When you’re carrying a lot of debt, the thought of working to get out of it can be pretty overwhelming. This is why it’s a good idea to start by planning out the entire process – and using a debt snowball worksheet can definitely help you do this.

By filling in one of these worksheets with your debt details, you’ll be able to clearly see the different debts you have and the minimum payments you have to make on each of them.

From there, you’ll be able to put them in order of precedence based on how the snowball method works and then continue to track your progress as you start to pay this off.

It’s all pretty simple but by doing this, you’ll have a clear picture from just one piece of paper (or one debt snowball spreadsheet, if you prefer to do it on your computer) of where you stand, how far you’ve come and how to get to your ultimate goal of being debt-free.

There are plenty of different examples of these out there. This is why we’ve narrowed down the list to find you some great, free printable worksheets to help you get well on your way to paying off all this debt.

What is the debt snowball method?

The debt snowball method involves paying off your debt in order of smallest to largest balance. When the smallest one is paid off, the amount of those payments shift to the next debt. The objective here is to give you the motivation to continue working at becoming debt-free, as each one is paid off in turn.

That is, the aim here is to give you a (relatively) quick win by having you pay off the smallest debt by balance first.

This can serve as great motivation for making money to help you to keep chipping away at your debts, providing you with the momentum needed to continue along your debt repayment journey.

(And you’ll need to make sure you’re budgeting effectively to make sure you’re able to stick to paying off your debt throughout that process. This is why I always recommend using Personal Capital – it’s a completely free budgeting app that automatically tracks your spending for you.)

Personal Capital

Our pick: Best budgeting app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

Does the debt snowball method work?

The debt snowball method works in terms of it providing you with motivation to keep paying off your debt, as you’ll quickly see the progress you’re making in reducing your debts. This, in turn, allows you to build momentum as you continue to roll over your payments to each subsequent debt, until you become debt-free.

It’s particularly effective for those who feel that the psychological push that the snowball method provides will help them stick to paying off their debts.

There’s no question that this process can take some time and it’s easy to get stuck or feel like you’re never going to make it. This is why having something like this method is perfect for those moments when it all feels impossible, as the quick win of paying off those smaller debts will show you that getting out of debt really is doable.

Debt snowball worksheets

The best debt snowball worksheet for you is going to come down to personal preference.

Maybe you prefer a fillable PDF version you can keep on your computer or maybe you’d rather one you can print and stick to your fridge, so you can always see it and be held accountable.

Perhaps you like one that’s more colorful to catch your eye or you like to keep it more in line with your overall decor.

Whichever one you prefer, there’s going to be one here that works for you!

1. Free printable debt snowball worksheet

We can’t help but recommend our own debt snowball worksheet (you can download it for free here) as a great option if you’re looking to track your debt payoff journey.

You can either print it or fill it in online as a PDF, so it works no matter which format you prefer.

Plus it comes with a section to track your payments as you go, so you can see how well you’re going – and how close you are to being debt-free!

The explanation worksheet included in the download will also show you exactly how to do this, so you’ll know you’re doing it right from day one.

