Financial freedom is the dream for many of us. And fortunately, the question of how to get to financial freedom is far easier to answer than you may think.

Sure, all these stories you hear of financial freedom being possible for people in their 50s, 40s or even their 30s may sound completely out of reach at first. But you’ll see that when you break this goal down and implement a few key strategies, following the steps to financial freedom is entirely doable.

In fact, as I’ll show you, just a couple of simple tweaks to your money management can have a massive impact on whether you’re able to be financially free – including just how early you’re able to get there.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

What is financial freedom?

Financial freedom is when you’re able to live the life you want without having to worry about the financial impact of the decisions you make. This will generally be due to having enough savings, investments and other assets to be able to sustain yourself financially.

While this doesn’t necessarily mean that you can spend the rest of your life traveling around the world first class, it does give you the opportunity to stop working and do what you want – within reason.

This is partly because you’ll have set up your finances in such a way that they’re working for you, rather than the other way around. With the amount of money that your investments and other assets are generating when combined with your savings, you should be able to survive off this for the rest of your life.

As you’ll see, financial freedom still means that you’ll have to manage your money effectively to make sure that it lasts. To make this as easy on yourself as possible, using a free app like Personal Capital to see all your finances in one place, while also getting personalized tips on how to improve your money management, is a great place to start.

Personal Capital

Our pick: Best budgeting app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

How do you achieve financial freedom?

The question of how to get financial freedom involves you reaching several key milestones when it comes to your finances. These include:

- Set financial goals – You can’t reach a goal unless you know what that goal is. In the case of reaching financial freedom, I’ll show you how to work out this goal below.

- Avoid high interest debt – And if you have it, do everything you can to pay it off as quickly as possible.

- Spend less than you earn – This is one of the key mantras of effective financial management but not enough people follow it. Without it, to be frank, you’ll never reach financial freedom.

- Start investing early – The earlier you start investing, the more time you give the magic of compound interest to kick in, which means the earlier your money can start working for you.

- Pay yourself first – This refers to the fact that the first thing you should do when you’re paid is to contribute towards your financial goals rather than waiting until the end of the month to see how much is left. By paying yourself first, you’re making sure that your financial goals are always taken care of.

If you’re really interested in learning how to achieve financial freedom, one book is always at the top of my recommendation list.

The Simple Path to Wealth by JL Collins is truly one of the best personal finance books out there. It’s simple and actionable, with his explanation for how to get your finances in order to start investing and set yourself up for retirement being incredibly easy for anyone to follow. It’s exactly what I do with my own finances and I can’t recommend it highly enough.

What are the 7 Steps to Financial Freedom?

The 7 Steps to Financial Freedom refer to different stages that we each reach when traveling along the path to financial freedom. This can really help by setting some guideposts to show you where you are and where you want to be.

These are also great for showing you that no matter where you are along that path, others have been where you’ve been – and still made it to financial freedom in the end. If you’ve ever wondered, say, “How do you become financially stable?”, because it seems like a distant dream, these seven steps will show you that it’s definitely possible.

1. Financial survival

This is the step most of us are on when we get our first real “adult job”, although it’s true that a lot of people are delaying this to save money while living with their parents for longer.

This means that when you get here, you’ll probably have just taken the big leap from having someone support you to keeping track of your own bills and payments, including rent.

Ideally, you’ll be putting some savings away every paycheck. Doing that while avoiding high interest debt are key here for making it to the next step.

Related:

2. Financial stability

Financial stability is when you start to get more comfortable with your finances. Your emergency fund will have started to grow, you’re not stressed out when your bills arrive each month and you’re confident in your ability to manage your spending so that you’re contributing to your financial goals each month.

Getting here is already a major achievement. After all, it was found that only 61% of US households could cover an unexpected expense of $400 without having to resort to credit card debt or other options.

Sticking to a budget can be important at this step, so that your spending stays under control – and even so that you may find yourself able to cut your expenses even further.

