One of the best things you can do for your money is to make sure it’s working for you. After all, by starting to invest your money early, you’re giving yourself the time for it to grow into a sizeable nest egg.

This is all thanks to the power of compound interest, which is almost always the key for anyone to achieve financial security.

So finding the best compound interest investments for you based on your objectives, timeline and risk tolerance can be one of the most important things you do for reaching your financial goals.

What are the best compound interest investments?

The point of any investment is for its value to compound – or grow – over time.

(At least until you start living off the investment, like if you choose to use stock dividends to pay for your expenses instead of reinvesting them.)

Some have a general trend of growing faster than others. But while this sounds great, these same high-growth investments can also often see more volatility, which may not be in line with your investment strategy or level of risk tolerance.

Others have lower growth (i.e. its value will compound at a slower rate) but exist to provide more stability to your investment portfolio. And that can be ok too, depending on your circumstances.

All this means is that the best compound interest investments for you may not be the same for someone else.

It also means that it’s important to consider every aspect of each investment vehicle before deciding which of them may be best for your portfolio.

Index funds

Index funds are one of the most popular investment choices these days and are a solid addition to almost any investor’s portfolio.

After all, there’s a reason that Warren Buffet, one of the most successful investors of all time, has described low-cost index funds as “the most sensible equity investment for the great majority of investors”.

As a low-cost option for tracking the performance of potentially thousands of stocks or bonds, index funds offer a great way to ensure diversification.

They have also, historically, been one of the best performing investment vehicles over time.

In fact, in more than 92% of cases, index funds have produced better returns than actively managed funds.

However, there are literally hundreds of types of index funds to choose from. As just a small example, here’s a list of the eight best index funds from Charles Schwab.

So we’ve broken them down into two broad types to show you the difference.

Related: How to Invest $25k: 13 Strategies to Grow Your Wealth

1. Broad market index funds

A broad market index fund closely tracks the performance of a large segment of the investable market. That is, they often involve investing in a large portion of stocks or bonds which are within some sort of major category.

One common choice for investors is index funds that track the S&P 500. That is, by tracking the performance of the 500 largest publicly traded companies in the US, investing in an S&P 500 index fund is equivalent to owning stocks in some of the biggest companies in the world such as Microsoft, Apple, Amazon, Facebook and more – without having to directly buy their shares yourself.

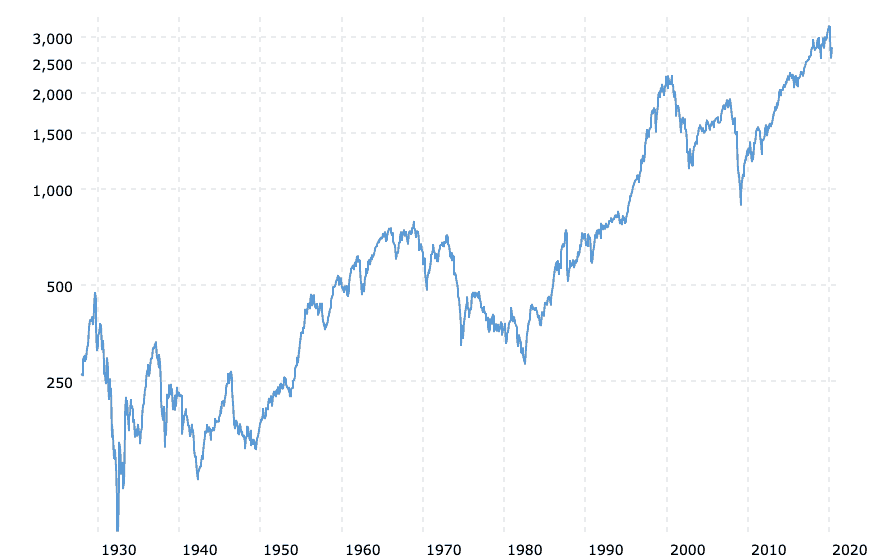

Here’s how your money would have grown over time if you’d invested in an S&P 500 index fund at some point over the last 90 or so years.