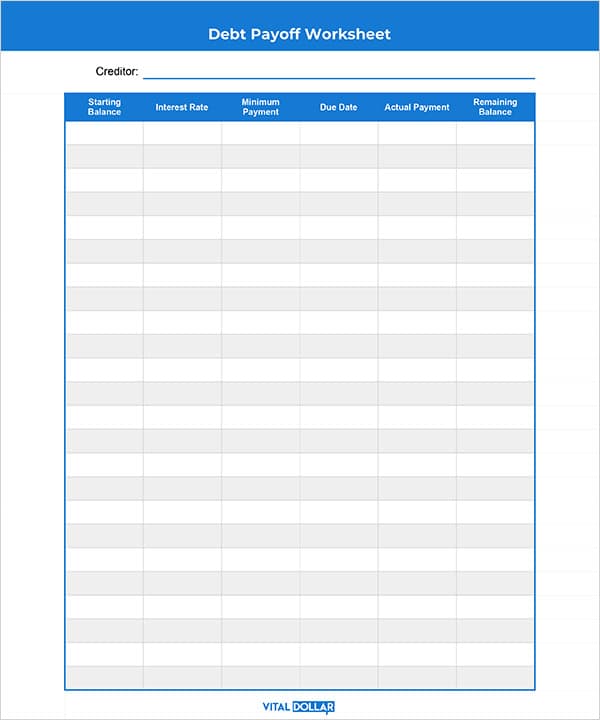

2. Debt snowball payoff worksheet

This printable worksheet gives you everything you could need at a glance to get started with paying off your debt.

It’s a really elegant way to deal with the not-so-elegant issue of debt repayment – but why not make your debt payoff journey nice to look at too!

It’s not all about aesthetics here, as this sheet is also really functional. Simply print it off and follow the instructions on the download page, where you’ll also find a bunch of other downloads that may help you take control of your finances.

3. Debt snowball worksheet download

These printables give you just the burst of color you may need to brighten up the debt repayment process.

And these relatively simple sheets are great for setting up this process overall. That is, not only will you get a debt overview printable, which lets you see all your outstanding debts at a quick glance and keep track of your bills.

But you’ll also get a debt repayment plan sheet which helps track your progress from month-to-month. This makes them a great pair for seeing your debt situation from both perspectives – as well as for the motivation boost you’ll get from seeing your debt balance dropping more and more as time goes on!

To get your own debt snowball worksheet, download the set here.

You may also be interested in: It’s Confirmed: Money Really Does Buy Happiness

4. Debt snowball worksheet PDF

This is a clean, clear way to see all of your debts in one place, as well as to see how well you’re progressing throughout the year.

Most of these worksheets are in portrait, but if you’re looking for a landscape document depending on where you plan to keep it, this could be for you.

It will need to be printed, which may not be an issue for you if you prefer putting pen to paper. However, if you want something in landscape format that you can complete directly on your computer, perhaps you should take a look at one of the debt snowball spreadsheets further on in this article.

You can download this debt snowball worksheet template here.

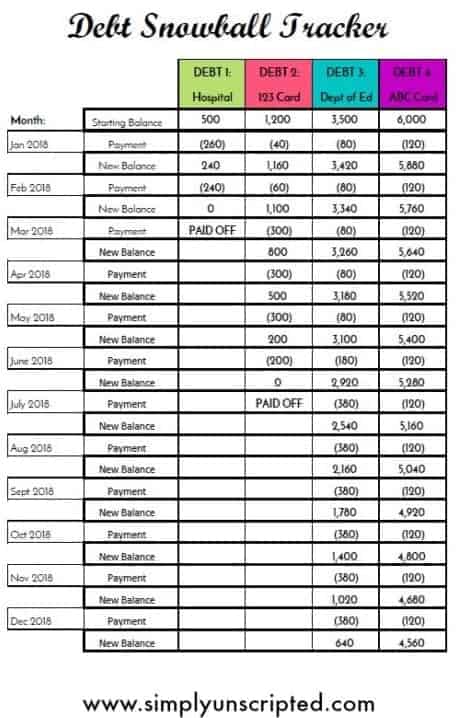

5. Debt snowball tracker

This one has a great balance between having some pops of color and keeping things simple.

You’ll also note that the months aren’t prefilled. This means that if you aren’t starting your debt payoff journey at the start of the year, you may prefer one like this so that you can add your own first month rather than sticking to the calendar year.

Grab this debt snowball tracker here.

6. Debt snowball method worksheet

I love this one as it really leans into the snowball theme! There’s also surely a joke to be made about putting your debt on ice…

But overall, this is a really fun-looking way to keep track of your debt payoff process. You’ll have to print one off every month, which has its downsides, but the big benefit of this is that it forces you to take note of your debt position every single month.

You can’t improve on something unless you know how it’s going and this will definitely ensure you stay up to date by forcing you to fill all of the information in once each month ends.