3. Financially assured

By now, you’ll no longer carry any debt with the possible exception of a mortgage. But you’ll at least have paid off any high interest debt you got yourself into so that all your spare money can now be focused on your financial goals. Your emergency fund will also be at full capacity (which, for most people, is three to six months of living expenses).

When it comes to reaching financial freedom, investments are key and, by this point, you should have started contributing to a retirement account or other form of investment. That way, your money can start working for you – and the earlier this happens, the quicker you’ll reach your financial freedom number.

Given that it’s probably been a few years since you were at step 1, you’ve likely progressed somewhat in your career – and your paycheck may have increased alongside this. Be careful not to get sucked into lifestyle inflation, which can be a killer at this point for any dreams of financial freedom.

Related: How to Get Rich From Nothing: The One Strategy That’s Proven to Work

4. Financial security

Remember The Simple Path to Wealth I mentioned earlier? The author of that book describes this step as being when you have “FU money”.

Want to quit your job for a while (and tell your boss to…well, you can probably see where the “FU money” saying comes in)? Here, you can afford it.

Or did you lose your job or aren’t able to work for a while for some reason? Then you’re covered.

This isn’t retirement as you won’t have quite enough at this stage to sustain yourself indefinitely. But you are certainly secure here, with a net worth that’s probably in the six figures by now, and so you should be easily able to weather any financial storms that life throws at you.

Related: What’s Next in Life After Your Mortgage is Paid Off?

5. Financial independence

This is one of the major milestones along your journey: financial independence. At this stage, if you never work again, your savings and the money that your investments are generating will be able to cover your basic living expenses forever.

The exact amount needed here will vary depending on your needs, with the biggest factor being your annual expenses. This means that the more you can cut these expenses, the earlier you’ll be able to reach financial independence.

The most common way to figure out how much you need to be financially independent is based on the 4% rule. This says that if you can live off 4% of the value of your portfolio annually, you have enough money to live off going forward as studies have shown your investments will generate enough money to keep you going.

For example, if you spend $40,000 on living expenses per year, you’ll need $1,000,000 to reach financial independence.

6. Financial freedom

Financial freedom is like financial independence but with more fun stuff. It basically means that not only can you cover your basic living expenses, but you’ll also be able to afford to start crossing things off your bucket list, like that big overseas trip you’ve been dying to do or buying a cabin in the woods.

That is, you’ll not only be able to retire, but you can retire well. While you won’t be able to spend completely wildly, you’re now in a position to stop working and start living the live you’ve been dreaming of.

7. Financial abundance

Funnily enough, the 7 Steps to Financial Freedom actually exceed financial freedom by going one step further.

Specifically, financial abundance is when you’ve continued to grow your net worth to a significant amount. This is the kind of wealth that can be passed down to the next generation or used to fund a charitable endeavor of your choosing.

You’ll be well past the stage of having to work, but your investments are probably still producing a pretty significant amount of money, allowing you to grow your wealth even more. Safe to say, if you make it to this step, you almost certainly have your finances completely under control and working very hard for you.

Is financial freedom possible?

Financial freedom is certainly possible, including well before the usual retirement age, with examples of people in their 50s, 40s and even their 30s reaching this. It’s going to depend on a few aspects, the most important of which are how early you start investing and how well you control your spending.

This is based on a few key concepts. Firstly, compound interest needs time to work its magic, meaning that the earlier you start saving and investing, the longer your money has to compound in value. As we’ll see below, even waiting a few years can have a massive impact on how much money you have at certain ages.

Secondly, your financial freedom number is going to largely depend on how much you need to spend each year. Put another way: the higher your annual expenses, the more money you’ll need before you can stop working. So the more you can control your expenses, the more likely it is that financial freedom will be possible for you.

