $40,000 after tax but expects to get a 3% pay rise for at least the next five years

- He has a housemate who is paying him $100 per week to help with the mortgage, but Fred only wants to live with someone for the next three years

- Fred is 35 years old and plans to retire at age 65

- He made some savvy investments over time and will receive $1,500 in dividends this year. He expects this to increase by 10% every year for at least the next five years as he further contributes to his investments.

- He doesn’t think he’ll be receiving any social security.

And one note for you: this is fairly simplified and only shows the first five years. When doing your own personal financial plan, it’s best for it to continue at least until you retire.

Current net worth

The first step is always to work out your current net worth so you know where you stand financially at the moment.

| NET WORTH | |

|---|---|

| Assets | |

| Property | $450,000 |

| Savings accounts | $25,000 |

| Investments | $32,000 |

| Retirement accounts | $58,000 |

| Personal assets | $20,000 |

| TOTAL ASSETS | $585,000 |

| Liabilities | |

| Mortgage | $300,000 |

| Credit card debt | $7,000 |

| Student loans | $40,000 |

| Car loan | $10,000 |

| TOTAL LIABILITIES | $357,000 |

| TOTAL NET WORTH | $228,000 |

Financial goals

The next step for Fred is to list his financial goals in the order he wants to achieve them, with the amount that he wants this to be (in his case, “in full”) and how long this will take.

| FINANCIAL GOALS |

|---|

| Pay off credit card debt in full in the next 12 months (i.e. by the end of year 1) |

| Pay off car loan in full in the next three years (i.e. by the end of year 4) |

| Pay off student loans in full in the next four years (i.e. by the end of year 8) |

| Have $1,000,000 in my investments and retirement accounts in 30 years |

Cash flow estimation

Fred now has to estimate his cash flow. As mentioned above, this is a fairly simple version of this but, at the same time, you’re not a fortune teller so it’s never going to be 100% accurate – which is exactly why financial plans need to be reviewed and revised from time to time.

But, for now, here’s Fred’s estimation for the next five years (noting that yours should be until retirement):

| ESTIMATION OF FUTURE CASH FLOW | ||||

|---|---|---|---|---|

| Year | Salary | House mate | Dividends | Total |

| 1 | $40,000 | $5,200 | $1,500 | $46,700 |

| 2 | $41,200 | $5,200 | $1,650 | $48,050 |

| 3 | $42,436 | $5,200 | $1,815 | $49,451 |

| 4 | $43,709.08 | $0 | $1,996.50 | $45,705.58 |

| 5 | $45,020.35 | $0 | $2,196.15 | $47,216.50 |

What should the next steps be in this personal financial plan example?

We go through this further below, but Fred’s job now is to use the information he’s prepared above to list the following:

- Brainstorm potential risks that could stop him from reaching his financial goals and determine how these could be mitigated, such as through taking out appropriate insurance policies or having a more conservative investment portfolio

- Create an investment strategy based on his financial goals, estimated cash flow and to avoid potential risks

For Fred, losing his job is a major risk given that it’s his main source of income and he has to continue paying off that mortgage. Some ways to mitigate this could be to increase his savings through living more frugally for a while or keep a housemate for longer than planned to help with the mortgage.

He may also want to consider taking out an insurance policy that covers him if he’s unable to work due to illness.

Fred’s investment strategy, noting his aim is to have $1,000,000 for retirement, also needs to reflect the fact that a lot of his money is going to be focused on paying off debt for the next eight years.

This means that, after that’s done, he’s really going to have to knuckle down and throw a lot of money at his investment and retirement accounts, while also making sure that his investments aren’t too conservative so as to maximize returns.

He should also double check that he has a valid will in place so as to cover his estate planning.

Personal financial planning strategy

You’ve now seen a personal financial plan example that incorporates the 7 key components of financial planning. And you know you need a plan given the benefits of having one that we outlined above.

But when starting from scratch, it can still seem a bit daunting to actually get started with creating your plan. This is why many recommend using the following set process for actually establishing this plan.

What are the 5 components of a financial plan process?

These 5 components of a financial plan provide a simple step-by-step way to prepare your first plan.

In fact, you can see how these were followed in the personal financial plan example mentioned earlier.

Keep in mind though that these come after you work out your current financial position. That always comes before any future plans are considered.

1. Set your financial plan goals

The first part of your journey is knowing just what your destination is! In this case, the first step is to define the financial goals you want your plan to help you achieve.

Remember the point raised earlier: these should be SMART. In finances, as with many things in life, simple is usually best.

The best way to do this is as follows:

- Take your time to think about what you want to achieve financially and list them as they come to mind.

- Next, list them in the order in which you want to complete them

- Finally, place numbers next to them in your personal order of priority. This will usually be similar to their chronological order, but can be a good way to distinguish between two priorities that have the same timeline.

Don’t worry, these aren’t now set in stone. In fact, it’s a good idea to revisit these as your finances evolve and you become better at managing your money.

2. Estimate your future cash flow

Having at least a rough estimate of your future cash flow helps in later steps when figuring out all the “what ifs”.

What if you lose your job in the next five years and can’t find another one for 18 months – will your cash flow with your existing savings allow you to survive?

Or what if you’re forced to retire 10 years early because of health concerns – how will you cope with that?

It can even be more positive – what if you actually want to retire 10 years early? Is this possible?

It should start to become pretty clear as you brainstorm more of these scenarios just how important having a cash flow estimate is when planning to cope with some of these (not always welcome) surprises.

Related: How to Calculate Your Savings Rate – and Why You Should

3. Assess any risks to your finances

These risks relate to the “what ifs” we mentioned in the previous step. That is, in this step, you’ll look at your goals and then list all the things that could get in the way of reaching those objectives.

Sure, you may want to save for retirement and pay for both of your kids to go to college. But what if (to use an earlier example) you have an accident and can’t work for some time – do you have an insurance policy to cover this?

Or what if the stock market crashes – does your potential investment strategy give you time to recover from this?

Maybe you want to buy a house in the next five years – does your salary allow this? Or are your assets liquid enough to allow this to happen?

Once you’ve exhausted all your ideas for potential risks, you can then go through these to see what you can do to protect yourself if they do actually happen. Insurance policies may help, such as medical or life insurance. For other aspects, adjusting your investment strategy may be needed.

4. Create an investment strategy

Your investment strategy should be a combination of:

- Your goals

- Your timeline to achieve these

- Your cash flow projection (i.e. how much you believe you’ll have to invest once you cover your other expenses)

- The risks you’re willing to accept as an investor – take into account any risks from the previous step that may affect your investments and can’t be mitigated through insurance policies or other protective acts

5. Review and revise your plan regularly

Your financial plan is never really finished. As your life changes, including your financial circumstances, your plan will evolve too to cope with this.

So make sure you sit down regularly to go through it and see what can be adjusted to make sure your money is being managed as solidly as possible.

Maybe you’ve reached a goal faster than you expected – or not fast enough. Or perhaps your income has gone up or down and adjustments are needed based on this.

Whatever it is, reviewing and updating your personal financial plan from time to time will make sure that it remains as relevant as possible to your current situation.

So, in summary, how do I write a financial plan for retirement? Can I just copy the personal financial plan example you used?

You can certainly copy that personal financial plan example and just insert your own numbers where needed.

Otherwise, one of the other templates you can find online will also do the job.

Just make sure you follow the process set out in the 5 components of a financial plan. Then, when it’s done, check that your own plan addresses each of the 7 key components of financial planning.

And from there, you’re on your way to reaching each of the financial goals your plan sets out to achieve!

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.