Download this debt snowball method worksheet here.

Related: Rich vs Wealthy: What’s the Difference and How You Can Get There

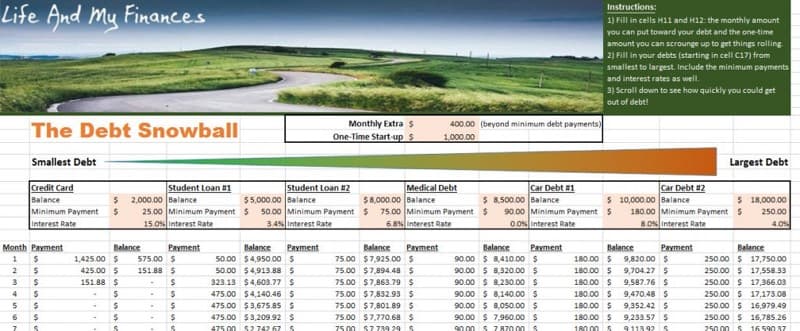

7. Debt snowball spreadsheet in Google Docs/Excel

If you’d rather work with a debt snowball spreadsheet in Google Docs or Excel, this could be perfect for you.

It’s especially good if you have a few debts to manage, as it will do all the calculations for you. This includes automatically giving you a snapshot of the current balance of each debt, so you’ll be able to get an immediate idea of where you’re currently at simply by entering in your payments each month.

Perhaps my favorite part of this though is the second tab of the spreadsheet, which has this chart showing your overall debt payoff plan!

You can get this debt snowball worksheet from Life and My Finances here – and as you’ll see, that page also comes with really detailed instructions on how to fill it in, so don’t worry about feeling overly confused.

8. Debt snowball budget spreadsheet

This is another spreadsheet, although slightly simpler than the previous one – which may be exactly what you need.

As you’ll see, it has all the benefits of coming in a spreadsheet form, including the automatic calculations it does based on the payment information you enter. It’s also great that it emphasizes down the bottom the amount of time it will take you to be debt-free, as having this countdown is incredibly motivating!

Get this debt snowball budget spreadsheet here.

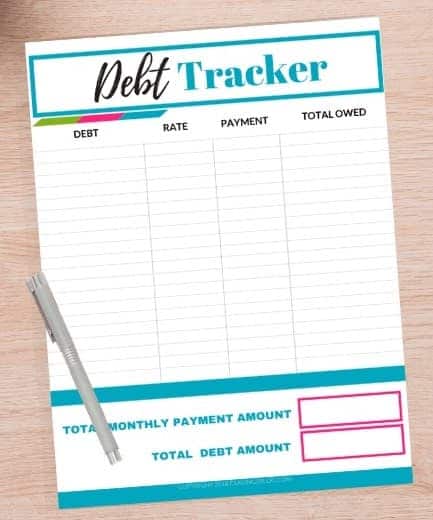

9. Free printable debt payoff worksheet PDF

This one starts to lean into a more colorful way to track your debts without being overwhelming. And for anyone who wants to keep their debt trackers interesting to look at, this one could be for you.

You can see in the image that this worksheet leaves it to you to decide which debt payoff method you want to follow. You could always use the debt snowball method and list your debts here from smallest to largest balance.

But it also works just as well if you’re considering following the debt avalanche method, in which case you’d simply list your debts from largest to smallest by interest rate. And while I actually think the avalanche method has its advantages over the snowball method, both can work just as well for helping you to avoid the dreaded process of having to respond to a debt collection letter.

Grab this free printable debt payoff worksheet as a PDF here.

You may also be interested in: 10 Best Personal Finance Podcasts for Beginners

10. Debt snowball or debt avalanche spreadsheet

You may not be entirely sold on the debt snowball method and that’s fine – it’s always good to keep your options open.

Specifically, you may be tossing up between that and another method, which is why this spreadsheet may work for you.