As you can see, the overall trend over time is clearly upwards.

Related: VOO vs SPY: Which S&P 500 ETF is best?

What to keep in mind

That said, there are some pretty severe drops in there (including one happening right as this graph was generated in early 2020 – stay tuned).

This might mean that if you have a low risk tolerance or are close to retirement so won’t have time to ride out any future drops, you may wish to consider investing in a broad market index fund like this along with some less volatile investments, like bonds.

But overall, this is easily one of the best compound income investments you could choose for your portfolio.

And if you won’t listen to me, just ask Warren Buffet. In his 2016 Berkshire Hathaway annual shareholder letter, he wrote: “My regular recommendation has been a low-cost S&P 500 index fund”.

2. Total market index funds

Total market index funds are similar to their broad market cousins, in that they involve investing in a large segment of the market.

For example, a total US stock market index fund tracks the performance of every publicly traded stock in the US, which amounts to more than 3,500 individual stocks.

This not only helps to maximize your diversification, but by doing this through an index fund, you’re also locking in the low costs that are one of the hallmarks of investing in index funds.

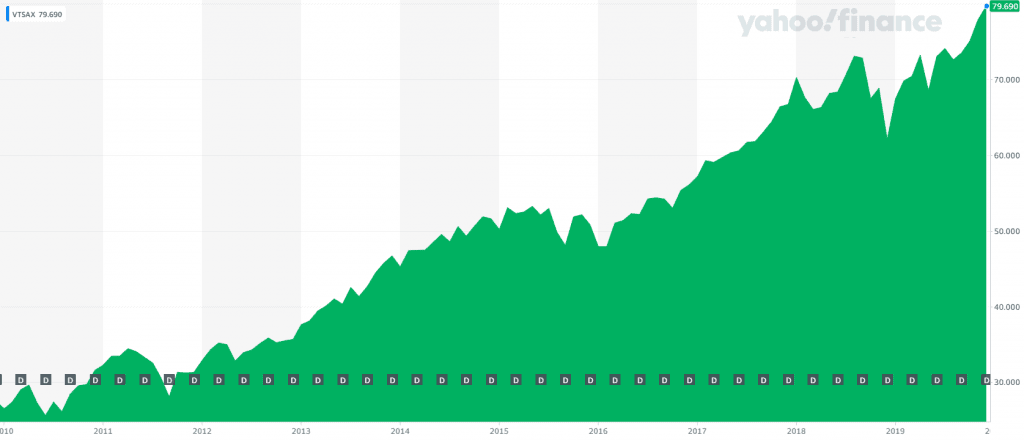

Vanguard is often hailed as the champion of index funds and its offerings of VTSAX and VTI are great options if you’re looking to invest in an index fund that tracks the entire US stock market.

Here’s how they have performed over time:

What to keep in mind

As above, performance is definitely strong here, but so are some of the drops. It can definitely be hard to watch half your portfolio get wiped out – even if, in every prior drop in history, the market has always recovered.

So the advice here is similar to that for the broad market index funds: consider balancing it out with some lower risk investments, even if it’s just to help you sleep at night.

3. Industry-specific index funds

Some index funds don’t track segments (or all) of certain markets. Instead, they track the performance of stocks in certain industries.

A classic example is one that invests in major real estate companies. This can be a good way to invest in the property market without the hassle of having to actually manage your own properties.

You can see in this graph the performance of one of the Charles Schwab index funds, the holdings of which are focused on real estate companies:

As you can see, it can be pretty volatile, so the earlier advice about how to consider balancing your portfolio applies.

At the same time, many people see funds like this as offering a great opportunity to diversify away from the “standard” holdings of broader stocks and bonds, especially if you want to focus on a particular area of the market.