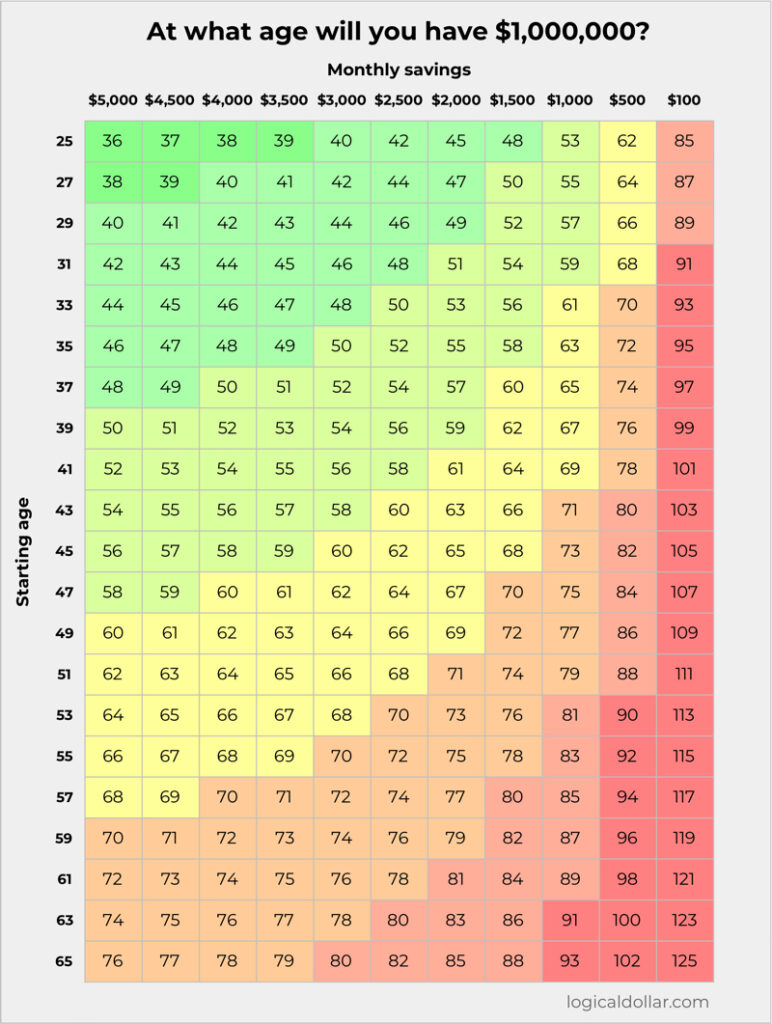

You can see both of these concepts come into play in the table below. It shows at what age you can become a millionaire based on the age you start saving and investing compared to how much you invest each month.

It assumes annual returns of 8%, which is the average performance of the S&P 500 over time so is likely to be what you would get in, say, a 401(k) that tracks the US stock market.

As you can see – perhaps unsurprisingly – it shows exactly that the earlier you start and the more you invest, the earlier you’ll become a millionaire. But more interestingly, it shows the significant impact that a few tweaks to your money management can have on your overall financial situation.

For example, if you start to invest $1,000 per month at 35 years old, you’ll become a millionaire when you’re 62. If you only invest $500 per month during this time, this adds nine years to your working life.

(And if you plan to retire with $1 million, that $500 difference means you won’t reach retirement until you’re in your 70s.)

If you want to change the amounts to suit your personal circumstances, this financial freedom calculator lets you play with the numbers a bit. When doing this, make sure you pay attention to the effect of starting earlier and saving more.

What is the first step to financial freedom?

Your first step towards financial freedom needs to be getting your spending under control, so that you’re spending less than you earn. From there, you’ll be able to start building your emergency fund to ensure you can handle an unexpected financial setback.

However, if you find yourself spending more than you’re earning, this is a major issue that you need to address as soon as possible. It probably means that you’re taking on debt in order to sustain yourself which, if it continues, means you’ll never reach financial freedom.

The best way to do this is to start a budget so that you can track your spending. Without knowing exactly where every single dollar is going, you’ll never be able to see where changes can be made to cut your expenses. This will also help you to make sure that you’re contributing towards your financial goals every month.

To get started, grab the free budget template below.