As you can see from the picture, it’s incredibly detailed, but also very well set out with the color coding making it easy to keep track of all the information you can see.

But it’s not set up to be used by only one debt payoff method, meaning you can use this as either a debt snowball or debt avalanche spreadsheet.

Download it here.

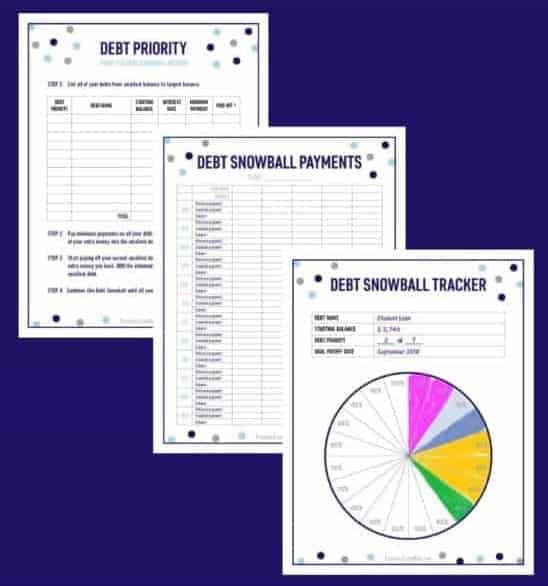

11. Debt snowball coloring sheet and tracker

Sometimes it can help to see your progress in a format that’s not simply a set of numbers of a sheet of paper. And for anyone who’s a fan of all those adult coloring books that have appeared in recent years, you may like this option.

That is, not only do you get the more traditional tracker, but you can also color in your “pie” as your payments progress.

It makes for a really satisfying way to see how you’re going – not to mention that, with all the talk of how effective coloring can be for stress management, this could be a good way to keep your blood pressure down if the debt payoff process seems to be a little overwhelming at times.

You can find this debt snowball coloring sheet and tracker at this link.

12. Printable package

If you’re committed to paying off debt, you’ll know very well that you need an overall financial strategy to get there. Whether it’s increasing your income or reducing your expenses (or both!), you do need to keep track of where your money is coming in and going out to get out of debt as quickly as possible.

This is why only having a debt tracker may not be enough. Instead, why not go for a complete money management package – like this one?

It comes with basically everything you could need to really focus your finances on getting out of debt. Not only do you have an easy debt snowball worksheet printable, to track the debt payoff process, but you also have other trackers and fun additions to keep you on course to success – even perhaps over the course of a 30 day challenge!

(You’ll even get a Confucius quote to guide you, which could be a great extra push in addition to our favorite financial planning quotes.)

Grab this package here.

Related: How to Get Rich From Nothing: The One Strategy That’s Proven to Work

13. Spreadsheet example

We mentioned a few other spreadsheets earlier, but there’s no harm in having options! Specifically, this one is incredibly well designed, with different colors helping you to find information easily while also balancing this with all the detail you may need.

If you prefer using Google Docs, you can certainly keep this online, although it works just as well in Excel too.

And don’t feel like all that information is too much to cope with, as you can find great instructions on how to set this up on the download page.

You can find this great debt snowball spreadsheet example at this link.

14. Dave Ramsey debt snowball worksheet

We can’t have a discussion about which is the best debt snowball spreadsheet without considering the OG, which is why it’s worth taking a look at the Dave Ramsey debt snowball worksheet.

As the main proponent of the debt snowball method, it’s not surprising that his version of this is a great option if you’re wondering how to get started with this method.

It’s clean, clear, does what it’s meant to and has plenty of space if you have a lot of different debts to pay off.

Grab Dave’s example of a debt snowball worksheet here.

15. Fillable worksheet

Not everyone wants to print everything these days, but it can also be good to not only be limited to using spreadsheets on your computer.

This is why having a fillable debt snowball worksheet can be great. It lets you complete all of the information you need to add without wasting paper or ink, which also means it can be easily updated.