4. Individual stocks

Buying a stock simply means buying a small portion of a company. When the company does well, your stock goes up in value. And vice versa.

Even better is if you buy stocks that pay dividends. This means that, at certain intervals throughout the year, the company will make a payment to its shareholders that represents a portion of its earnings. The more stocks you own, the more dividends you receive.

Clearly, investments in certain stocks can do very well, making investing in the share market one of the best compound interest investments you can do.

That said, it can also go very wrong. Just ask anyone who’s invested in a company that went bankrupt.

So if you choose to invest in individual stocks, make sure you do your research. Not putting all your eggs in one basket is key to avoiding potential losses, so diversification is key.

Because if you do it right (and with a little luck), investing in stocks can be a truly lucrative investment option.

Related: Acorns vs Robinhood: Which Micro-Investing App is Better?

Do stocks pay compound interest?

To clarify, stocks do not pay compound interest. However, the dividends that they pay out – if you choose to reinvest them (which you should) rather than take them as cash – work like compound interest in that they add to the overall value of your investment.

This also works hand-in-hand with the (hopefully) growth of the value of the stocks you own based on a growth in value of the underlying company.

The result of all of this – at least ideally – is that, over time, the value of your investment goes up. Much like when adding compound interest on to the balance of, say, a bank account.

5. Managed funds

Managed funds involve a fund manager choosing which stocks to add to a fund, which you then buy into.

In some ways, they’re similar to index funds in that they involve investing in a basket of funds.

The main difference is that the fund manager has the choice of what to put in there, meaning that the fees are often much higher for managed funds to pay for this service.

Don’t get us wrong, they’re still a solid choice as far as compound interest investments go.

But, in our opinion, managed funds offer nothing that an index fund can’t do better. Stick with what works.

6. Property

If you invest in rental properties, the rent paid by your tenants can be a great way to generate (mostly) passive income. This rent, when added on to the (presumed) increase in value of your house, can work much like compound interest.

There’s a reason that, historically, property has been one of the best compound interest investments for many people.

That said, property maintenance is a lot of work – and, often, a lot of money.

There’s also no guarantee that the property will go up in value, which can be a huge problem, especially if you end up owing more money through your mortgage than the value of the house.

Property can be a great investment choice if everything works out, especially in terms of its ability to bring in long-term income. Just make sure you do your research before locking in a significant amount of your money to this one asset.

7. REITs

REITs can be a strong alternative to investing directly in property, especially if you want to avoid the hassle of managing your own purchases.

This stands for real estate investment trust, which is a company that owns and operates income-generating real estate.

You invest in them through buying stocks in the company, making it much easier to sell back your ownership if you decide to do so – unlike if you own your own property.

The downside is you don’t really get to benefit from an increase in value of the underlying properties. They do, however, generally offer stable, strong annual dividends.

Related: How to Invest and Make Money Daily: 7 Proven Strategies

8. Bonds

Bonds are one of the best compound interest investments. This isn’t, however, because the earnings they can give you. Instead, it’s because of the role they play in your portfolio.

When you purchase a bond, you are essentially providing a loan to a company or the government, with government bonds generally being lower risk. Your “loan” will be at a certain annual interest rate that the borrower agrees to pay to you over a certain period of time (the ”term”).

Bonds will almost always perform weaker than stocks. But they are also less volatile, making them an excellent way to balance out your portfolio if you are also choosing to invest in stocks or index funds.

In particular, if there is a stock market crash, having the steadier hand of bonds in your portfolio will ensure that your portfolio value doesn’t drop as much as it could have.

9. High-interest savings accounts

High-interest savings accounts can be a better place to keep your money than a standard account, although they will never perform as well over time as the other options on this list.

However, they are one of the best compound interest investments for those who need to keep money somewhere for a shorter period – say, two to three years.

For example, if you’re saving up to buy a house in two years, you wouldn’t keep the deposit in an index fund. This is because, if the market dropped in that time, you would need your money before the market had time to recover, so you’d lose out.