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

And if you’re not sure how much to assign to each budget category (so you can figure out if you’re spending too much on a specific item based on your earnings), a great idea is to follow the 50/20/30 budget method.

What is the 50/20/30 budget?

The 50/20/30 budget method involves dividing up your expenses into three broad categories and allocating your income to these based on the following percentages: 50% on needs, 30% on wants and 20% on goals.

They key here is to make sure that you’re not “accidentally” putting your “wants” under “needs”. This means that it’s important to be honest with yourself about what you really do need – for example, groceries are a “need” but take out is a “want”, even if they both involve eating.

(And by the way…if you want to get started with your own 50/20/30 budget, that template just above is built for that!)

What is the difference between financial freedom and financial independence?

Financial independence is when your savings and the money that your investments are generating are able to cover your basic living expenses going forward. Financial freedom, on the other hand, is similar but allows you to afford some lifestyle upgrades, such as travel.

That is, when it comes to financial freedom vs financial independence, a lot of people see them as the same thing – and it’s definitely true that they’re similar.

But financial freedom, as you can see from the seven steps above, is essentially the cherry on your financial independence cake. Don’t get me wrong, financial independence is amazing, especially as it means that you’ll never have to work again.

It does, however, mean you have to keep an eye on your expenses to make sure your spending stays within the 4% limit.

Financial freedom gives you, well, more freedom than that. It’s probably closer to the dream retirement that you have in mind, as it frees up more of your budget for those things you’ve been wanting to do once you no longer have to work.

To be clear: You can’t entirely spend whatever you want, whenever you want when you’ve reached financial freedom. After all, you don’t want to find yourself struggling in a few years time and having to go back to work. But you certainly have much more room for starting to tick things off that bucket list.

How much money do I need for financial freedom?

Calculate how much you think your annual expenses will be during retirement and then multiply this amount by 25. Based on the 4% rule, this will show you how much you’ll need in order to reach financial freedom.

This financial freedom formula also applies to how much you’ll need to reach financial independence. The difference comes down to your annual expenses.

As mentioned in the discussion of what is financial freedom vs financial independence, financial freedom involves you having the money to do those extra things you’ve been dreaming of doing. As that will obviously involve your annual expenses being a bit higher, it’s important to at least roughly estimate how much you want to allocate towards these.

By doing that, you can then figure out how much money you need for financial freedom and set up your personal financial plan accordingly in order to reach that goal.

Why is financial freedom important?

Financial freedom is important as it allows you to live your life free from stressing about the financial impacts of the events that occur and the decisions you take.

Of course, continuing to manage your finances effectively is critical – financial freedom doesn’t mean you’re free to spend like a multibillionaire. But removing the stress that comes with having to watch every dollar and not having that sinking feeling when another bill lands in your mailbox are just some of the benefits that come with reaching this stage.

There are plenty of great financial freedom quotes out there, but my favorite financial freedom quote that shows why it’s so important comes from J.L. Collins (yes, the author of The Simple Path to Wealth that I raved about above). He says:

“There are many things money can buy, but the most valuable of all is freedom. Freedom to do what you want and to work for whom you respect.”

J.L. Collins

Check out more financial planning quotes here.

Final thoughts on reaching financial freedom

As you can see, financial freedom is definitely possible if you have an effective financial freedom plan in place. By saving and investing consistently with as much money as you can, you too can reach financial freedom in the years to come.

Let’s be clear: It’s not going to happen overnight. So if you’re just starting out, wondering how you get to financial freedom in 5 years is probably the wrong question to ask.

Instead, look at how you can limit your expenses so that you can allocate more of your money towards this goal. Doing something like a 30 day challenge can be a great starting point for this.

This also has the added benefit of reducing your annual expenses, meaning your “financial freedom number” is going to be smaller and thus quicker to reach.

The 7 Steps to Financial Freedom provide a great map for how to get to the end, although each person’s journey is going to be different. Sure, you can be financially secure by 30, for example, but if you’re not, simply readjust your financial freedom plan – and continue to look forward to a future free of financial stress.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.