At the same time, you still get all the benefits of having your debt progress written out!

I will say that it’s not the prettiest worksheet to look at but it’s definitely functional, as you’ll see if you download it here.

Related: The Personal Financial Plan Example You Can Use To Reach Your Financial Goals

How do I make a debt snowball spreadsheet?

To make your own debt snowball spreadsheet, collect the name, interest rate and minimum payment of each of your debts. You will then put these in a spreadsheet, from smallest to largest balance, to keep track of each payment you make against all of the debts, as well as to see when you will become debt-free.

Whether you choose to build your debt snowball worksheet in Google Sheets or Excel is up to you as, in the end, the outcome is the same.

That is, it lets you see how the balance of each debt reduces over time. You’ll also be able to have an approximate idea of when each debt will be paid off, allowing you to see when the payments on that first debt will be able to start to be applied to the second debt – and the next debt and the next debt.

For these kinds of things, it’s much easier to see how to set it up rather than trying to read an explanation on how to make a debt snowball spreadsheet. This is why I’d suggest you watch this video below to see exactly how to do this:

How do I calculate my snowball debt?

You can organize your snowball debt as follows:

- List your debts from smallest to largest balance (not interest rate)

- Make the minimum payments on each of the debts.

- Any additional money you have should be used to pay off the smallest debt.

- Once that is paid off, use that money to pay the second smallest debt.

- Continue until all debts are completely paid off.

And that’s really the snowball method in a nutshell!

And if you’re looking to calculate some other things relating to this, like how long it may take you to become debt free, I’d suggest you watch the video above about creating your own debt snowball spreadsheet.

That way, you can have the application calculate all this for you based on the payments you’re able to make.

Should I pay off the smallest debt first?

You should pay off the smallest debt first if you are following the debt snowball method. This works on the understanding that paying off debt in this way will allow you to clear the first debt quicker, providing you with the motivation needed to keep going and, ultimately, become debt-free.

That is, the debt snowball method is preferred by some because of the psychological advantage it gives.

And there’s definitely an advantage here, especially if you think you need that mental push to stick to your debt payoff strategy.

Paying off the smallest debt first will show you that yes, you really can do it! And if that’s what you think you’ll need to continue down what can be, let’s face it, a pretty long road sometimes towards being debt-free, then you should really consider following this method.

Is the snowball or avalanche method better?

The best debt payoff strategy is the one that works most effectively to help you become debt-free, with both having their advantages. The snowball method is good for motivating you to stick with it, while the avalanche method is better in that you’ll ultimately end up paying less overall.

That is, the avalanche method involves you paying off the debt with the highest interest rate first. This may not be the one with the smallest balance, meaning it may take you longer to pay off that first debt compared to the snowball method.

However, because you’ll be getting rid of the debt with the highest interest rate first under the avalanche method, you’ll pay less interest overall on your debt.

This can mean, depending on how big your debt is, a difference of thousands of dollars by the time you become debt-free.

At the same time, the extra money you pay under the snowball method could be 100% worth it if it helps you actually stick to working at paying off your debt. After all, that’s the end game here, as this makes all sorts of other things possible – like reaching financial freedom.

To get an idea of the financial difference in choosing one method over the other, check out this avalanche v debt snowball calculator.

Final thoughts

Choosing the best debt snowball spreadsheet or worksheet for you is going to mainly come down to whichever format you think makes it most likely that you’ll stick with the debt payoff process.

Some people love a colorful sheet with plenty of features to catch your eye. Others like to keep things more simple and structured, so you remain similarly serious about finally getting out of debt.

As you can see from this list, there’s a full range of options out there, although the ones here are, in our opinion, some of the best.

That said, while they may all look a bit different, when it comes down to it, they all have exactly what you need. You’ll see where you stand at the start of the process, how well you’re progressing as you start to pay down that debt (which can also help you with other things, like calculating your liquid net worth) – and, ultimately, you’ll get the ongoing motivation needed to reach your goal of being completely debt-free.