Do banks offer compound interest?

Banks don’t “offer” compound interest, as such, but they do calculate compound interest earned on your accounts with them to add to your existing balance.

The rate and frequency can vary, so read the fine print before signing up.

10. Certificates of deposit (CDs)

A certificate of deposit, or CD, is offered by banks and other financial institutions. It involves you agreeing to leave a certain amount of money with them untouched for a certain period of time at a premium interest rate.

This means that they are a steady way to earn compound interest and can be a good investment option if you need to keep your money somewhere safe without being able to access it.

11. Money market accounts

A money market account is an account at a bank or other financial institution on which you earn interest.

They generally pay a higher interest rate than standard savings accounts, although with some restrictions. These may include, for example, only allowing a certain number of transfers per month.

While not one of the best compound interest investments, they are certainly worth considering if you want to keep some of your money in an account where you can use it while still earning some interest.

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

How to choose the best compound interest investment for you

Choosing where to put your money from this list of the best compound interest investments should be based on a number of factors. These include:

- Your risk tolerance – better returns over time often mean more volatility. You’ll need to determine whether you’re willing to cope with some white-knuckled drops.

- How close you are to retirement – the closer you are, the more risk-averse you should generally be

- When you need to access your money – if you will need your funds in the next few years for a certain goal, like buying a house, it’s best to put them somewhere with less volatility

- Your goals for the money you plan to invest – if you’re investing for your kids’ college funds and your kids are still in diapers, you may be able to consider more volatile investments as you’ll have the time to recover from any drops. Alternatively, if they’re in their teens, perhaps consider more conservative investments to make sure your money isn’t at risk before they hit their college years.

Where to invest money to get good returns

Some of the investment options on this list, like index funds, managed funds and stocks, generally have better returns than others such as bonds, high-interest savings accounts and money market accounts.

That said, past performance is no guarantee of future performance.

In addition, the possibility of good returns isn’t the only thing that should be guiding your investment choices. Take a look at the list of other factors to consider above.

Related: 12% Compound Interest Accounts? 8 Investments To Earn You Massive Returns

What types of investments have compound interest?

Generally, compound interest is applied to things like bank accounts, where the bank calculates the amount of interest you’ve earned on your balance and adds the interest on top of that.

This means that many of the investments on this list don’t actually generate compound interest in the literal sense. They do, however, work in a similar way.

For example, when a stock or index fund pays out dividends and you choose to reinvest them, the value of the dividends is added to the value of your existing investments. Over time, this can have a huge effect on your overall wealth.

Can compound interest make you rich?

Compound interest is one of the major ways to build wealth. Over time, it can turn your initial investment into a significant amount.

Just ask Grace Groner, who bought $180 in shares in a company in 1935. When she died in 2010, her estate was worth $7,000,000.

Compound interest example

Let’s look at a more detailed example of how compound interest can work.

- You put $10,000 in an investment that earns an annual 7% rate of return – which is the historical average for an S&P 500 index fund, adjusted to inflation.

- After twelve months, that has become $10,700.

- You continue to earn %, but now that rate is being earned on the increased amount, meaning at the end of the next year your savings are worth $11,449.

- By doing absolutely nothing, after ten years you will have $19,671.51 or almost double your starting amount.

Now let’s adjust this slightly – say you invest $10,000 every year into that investment.

After ten years of investing a total of $100,000, you will end up with $147,836. This means you will have almost $50,000 extra for doing absolutely nothing.

And if you keep doing that for thirty years, you will have $1,010,730.41 – after investing only $300,000.

Final thoughts

By now, it should be clear that by investing regularly over time, compound interest can make you seriously wealthy.

And this list of the best compound interest investments provide some strong options for any investor looking to build their portfolio.

So through considering your own individual circumstances and with some patience, there’s no reason why you can’t use your investments to achieve your own financial goals.